Real Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+

Rates are increasing to more normal levels and the hysteria in the market just highlights how juiced and stretched we have played this low interest rate environment. Inflation is now out of control and the Fed will have no choice but to act and this of course will cool the housing market. Last year the market was driven by FOMO and people were bidding junk up because in many cases, they were desperate. There is now talk of another housing bubble and people counter with – what about subprime? Let us remember that with the 7,000,000+ foreclosures in the last debacle, about 1 to 1.5 million of those were subprime. The rest were vanilla 30-year fixed rate loans that hit households that lost jobs and they simply could not pay their mortgage. Venture Capital is getting more restrictive, and we are seeing ridiculous companies implode with valuations that only “Web 3.0” would love. But let us look at some insane prices in working class areas of Southern California.

Paramount Example

Paramount is located right next to Compton and is a working-class area. The median household income is $55,000 for the city. So let us take a look at what a regular home is going for right now:

Okay. So this home is selling for $825,000 and last sold in 2005 for $425,000 (a bubble price at that time). So is this a good deal? The elementary school is rated 4/10 and the middle school is 5/10. Not exactly ratings you expect when you are shelling out nearly $1 million.

The monthly payment on this place will be close to $5,000 or you can rent a house in the area for $3,000. But again, the median household income points to people stretching to the absolute max with multiple incomes supporting rent or house payments. Inflation is already eating away purchasing power via energy, food, and other consumer goods. What if we enter into a recession? How will people cover the mortgage? And guess what? Rates are going up so it should be apparent what the next step will be.

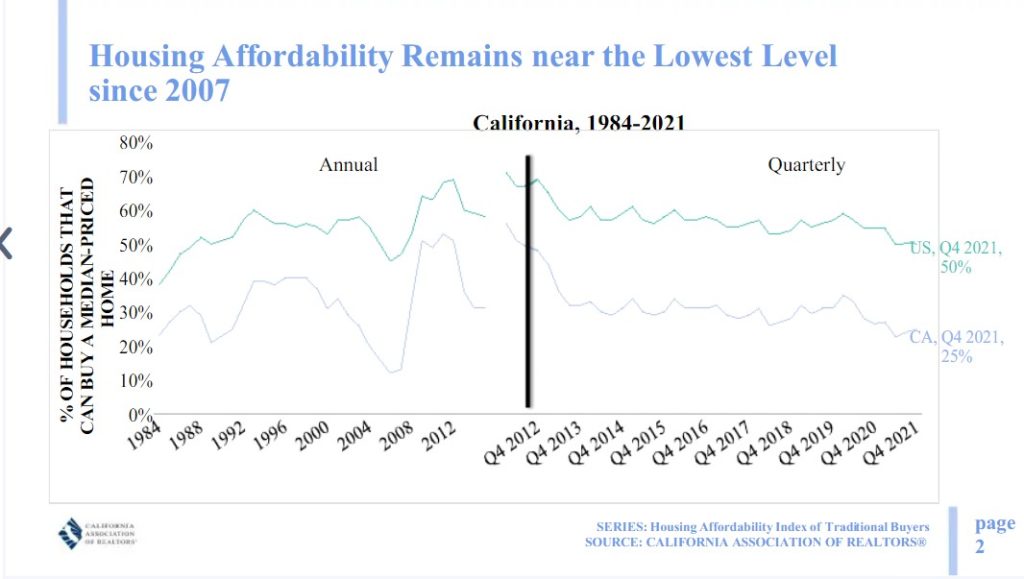

Even the California Association of Realtors, not exactly someone to talk about a housing bubble, shows with their data an affordability crisis:

Yes, all of this is completely normal and they even point to levels last seen in 2007. What happened in the subsequent years? Of course, a 4 bedroom in Paramount for $825,000 makes total sense. This market is completely unhinged and there are signs of over heating everywhere. For the housing drunkards, are you going to buy this house? If you truly believe in your thesis, it should be an easy move and you should plunk down some money on this “no lose” deal. Keep us posted.

The inflation numbers we are seeing right now are off the charts. Something is going to give this year simply because household incomes do not support these prices and low rates are maxed out and causing said inflation. Irrational Exuberance once again.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

213 Responses to “Real Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+”

“Irrational exuberance!”

The FED turned on the animal spirits and the lemmings are running off the cliffs!…I am selling RE at these prices, but I wouldn’t buy.

We agree again, Flyover. I wouldn’t buy in this market.

Given that the comparable rentals in Paramount are renting for 3K/month and the PITI for this house is $5K/month, it is not a good short term investment property.

The only reasons that would make me buy this house are:

1) I consider this house as my “forever” home in an area that I have always wanted to live.

2) I plan on living there for at least 15 years.

3) I have at least 3 years of cash to cover PITI ($180K)to prevent losing the house and all of my down payment money and time. (Job loss + stock market crash (like 2008)).

I can safely predict that within 10 years, the rent on this house will surpass $5K/month with current inflation.

Is it the best time to buy? No, but long term renting is financial suicide (Mr Landlord).

A house should be a place to live and enjoy for the long term.

Chunk of the PITI is principal payment (which will be recovered after sale since it is debt reduction) and some portion of PITI is tax deductible.

In other words, for true comparison of PITI vs Rent, one needs to discount principal portion and tax deductible savings.

Of course, there is opportunity cost coming from downpayment, but this can be compared against house appreciation.

True, but….

Principal the first year with a 20% down (165K) 30 year loan on this house would be about 900/month the first year. After 18 years, the principal payment would be up to 2K/month.

If the total PITI was about 5K/month (3500 PI, 1000 T, and 500 insurance (this seems high), and rent in the area is 3K/month, then IMHO it would still be a poor investment for the first decade. That’s not counting maintenance, etc.

As I said above, if you love the area and can live there for 10-15 years, you could then offer it as a rental and make a profit.

5000-900 principal – say $300 for tax write off = $3800

$3800 (fixed) vs $3000 rent sounds almost like a no brainer-to-me.

After 18years, principal won’t matter inflation will completely obliterate the fixed payment.

I’m going through this now with my son who has an offer on a house. He is single and since taxes are different for married vs single and for different income levels, I’ll use his situation.

Hypothetically, we will assume that he is renting in Paramount for 3K and considering buying this house for full price with no irrational bidding wars.

House price – 825K

Down Payment 20% – 165K

Mortgage amount – 660K

Interest rate with no points – 5.0%

Monthly payment with 1.1% taxes and flat 200/mo insurance – 3543 + 600 + 200 = 4343/month.

Interest per month for the first year: 2732/month = 32800/year.

Principal per month for the first year: 815/month

PITI-Principal – 4343-815 = 3528 /month – Compared to 3000/month rent.

Interest + prop taxes per year = 32800 + 7260 = 40,060

He is in the 24% tax bracket (which is why he would need a co-signer). .24*40,060 = 9614/year which is a deductible amount. This is 801/month

He would have to live very lean with a 100K income and a 52K PITI (or rent a room).

3528 -801 = 2726/month = total monthly payment removing the principal and including the tax benefit.

Renting is 3K/month but with the 12K/year tax std deduction comes out to 2K/month

Assume utilities are the same for both.

During the first year of owning with home warranties and no expensive maintenance assume 0/month in maintenance for owning. He never asks his current landlord for anything.

Owning would be 2726/month and renting would be 2000/month.

As the principal payment increases over the life of the loan, owning would be 2000/month after 14 years but rent will likely go up with inflation Maintenance would likely increase over this time for owning.

The house should appreciate at least the inflation rate on average (Unless you live in Detroit or the area becomes less desirable) so when it is sold, it is definitely better to own long term. The principal put into the house is like a long-term piggy bank that you should not be able to break. Long term renting is financial suicide.

In other words, I see your point for the long term. Neglecting that the money tied up in the house could be invested elsewhere which should gain at least the inflation rate.

With this severe inventory shortage I expect that house prices will continue to rise. On top of that buyers are facing higher interest rate payments. Ouch. People should have bought when we (experts on this blog) advised to buy. It just keeps getting more expensive.

Don’t try to time the market. Buy when you can comfortably afford it.

Thank me later

Supply and demand, that basic law! The good news is no more Ninja Loan and the bad news is not easy to get a loan.

“People should have bought when “we” told them to buy”. Obviously you don’t have a clue who is desperately trying to get into homes of their own. 3 of our married daughters ranging in ages from 30 to 40 are in the demographic who would like to have a small bit of the “American Dream”.

They did everything according to “the experts”. They worked hard, built their credit, saved every penny and yet they are totally screwed. All make good money with their partners, 100,000 on up. Yet time and time again they have been outbid by cash buyers, investors, and even realtors who flip on the side. Airbnb investors, buying up homes in Southern CA to rent out. It is a nightmare. It is totally unfair to their generation, while older people who bought much lower gloat about how much their homes are worth now, but couldn’t afford to buy them today.

One of our children bought Compton adjacent, because that was the closest she could get to our beloved South Bay. Her friends are leaving the area and state. She was lucky to get a 3% interest rate on a home with a 5500 sq ft lot under 600,000.

We are still cleaning it up and making repairs.

All that said, how in the hell are young people supposed to “buy when we told um”? Why do you think there is such a shortage of service workers in such expensive areas? Who will be doing the lawns, fixing the cars, and wiping the elderly butts of all the smug house rich baby boomers, after everyone else moves on due to lack of affordable housing? Good luck.

Sheila pls don’t sound so entitled. Owning a house is not a right. Go to Europe and ask around, most couples with dual income are renting. No houses for sale and if they are for sale they cost a fortunate. In Germany the mortgage rates are 1-2%.

In the US you can easily buy a house if you are willing to relocate. It’s already to busy here in California (close to the coast). If you can’t afford to buy a house here move away.

Thank you. I wish my parents were more like you. This empathy is deeply appreciated.

AirBNB – single handedly ruining small or desirable cities all over US.

Esp by investors buying up homes that our children or grandchildren would glad live in for the rest of their lives.

M: People should have bought when we (experts on this blog) advised to buy.

M’s “expert advice” was to NOT buy a house. All through 2019, 2018, 2017 and whenever he first came on this blog, he “expertly” advised against buying.

It wasn’t until his (alleged) home purchase in February 2020 that he did a 180 flip and advised people to buy.

Your daughters should be “smart” like M, who (allegedly) obtained an inheritance to buy a house.

Agreed SOL, experts like me have been telling people over and over to buy. I used to be bearish but finally decided to buy in Q1 2020. That was a smart decision. People like SOL have told me I bought the top and the cheered that the market will now crash since I bought lol. How foolish! To think that the market cares if a bear changes his mind and buys.

What can you learn from this story?

Buy when you can comfortably afford it

Don’t try to time the market

Don’t be bias, cut out the noise

Don’t listen to those crash-bros

Learn from my story

Listen to experts like me

lol @M with the condescending entitlement accusations. “if you can’t afford the coast move somewhere else” OR “wait for my family to die so that I can take their inheritance and pretend like I had earned my way here” ROFLMAO

SOAL, that’s right – my son did a complete 180. I think the basement views are getting to him…or maybe the heater is broken down there. I do remember him complaining about how his imaginary wife who was also previously frugal flipped 180 too and went crazy buying holiday decorations. As challenged as he is, my son does has a great imagination. Thank you for being here to entertain (babysit) him. He’s pushing 40 and still lives with us… the irony is that his favorite show is “Arrested Development”

M has some very valid points. He will be the last Bull on this HBB.

His Millennial generation is THE most fortunate generation in the history of mankind.

All they needed in 2019 (ages 23-38) at the height of this generation’s buying power was to have some money. They multiplied this money 800% buying BTC, 50% by buying a house, 1000% by buying Tesla and other stock.

I feel sorry for the next generation who will suffer and blame the Millennials for decades for their misfortune.

Signed

A Late Boomer

Sheila,

I have kids going through the same now. We are fortunate enough to be able to co-sign to help. We trust them enough to pay the mortgage with their current income and not wipe out our retirement savings. They won’t run like panicked lemmings if 2008 happens again. They will enjoy their homes and raise their families for decades. I hope yours will do the same.

Having purchased our first home in S. CA back in the late 1980’s with our first jobs, it wasn’t much different then. We needed a parent to co-sign and were were paying over 40% of take home pay on the PITI. We didn’t have much else to spend on without kids so Taco Tuesday Happy Hour and walking for free on the beach was our life. We never experienced a crash but housing was mostly flat but we were able to refi from our 11% mortgage rate down to 8% and finally have kids. This time may be different since rates are still historically low. There likely will not be much relief with lower refi rates for awhile but hopefully wages will rise to match inflation.

We are grateful to our parents helping us with this first purchase. We broke even after owning it for 6 years (tax-wise) but the principal paid and down payment were used for the next house. We considered it forced savings that we likely would not have had if we had rented.

“ M has some very valid points”

Thanks BOB! I guess I learned a thing or two by being on this blog for years and owning RE since 2020. 🙂

Sheila does not sound the least bit “entitled” to me.

True, owning a house is not strictly speaking, a “right”. However, when 80% of the population can only stay housed by doubling up with another family in a crud rental, no matter how they work, scrimp,save, and sacrifice, while people need to be in the top 10% of the population in income to buy a Lakewood shit-shack that was built in 1951 for high-school-educated factory workers and sold for $12,000 then, you have a third world society, with all the dysfunction and toxic politics that means.

I’m grateful that I’m a Baby Boomer, and that I own a place I love outright. But it saddens and sickens me to witness the increasing and extreme bifurcation of our society, and to see 75% of our younger generations emerging from school burdened with six-digit college debt, into situations of extreme economic precariousness.

“However, when 80% of the population can only stay housed by doubling up with another family in a crud rental, no matter how they work, scrimp,save, and sacrifice”

That means we won’t run out of renters anytime soon. I am already thinking of buying a second rental. We landlords provide shelter to our beloved renters. That’s called capitalism. I would appreciate if only dual high income couples with two kids rent my place. Clean, no pets, great credit, clean car, dress well, no criminal background, no bankruptcies. And 2.5x the rent as a deposit. Thank you, your Millennial Landlord

My son also likes to posts fantasy posts (such as deposit 2.5x rent) to attract the attention. He is still in early stages of fascination of capitalism and he has not advanced to the more advanced nuances yet.

Thanks Dad! I always knew I would have more money than you. But to be fair, back then you guys didn’t have Bitcoin and Ethereum!

>Who will be doing the lawns, fixing the cars, and wiping the elderly butts of all the smug house rich baby boomers, after everyone else moves on due to lack of affordable housing?

I don’t know about your daughters, but I know kids who bought their houses with hard-earned savings, with our help, and with help from inheritances from Silent Generation members whom they helped in their later years. They did that out of love, a sense of connection, and genuinely liking these elders, no expectation of a legacy.

One of these was a bedridden scholar whose last years were made less heavy by interaction with a kid who could read/translate Latin and cared about medieval scholarship. Another was a retired engineer thrilled to share everything he knew about legacy electronics and radio/broadcasting, also rocketry, with a geek kid thrilled to find an auldphag who knew more about all that stuff of interest than, alas, Dad knew. The love of my life and I were as surprised as they were to learn these friends/extended family members had provided for the kids in this way. And because of this support from people who loved them–unrelated–both these elders could live out their lives in their homes, pass along interests/skills, and have daily lives much higher in quality than in some phony-baloney “community” (elder ghetto).

Maybe part of your daughters’ problem is that they see older people as you appear to: a population to despise and segregate, not a part of the community. A population of nasty old people with poopy butts and shabby lawns…whose houses you want. Not bearers of memory, tradition, culture, and relationship to be treasured for the sake of something other than money.

Maybe part of your daughters’ problem is that they have a 1980s Money Uber Alles sense of entitlement and resentment…that, one guesses, they learned from you.

“>Who will be doing the lawns, fixing the cars, and wiping the elderly butts of all the smug house rich baby boomers, after everyone else moves on due to lack of affordable housing?”

well, our house cleaners are spanish speakers. they do a great job. My lawn is turf. In SoCal we dont like having real grass. I believe the cleaners live with two other families in an apartment. they can easily afford 4000 for a 3b between 3 families.

M is only an expert in being a spoiled hypocrite who preached for years of the impeding doom in housing and how he was going to wait for it to bottom out, but immediately bought a house the second grandma’s inheritance check cleared days after preaching he wouldn’t buy with his own money. The ultimate entitled hypocrite.

That’s true. I didn’t feel like I wanted to pay for high prices with my own hard earned crypto money. After inheriting I had so much money that I couldn’t justify to myself to not buy! And it was during Q1 2020 when everyone told me that I am buying the top. Lol

The story shows that you should buy when you can comfortably afford it. Don’t wait for a crash like I did. I bought and we couldn’t be happier in our big new house (it was a new built). Now I have already my first rental property as well. I think you can’t go wrong buying RE and holding for the long term.

My advice is free. What you do with it is your choice. But it can’t hurt to listen to people like me who are very successful. If you take at least this piece of advice: don’t try to time the market!

Here is a crime profile of Paramount:

https://www.areavibes.com/paramount-ca/crime/

It only looks good compared to this:

https://www.areavibes.com/compton-ca/crime/

I’d have to think that the property is being marketed to investors, since the greater area is a gangster’s paradise. But it may be a good place for landlords, and for building an ADU onto an existing property and jacking up the rental income. Unless you are already running units in that area and know what you are doing, I’d pass. You can get a lot less crime in a lot of places in So Cal for $800K for a $BR 2000 sq ft house.

The area is rapidly becoming Latin. Compton is 70% L, 25% B. Paramount is 79% L 12% B. And the City government is run mostly by Latins (Council + Mayor). Compton still has mostly Black control over the Council and government. This may be a play on a large influx of Latins into the area with rising rents. Crime in Paramount may be partly a spillover from Compton (which has a history of massive municipal corruption). Both towns are now patrolled by the Sheriffs.

Paramount has been Hispanic/Latin since the 1980’s. It’s Compton that is becoming Hispanic. The actual number of Hispanics in Paramount is closer to 90% but many of them identify as White so the “official” numbers are lower. The crime levels appears to have calmed down and become more civil. Back in the 1990’s Paramount had a similar crime rate to Compton although the murder rate in Paramount was much lower than Compton.

Here is a link to “SOLD” houses in Paramount on Redfin:

https://www.redfin.com/city/14399/CA/Paramount/filter/include=sold-6mo,viewport=33.91246:33.88571:-118.14035:-118.19056

Check out the recent sold house near the top of the list.

Who knew Paramount was so pricey?

Not surprising

home prices are not crazy – the amount of money people are earning is driving this.

Dumpy homes in West Adams are now selling for $1M !!!

Thank you Dr. for going back to the “Bad Old Days” of the “Real Homes of Genius” I really missed the dark humor of those days.

From the listing photo, I have one comment:

In these new days, for $825K, they have improved the photography and removed the the trash cans and the bars on the windows for the listing photo.

Something will happen by the end of 2022 at 5%-6% mortgage rates. The demand is still high, institutional investors are still buying now when savings rates are at 0.1% and rent is skyrocketing. When will government insured savings rates rise to 3%-4% again. Will it be worth the risk to invest in Black Rock or Invitation homes when their current dividend rate is 2%3%?

I opened another bag of popcorn and eagerly await your new posts.

Lansner of the OC register has another of his Bubble Watch articles today. He put the bubble meter at four bubbles (out of 5). He gives a decade by decade comparison of appreciation, inflation and interest rates. Last year was the first year since 1979 where inflation rates topped interest rates. The 30 year rate is twice what it was at the start of 2021.

What I don’t know is how much cash is been moved into residential real estate by big players. Clearly rising interest rates will deter first time buyers. Whether they also will make investors more willing to hold bonds, mortgages and cash is also important. Big money leaving real estate investment in a rising interest rate environment would make it easier for thrifty individuals with sizable downpayment to get back into the market. But that wouldn’t happen if the rising rates don’t control inflation. Think of Hugo Stinnes who had cash flow from coal mines that allowed him to borrow huge sums in paper marks in the early 1920s Weimar Germany, which he then used to buy real assets. He paid the debt off with inflated paper marks, while his new real assets went up in value exponentially in the same currency.

lmao, down she goes :))))

San Diego, CA Housing Prices Crater 12% YOY As Inventory Soars Triple Digits

https://www.movoto.com/ca/92110/market-trends/

Bend, OR Housing Prices Crater 22% YOY On Soaring Inventory As Desperate Sellers Slash Prices Double Digits

https://www.movoto.com/bend-or/market-trends/

As one Bend broker observed, “Now that everyone is desperate to sell, all the fraud will be laid bare for all to see.

Thank you Big Fat Bastard for paying my mortgage! Why pay for a quickly depreciating asset when the Big Fast Bastard will pay your mortgage for you?

My Brother and his Wife have been looking at several towns in the PNW. Bend was on the list as he had lived in Bend briefly some time ago, and they had relatives in nearby towns. I think it is off the list partly because of high prices, and nothing in that linked article would change that enough to put it back on the list. I’d call it a mild correction. Maybe if a REAL bubble pop occurs, he’ll change his mind.

Looking at redfin, it seems that most of the houses fall into the 500k to 600k range.

Not sure how you have much crime in a neighborhood with those type of prices. In my city, households living in this price range are the upper middle class. Low income crime usually has to find somewhere cheaper to live.

The homes will be a bit bigger, 3000+ sq ft and 3 car garages.

I wish I could find a 4 bedroom, 2000sf house for under a $1M. Near me this house would be $1.5M.

My house is half the size and appraised for $900k+ when we got our renovation loan earlier this year. We’re building an addition instead of trying to find non existent inventory to trade up.

My new hobby is browsing Redfin and seeing houses for sales that have sold in the last two years. I just saw a house in Temecula, CA offered at $695,000 that sold in June for $520K. Did a little digging and calculated my numbers as conservatively as possible and here’s what I found:

June 2020

Interest: 3.3%

Down payment (20%): $104K

Mortgage (including HOA, Insurance, Tax, etc): $2500

April 2022

Interest: 4.85%

Down payment: $139K

Mortgage (including everything): $3800

In 22 months the monthly payment went up 52% AND the buyer needs to come up with $35K more for the down payment. One can argue that the monthly payment was underpriced in April 2020 relative to today’s ever inflating dollar value but even at half the increase that’s still a tough pill to swallow. I don’t think this will last to the end of the year at this rate.

I still don’t believe we will see a Great Recession style crash, we never ever will. But I do expect drop in the MONTHLY PAYMENT (not necessarily the sticker price) depending on where interest rates stand in the coming months. Sticker price doesn’t mean anything, interest rates control this market and that won’t change for a very long time. Of course this is just the beginning of actual hysteria and bubbles always get crazier than crazy before they come back down to their senses. If this does come to end it will be a gradual and steady decline, not a sudden drop like last time. We shall see what these interesting times will show!

“Soft landing”, just like they said in 2008 >.<

My other new hobby is entertaining myself with comments that compare this housing market to 2008. Drawing comparisons to housing crashes of the past without considering factors of the current market vs previous markets is a foolish perspective that will get you internet points at best because it sure as hell won’t create any wealth for you.

Back to the main point. There are vast differences in both markets that will lead to vastly different outcomes.

2008: Oversupply, subprime lending, high unemployment, stagnant wages, decelerating rent prices

2022: Undersupply, strict lending, employee shortage, rising wages, accelerating rent prices

Literally the exact opposite in almost every major indicator and somehow some way we will get the same result. Makes perfect sense to me!

Soft landing is the best case scenario for housing doomsdayers.

This time it is different. Agreed.

You should compare apples to apples. 2006 to 2022.

2006: Undersupply, subprime lending, stable employment, rising wages, rising rent,

2% inflation, stable mortgage rates

2008: Oversupply, subprime lending, high unemployment, stagnant wages, decelerating rent prices

2022: Undersupply, strict lending, employee shortage, rising wages, accelerating rent prices,

Added – 8% inflation, rapidly rising mortgage rates.

2024: ?? – Depends if there is a soft landing.

Trust the Fed to not repeat what they did in 2008.

The main differences are subprime lending, rapidly rising mortgage rates, and inflation. I would count 0% down (VA), and 3% down FHA loans as loose lending for 2022. The effects of 2020-2021 mortgage forbearance haven’t propagated through yet.

Inflation, mortgage rates, wages and rent in 2006 were not accelerating as fast as 2022.

“ Soft landing is the best case scenario for housing doomsdayers”

So true @NewAge

The thing is, these crash-boys don’t care about facts or data. “It’s going to crash” is the default response no matter with what you confront them.

When you ask them simple questions that they don’t want to answer or can’t answer them they simply call you names. Reminds me a bit of the radical left and their cancel culture.

The main red alarm in my opinion is when the average mortgage far exceeds the average rents. This happened in 2006 when mortgages were 50-80% higher than comparable rents. This is heavily dependent on interest rates and the rate of rent increases. Rents today are accelerating faster than ever. Wages have never been this stagnant both factors are deflationary when it comes to bubbles. Prices aren’t accelerating and seem to have stagnated in my local market but not coming down either. You can argue 0% mortgages are 2022’s version of loose lending but the borrower still has to have the necessary income to qualify. In 2006, that was not the case.

The definition of a bubble is when the price of an asset far exceeds it’s value. Homes are pricey relative to a few years ago but even mortgages at 30% above comparable rents are not enough to cause homeowners to commit financial suicide and walk away because rents will catch up in a few years time and their wages will rise. I’m seeing a well balanced market between buyers and sellers. It’s definitely not a hot sellers market but it’s definitely not looking like a crash on the horizon either. It will be a soft landing at the best case scenario for buyers. Don’t bet on another 2008 style crash like everyone else is because there’s always someone out there willing to pay a dollar more than you are for that house.

Very few are selling especially in prime areas.

You are correct that monthly cost has increased as both prices AND interest rates have risen (which is counter-intuitive).

The issue again is inventory and need to park the money somewhere (money from investments, bitcoins, etc…). US RE remains very attractive for reasons beyond simple rent vs. buy economics.

Monthly costs are unlikely to come down. They will either trickle up just a bit to allow inflation/wages to catch up or stay flat. In general, expect higher % of the people’s budget to go towards housing (as is seen in Europe and more established parts of the world).

You are on point. Finally, someone who knows what they’re talking about!

Median household income is a huge factor but I suspect it is not altogether accurate. I know of many homes owned by a single person and room(s) are rented. Homes consisting of multiple generations are also common with multiple incomes supporting expenses. These scenerios are quite common in costly states like California.

https://nypost.com/2022/04/12/bitcoin-fans-are-psychopaths-who-dont-care-about-anyone-study-shows/

The average Bitcoin investor is a calculating psychopath with an inflated ego, according to scientists.

A team of experts recently surveyed more than 500 people to uncover the personality traits that are most common among crypto nuts.

They identified that many investors exhibit signs of the “dark tetrad”, a group of four unsavory traits made up of narcissism, Machiavellianism, psychopathy and sadism.

In plain English, that means dark tetrads have an inflated sense of self-importance and derive pleasure from the pain of others.

They also find it difficult to empathize with others and are sly and manipulative.

Bitcoin is the best thing since sliced bread. Our millennial generation has finally a financial vehicle to get rich slowly by investing in crypto.

I made over a million by dollar cost averaging and remaining patient.

You can do it too. Start small and don’t panic when crypto dips. Buy the dips and wait for the launch to moon.

M, you are not a psychopath. You have all of the traits of an excellent engineer.

When a product is doing well and selling well, an excellent engineer promotes and works until 2AM to expand and promote it. Excellent engineers have the drive and determination to work long hours to achieve a goal. On the political side, these are the people who work tirelessly for what they believe.

It the winds change and there is valid backup, the excellent engineer converts to the new idea/philosophy and they continue to work until 2 AM for the new cause. From my experience, an excellent engineer can do a complete 180 on any project or idea with a majority of factual proof. This is not a disconnect. It is a new concept that has science and interest to back it up.

A successful engineering manager has a tough job. It is a job best described as a lucky charismatic dictator who must have facts and experience to lead and motivate their team.

Successful engineers often do not have years of experience to rely on. Good engineering managers must balance experience vs current reality. The engineer and manager who allowed the “Pet Rock” or “Furby” projects to move forward were in retrospect geniuses of the human psyche. Engineers who promoted the Edsel were not.

I don’t see a 180 on any project as a failure of the engineer. It is a failure of engineering management to provide enough facts to provide a proper direction. It is our job on this blog to provide facts and experience.

M is correct. He did a complete 180 on the housing bubble in 2020. He was correct on everything. House prices, bitcoin, RSU stocks. Short term, I think M is a genius. Long term, it remains to be seen. Young engineers, like young political activists rarely are able to see the long term.

His head has become as bloated as the housing/stock bubble because of this.

M, you need to mellow out.

He just hasn’t seen the dark/down side yet and become an old practical engineer like myself.

Give it time. Comments won’t help but experience will solve it for any engineer or political activist.

One other comment because my ego is large enough to have the posting name: “Seen it All Before”

This time reminds me of the DotCom bubble of 2001. I was M’s age at the time.

My tech co-workers with heads too big to fit through the office doors were wandering the halls at work bragging about their 1000% gains in tech stocks like Cisco, Apple, Lucent, Amazon, Pets.com, QQQ, and a thousand more little known “E” companies.

Of all of the thousands of companies above, only Apple and Amazon were winners. Even they dropped 80% by 2003 but recovered within 4 years. The rest either disappeared entirely with bankruptcy or are still here but never regained their 2001 highs (Cisco).

All of these bloated headed engineers became very quiet after the crash. At least until the first housing bubble and now bitcoin came along. Some people never learn. Most are still working as engineers to conservatively save for retirement. The smart ones overpaid for a house in 2005 and are in good shape for retiring soon. Some showed their typical engineering irrational exuberance and bought rentals at an over-leveraged high price and walked away in 2009 when they were laid off and couldn’t afford the payments.

If you doubt me, look at what tech stocks and bitcoin have done in the last 6 months. Look at Netflix recently. This is the same pattern that we saw before in 2000. It took about 1.5 years for these stock to deflate entirely. We are at about 6 months. Some will survive at a temporary (4 year) loss. Apple, Amazon, Google. Many won’t.

If you bought anything, stocks, bitcoin, houses, before 2019, you can ride the roller coaster. It might be best to sell some and cash out. If you purchased 2020-2022, be prepared for an exhilarating downward ride until the next bubble starts inflating.

Bob I have seen it before as well as I am an older guy. I was tuned into RE and stocks beginning in the late 80’s and have seen plenty of boom and bust cycles. The fact patterns change but the human side of it is always the same. The cliche ‘pigs get slaughtered’ was not made up for no reason. The cycle of the smug and self-satisfied timing investment self-proclaimed geniuses, turned into quiet mouses when the downfall occurs. It will happen again as it always does. It’s very hard to talk when you are dining on humble pie.

Just as with the S&L Crisis, Black Monday, dot.com bubble popping, prior stock market crashes and super bear markets, other commodity/asset devaluations, and RE devaluations, after the evaporation of enormous wealth people will look back and see how a severe reversal was obviously going to happen.

Fortunately i for the most part get to sit back and watch the show and this one’s going to be another doozy.

M has traits not of just engineer, but specifically of hardware engineer.

Surge,

Ha! I have been a hardware engineer my entire career and primarily work with hardware engineers. My comments are likely biased because of this.

Having the experience of 2001 and 2008 and watching co-workers go from riches to rags with their exuberance, I thought we were at the top in 2018 for houses and stocks.

I was wrong. The Fed lowered rates to zero and purchased mortgage backed securities to drive mortgage rates to record lows. During the pandemic, the government sent out free money (and tripled the yearly deficit) to all to avoid a recession. That worked. We avoided a recession at that time. Financial engineering worked.

However, the effect of zero interest rates drove house prices up by lowering monthly payments. . Combined with free money and 800%-1000% gains in bitcoin and stocks drove the ability of people to pay the higher prices of houses up even further.

It was as if the Fed and government dumped a tanker full of gasoline on a wildfire.

M, caught that wild ride and became a homeowner and millionaire. My experience did not see it coming. Who in their right mind puts their money in risky investments during a pandemic? Not saying I didn’t benefit with the 500% rise of tech stocks. I’ve sold much of that portion to stay diversified. My current house went up also. It is a place to live and enjoy now and when I retire and not a place to pull out all of the principal to buy a car or boat.

The fire is now going out with higher interest rates and no more free money.

Will the Fed dump 100 tankers of water on the fire and cause massive mudslides like what happened in 2008 causing a recession? ie will houses crash?

Or can they pull off a soft landing and control this fire with calculated rate hikes and threats of rate hikes?

The financial engineering of what is happening is fascinating. I hope we aren’t commenting a year from now about how the Fed should have put on the brakes of the Titanic sooner before it hit the iceberg and sank just like what happened before in 2008.

I’ve seen it all before but could this be different? I’m sure the Fed supercomputers are running day and night to control this soft landing. At least I hope they aren’t a bunch of clueless old rich guys making decisions over their martini lunches.

If I were to bet, based on history, I’d say they are clueless old rich guys. I am diversified enough to ride this out and I missed out the last time in 2010 at buying another Real Home of Genius house at the 50%-off bottom. Experience says this will eventually happen again. History repeats itself.

Fiat money is giving an option of fine-tune velocities of the money. Inflation is a feature, not a bug. Downside of course is the probability of sub-optimal decision/tuning of the these velocities (effectively an interest rate). It is guaranteed to be an overshoot or undershoot, especially when you are considering a multitude of groups impacted. Crashes are also possible. But it’s not like tying a currency values to some piece of metal is going to reduce # of financial crises.

To survive financially downturns, one must have multiple levels/back up systems in their financial fortress. Healthy cash flows, real estate, cash. It is wise to do a stress test scenario on your finances for example; what happens if RE prices drop 30%, stocks 50% and your income is reduced by 50%.

and…The rich old men are clueless only when we are losing.

Yes, and you are a good person. Clap clap

Great article. The crazy monetary policies of the Fed and US Government are putting all of us into poverty.

Doc, It’s good to read you again. You provided so much support and facts during the meltdown. I think back, it’s hard to remember how many banks from that time are gone. The shenanigans the banks were pulling while unable to actually run any solutions. Horrible times.

This is not on Real Estate, but I’m posting it anyway to see what this gang thinks.

I have never had a Twitter account. Nor do I ever go on their site directly, or have a Twitter app on anything. I prefer to look at issues of interest on discussion boards like this one where a wide variety of opinions are given.

I have been following the Musk Twitter share purchase, as many of you no doubt have been doing also. Even with almost 10% of the shares he couldn’t get any kind of censorship removal concession. Now he’s not even the largest shareholder. Vanguard (where I have a lot of retirement money) is now the largest shareholder. Another huge shareholder I found out is the Kingdom of Saudi Arabia, that well known upholder of journalistic freedom. They are rejecting Musk’s money (Like they need more money, huh?). Vanguard has a history of voting with current management. Damn the fiduciary duty to maximize their fund holder’s profits (Musk is willing to overpay, but apparently so is Vanguard if they are buying now). Maybe I should move my accounts to Schwab?

Well, I guess the big boy investment companies with large chunks of Twitter decided that $52.40 a share wasn’t a pipe dream. My faith in Capitalist pigs wanting a full trough has been restored. That was pretty expensive corn you filled the trough with, Elon!

The lefties on Twitter will have to put their boxing gloves back on and climb back into the ring for a verbal slugfest.

It’s good to see Real Homes of Genius back again. I wished I would have bought some of the older RHoG, especially that 600K shitbox in Manhattan Beach with all the trash cans out front. The housing market is completely insane. But this time really is different because it is insane all over the country. My war chest has been overflowing, I still want a rental…but nowhere near these prices.

The reason housing is insane is because there are more Milleniala and GenX’s than the entire population of Japan. And many of those M’s and GenXrs are well paid professionals who want to buy a home – demographics are keeping housing high combined with chronic underbuilding of homes since 08.

It doesn’t help prices when the horde of investors in BlackRock, Integrtiy Homes, etc (think pension funds, hedge funds, ETFs, mutual funds, and personal REIT investors) are pumping money making a 4% return into making houses more unaffordable. They are driving the 20% of the cash purchases for houses.

“The enemy is us”.

The Fed needs to raise savings rates above 4% to keep us from destroying our future generations and to drive these leeches out of business.

I used to yawn at 4% when I was young. I took out a car loan at 4% when my bank account was paying 6%. That didn’t last long so after much hassle, I paid off the car loan in 2003. It took the lender 4 months to provide me a payoff amount. I was so pissed that I will never take a car loan out again.

There are two somewhat conflicting articles in the OC Register RE section today. A poll by Zillow showed 84% of adults in LA/OC support addition of units to existing houses. Similar rates were seen in the Bay Area. Construction of small to medium size apartments got 63% support in LA/OC. Renters of course support this more than homeowners. And younger people are more pro-ADU.

The second article is on organized resistance to duplex/ADU construction. Temple City passed a design standard ordinance to limit ADUs. The ordinance forces owners to get rid of their garage and driveway, and force tenants to not own a car (no parking permits allowed). They also are demanding a higher level of building code certification (LEED). The ordinance limits housing additions to 800 sq ft (the minimum under the state law), and demands low income friendly rents for 30 years. Example: a family of 4 would have to make less than $94600 and could pay no more than 30% of their income in rent.

Sonoma has similar restrictions, and adds a mature tree and shrub requirement. Laguna Beach prevents lot splitting by mandating that each lot be a perfect rectangle. The ordinance also requires mac lot have a continuous 30 ft road frontage. Since the average lot in Laguna has 50 ft of frontage, that dooms the project. Sonoma bans flag lots. (Flag lots are common in rural areas; my Brother recently sold a 2 acre lot with a house that had a 40 ft wide 300 ft long flag to the county road.) In more urban areas, flag lots generally have a “flagpole” wide enough for a driveway and a walkway. Maybe 15-20 ft wide.

Redondo Beach, Torrance, Carson and Whittier have filed a lawsuit against SB9. The article I saw on the lawsuit filing was dated 04-04-22. So this is only the beginning.

Interestingly, Yorba Linda has welcomed the state mandated housing plan with open arms:

https://therealdeal.com/la/2022/04/15/yorba-linda-first-city-in-oc-to-complete-state-mandated-housing-plan/

I wonder what this will mean for the future…. I have a friend who owns a rental there and another buddy for mine just moved his family to that area on a nice big lot.

Places like LA have become AirBNB meccas and that will be key for the next downturn. The bubble is partially built up because not only does everyone have a job, but that job allows them to buy a house and then rent other houses part time for vacations. When a bunch of those people lose their source of income from rates increasing and QT, supply will come on board. Until then, I am waiting. I chose to work a job years ago where I will be the last to lose my job. People working for zombie corporations have no choice than to buy right now. They have never had this money before. But it is all based off of corporate bonds that are about to become a lot less attainable. That is what I see being the next needle to pop this ridicilous bubble. I never thought it could get to this.

So far, not only the FED did not eliminate the QE, they increased from 30B/mo to $55B/mo – almost double. And that, only in the last 30 days. The FED is lying; they do exactly the opposite of what they say. Inflation is here to stay. When you pour 55B of “gas” on the inflation “flame” of 8.5%, nothing good comes out of it. The FED acts as arsonists for the economy.

The Fed tries “jawboning” and warning what they will do first. Many sheep believe them and react.

When that doesn’t work, they do 1/4 of what they say.

Bad parenting is their basic skill.

I believe inflation is part of the plan to eliminate the massive bubbles. a 30% bubble is gone in 3 years with 10% inflation.

The Democrats want higher wages to relieve the pain of inflation.

You still have to work to get your raises. Unless you are on Social Security, then you get them automatically

Mortgage Rates at 5% are certainly not ideal. But the low housing inventory will help counteract the higher than normal rates. This should keep housing prices elevated at current levels at least the rest of the year, I believe even thru 2023 prices will remain at these current levels.

In 2023 if we see rates pop up over 6% and more inventory starts coming into the market then I believe there is a chance we could see as much of a 20% reduction in prices into 2024. I would rate that an an extreme downside prediction over the next 2-3 years And I believe the extreme upside prediction could yield an additional 20% to the already elevated levels over the next 2-3 years. And my more than likely prediction I believe the 2-3 year outlook ends up relatively flat. Meaning these current levels will be with us next 24-36 months.

The big question is why is the supply so low compared to historic values?

Is it because:

1) People like me sitting on a primary “forever” home with a job to pay the mortgage?

What happens if people lose their jobs in a recession? Will supply increase like 2008?

2) Is it the demand of investors and pension funds chasing a 3% yield and investing in companies like Black Rock and Integrity Homes who are using this money to buy up all supply possible?

What happens when the Fed raises savings rates to above 3% and they are wiped out?

3) Is it late Millennials or Boomers/GenX who missed their flights trying to panic scramble into a house with no inspections?

What happens when the banks tell them they do not qualify at a 5% mortgage rate?

4) Is it because builders are not building the high demand SFH’s?

Will they? Yes, but they are limited to labor and material costs. Is there still a market?

5) Are home buyers cashing out on their 50% bitcoin/stock gains to buy a house?

They are for the moment. So many who invested in BTC and stocks are millionaires like M from 2019.

6) Is it people who received $3,000 Covid relief checks who are buying million dollar houses?

Nope.

So many dynamics to the supply and demand questions.

You are correct. Supply is currently low and demand is high. Everyone has a job who wants one and the stock market is still at all-time highs. Yay Biden and Trump for this awesome economy with money for all. Utopia has been achieved thanks to government deficit spending and Fed money printing. This is better than communism.

Rate is already over 6% for many. I am afraid we might be seeing 7% this year. No need to wait for next year.

RHoG, glad to see this is back, reality check for sure especially when you look at the price history. Doc,you should take a look at homes in Lakewood sometime, what was $660,000 in 2019 (it was overpriced back then) is over $900,000 today and still going up, not common to see homes sell for 6 figures over asking in the area, especially 90713, how long can this go on for, as rates started to rise to the 5% mark, homes started selling like hot cakes again…

I have a question for all here – what can be the impact on the derivative market if interest continues to increase?!….We know that Warren Buffet described them as financial weapons of mass destruction. I am asking that question because if it blows up, that can have a tremendous impact on the banking sector and implicitly on the RE sector.

I know someone who recently got preapproved for a $980k home on a 30 year fixed loan. They have a $160K income but also have ~$150K in student loan debt. Their credit score is 800+ credit score, but this still sounds like a bad/subprime loan. I’m not buying the story that subprime loans are a thing of the past.

Sounds like a kamikaze maniac to me. $160K in income with a $150k student loan? That’s a recipe for disaster in the event of a job loss, etc. And you’re guaranteed to be house poor for the next 10+ years. Unless he expects to earn substantially more money in the near future, it seems like a bad idea. Of course, with my luck (I’m one of the many on the sidelines with good income and big down payment), inflation will continue unabated and he’ll look like a genius.

I was warned about being “house poor”

I was house poor for about 5 years as were all of my friends who purchased in S. CA during the mid to late 1980’s.

Our wages then went up 5X, we refi’d from 11% down to 3% and have paid off our loans.

We are set for retirement. 2/3’s of this may happen again for Millennials today.

The penalty back then was all of us lived VERY cheaply with free tacos and dollar well drinks at Happy Hour. Walks on the beach were free. We all postponed having kids and bought cheap used cars. I preferred a bicycle. I didn’t mind. I just came from college eating ramen.

When we had kids, then the costs went up. Bigger house, bigger car, new clothes every week, accessories, sports, dance, college, etc…..

I was much richer but also financially poorer.

My house financial investment cost was much less than the cost of having children over the long term.

A downturn in loan applications has/will lead to desperate, irresponsible business in the mortgage industry.

“I know someone who recently got preapproved for a $980k home on a 30 year fixed loan. ”

I see a few possibilities:

1) Subprime loans have never left as you suggested. What is the rate they were quoted?

2) The buyers have 500K in bitcoin gains they are ready to apply to the down payment in order to get into any house. A 500K loan on that income should be doable.

3) They have a co-signer who is adding their income to the loan.

I think any of these are possible.

I think the buyer could handle it if they live extremely lean, they don’t lose their jobs, and they have 2-3 years of payments in cash in reserve. They will be house poor for years but they will be in a house. Long term renting is financial suicide.

The lender for my investment property sourced any large account that was used for the 25% downpayment. On top of that I had to show 6months of mortgage payments as reserves in order to gain approval from the underwriter.

People who buy investment properties can afford it and can weather a storm. Short term I think there are price reductions and muted demand ahead of us. Neighbors of mine missed the window to sell high. Now they are going through multiple phases of reducing prices. Just a few month ago before the steep incline of rates we saw multiple offers above asking. The market is changing quickly which doesn’t mean price reductions year over year. A reduction in ASKING prices doesn’t mean a decline YoY in sales prices.

Interestingly, rates have doubled in Germany as well. Inflation and the Ukraine war.

Hey guys. Long time no see. I don’t follow this blog anymore, but dropped in throw out an interesting data point. I retired at 55 from the aerospace biz a bit less than a decade ago when salaries for experienced engineers and scientists were in the $150-200K range and you could still find decent homes in the LA area for $500-600K. I just chatted with an old friend of mine still in management and they are DESPERATE for experienced people. He quoted me an offer of $320K and said that was now common in the industry for hirees with 15-20 years experience. That blew my mind (but didn’t tempt me to go back to work).

Much as I hate to say it I think the insane RE prices around here may actually be supported by the salaries people are getting.

Interesting. I know we are desperately trying to find engineers with specific skills.

I did not know current salary offers. I should talk to my manager. 🙂

I do know that some lucky engineers are sitting on large quantities of RSUs that are waiting to vest.

RSU’s granted 3 years ago are now worth 5X-10X more than they were back then since the stock prices have bubbled extremely high. Nobody wants to leave until their RSUs vest. Depending, it could reflect a 50%-100% pay increase per year.

When the stock market bubble finally bursts, that will likely change.

We got 3 quotes to remodel our 2 small bathrooms. One a 9×5 shower, toilet, pedestal sink. Master bath isn’t much bigger.. but has a tub/shower combo and dual vanity. Nothing special. All the quotes quoted JUST labor at $15-20K for the small bathroom. and $20K-35K for the master bath.. JUST FOR LABOR! Vanity, toilet, tile costs were up to me.. but additional cost. What a bargain! THIS is why houses cost so much. My parents bought an entire home for the cost of a 2 bathroom remodels in Los Angeles. Plan to just wait until the inevitable next recession to have work done. When we bought our home in 2010 we got a bargain on all work done to the house because all contractors were out of work. Right now they are over-worked with all the remodeling jobs so they care charge whatever.

THe builder i talk to told me the income of families who buy his houses here in Socal are 250k+ (household income) and they all bring a hefty downpayment to the table. In other words they can afford a 1M dollar home.

https://fred.stlouisfed.org/series/ACTLISCOUUS

here the active inventory listing chart for the US…..which inventory soooooo low there cant be a housing crash….Plus, who in their right mind sells their house during 5%+ rates when they are currently locked into 2-3% rates??

“Plus, who in their right mind sells their house during 5%+ rates when they are currently locked into 2-3% rates??”

I wouldn’t. I expect most homeowners who are in their “forever” homes wouldn’t either.

I suspect some reasons may be:

1) People who are downsizing or moving out of the area and want to sell their current house at an amazing gain and pay cash for the next house with that gain.

2) People who are panicking after their house in 2008 became half its value from what they paid in 2005. They are selling and renting now to try to time the market. I don’t know of any one who was successful with timing the market from 2006-2014 but most people should believe that with millions of dollars in the bank, they can rough it and rent for a decade if needed. Otherwise, they expect to time the bottom.

3) Landlords selling their rentals and cashing out on incredible gains. Even though rents are up now, cashing in for millions while the market is peaking is a good financial wealth diversification/rebalancing move. Median rent flattened from 2008-2011 and fell from 2011-2014 in LA County as the economy recovered. Rent forbearance prevented many from selling in 2020-2022.

Very solid point M on who would sell their house when locked in under 3% on current mortgage. I think only those with a ton of equity in their house who really need/want to upgrade into more square footage/different town or neighborhood. But certainly as the rates push over 5 and closer to 6 the pool of would be upgraders will get smaller and smaller.

Selling and upgrading is very difficult:

Imagine if you bought a house for 1ml and now it is 2ml (after few years).

If you want to buy identical house across the street.

Yes, you will get extra 1ml in equity, but…

1) New house also appreciated

2) Astronomical price gains (especially prime coastal areas) will cause significant tax burden post 500k gain exclusion for married. In the example, tax on of 500k gain.

3) Property tax burden increase ~2X (California only)

4) Costs of selling.

5) Rate exchange from low to high.

So, homeowners

OC Register columnist Lansner has an article about the huge jump in the average monthly payment for a house in SoCal. This figure does not include taxes, association fees and insurance so the real story may be a lot worse. The six county region had a 31 % surge. That would be a house payment of $2738 for a $735000 house. He has tabulated year to year data for all months going back to 1988, and this jump tops 96% of all one year jumps for a given month. The worst jump was in Orange Co, with a 37% increase in loan payment. And the median price was $1,020,000 with a $204,000 down payment!!

This is a combination of rate increases and price increases. I don’t see monthly payments going down anytime soon. But cash or mostly cash buyers could get a windfall if interest rates rise to match inflation. The payment for people who finance most of the cost will still be astronomical, but the selling price (except maybe for mansions and estates) will not stand at the current level unless big money investors jump in with both feet. That would be the worst possible outcome.

This is a great read. Holding off purchasing a property for now. Everything seems so uncertain.

Headline: Mayor Launches Campaign to Hike “Luxury” Real Estate Tax

https://www.surfsantamonica.com/ssm_site/the_lookout/news/News-2022/March-2022/03_31_2022_Mayor_Launches_Campaign_to_Hike_Luxury_Real_Estate_Tax.html

Mayor Sue Himmelrich has launched a campaign for a ballot measure that would dramatically hike Santa Monica’s transfer tax on “high end” real estate to help fund “homelessness prevention” and build affordable housing.

The proposed tax measure — which also would help fund the local School District — would charge a real estate transfer tax of $53 per $1,000 on properties valued at $8 million or more, primarily apartments and commercial properties.

If successful, the “Funding for Homelessness Prevention, Affordable Housing, and Schools” ballot measure is expected to generate $50 million a year. …

Rates are impacting the RE market tremendously. Affordability took a big hit as prices remain very elevated. Buyers demand is dropping like a rock. Inventory is starting to rise as buyers back off. It’s not that people are rushing in to sell its simply this: people stop buying.

This is needed and healthy for the market. We were going far too fast and hot for 2 years. The market is finally slowing down. Will it be a buyers market towards the end of this year? Nobody really knows. A major slowdown is here. Does that mean crash? No. Does it mean yoy price reductions? Maybe. We could slow down and still be positive with yoy price growth. Mortgage applications are down 17% in SoCal and expected market time is finally rising again. Interesting times ahead. Maybe another buying opportunity for me.

We sold our home in 2006, bought in 2011, and just sold. I can not predict what prices will do in the next year, but in my eyes, the risk and chances are much greater for the downside than the upside.

You are trying to time the market.

How did that work out in 2006-2011? Did you come out ahead? The selling and buying years show that you timed it very well last time. Nobody else I know timed it as well as you.

Let us know how that works out.

What’s wrong with timing the market? It doesn’t mean you have to wait until the absolute peak or the perceived bottom until you sell. If you can move in and out of the market whether it be houses, stocks, or pork bellies while taking your gains and putting them aside, why not? Housing has essentially turned into the stock market with all the investors, hedge/pension funds, etc. Just watch how fast they run for the exit when treasuries start paying 4-5% or more.

I moved almost all my investments to cash this past December. I figured I’d take my nearly 300% gains over the last decade and park it. Yes, I’m losing money to inflation but the S&P is down at least 4 points more than the declared rate YTD so I figure I’m breaking even at worst. You don’t need to be a financial genius to recognize which way the wind is blowing.

The worst mistake I made was a couple years ago waiting to jump in feet first when the DOW hit around 19K (I told myself I would wait until 15K). I should have went all in somewhere in the mid to low 20’s and sold again around 30K.

Yes, you can dollar cost average, hold onto your home and your investments for dear life, and keep making your payments feeling good about your 2-3% rate and keep telling yourself you “don’t lose anything until you sell”. Then I will swoop in and buy the house next door for even 20-30% off which equates to hundreds of thousands of dollars in my neighborhood. I don’t care if the rate is 18% when I’m paying cash.

If we have a job loss black swan type event combined with the rates going through the proverbial roof, look out below.

In the mean time, I’m getting rich off the “special military operation” by Trump’s comrade. Biden is doling out dollars for contractors like a pimp. First Afghanistan, now another never ending cold war. Conflict pays the bills if you know how to get a piece. Just need a massive lob loss scenario and I can play big bank takes little bank.

If I’m wrong, I miss out on some gains and sit in my almost paid off home with a PITI than I can pay with a barista salary. Then I’ll start slowing investing again a couple years from now. I see storm clouds ahead.

“Then I will swoop in and buy the house next door for even 20-30% off which equates to hundreds of thousands of dollars in my neighborhood.”

Lol, funny how people think housing could fall 20-30% off of today’s prices 🙂

SoCalGuy,

I try to time the market with stocks. Not very well sometimes.

I would never try to time the market with a primary home unless I was planning on moving anyway and wanted to rent for awhile due to a temporary job assignment or to study the area I was moving.

Anecdotally, a friend tried, but thought the market peaked in 2005 so they sold their house. They finally bought a house in 2014 after the bottom. They still paid less for a similar house in 2014 but they had selling costs in 2005 and buying costs in 2014.

They had to live somewhere for 9 years so they rented waiting for the bottom. They had 9 years of rental costs of about $2000/month = $216,000. That ate into their initial profit and with the house they purchased in 2014, they had to re-start with a 30 year loan. 9+ years of lost principal payments.

cdcrez had the timing much better. cdcrez sold at the peak and bought at the bottom with only 5 years of renting.

Can cdrez do it again?

@ M

“Buying makes sense if the market is about to recover after a crash. So buying at the peak (like now) is the worst time to buy.

Have you ever heard buy low sell high? If so, thats a phrase to memorize. Have you ever heard of buy super high and foreclose when you lose your job? Thats not a path to great riches. Is it more likely the latter happens in this environment? Yep! Is it more likely at some point in the near future we will get a bust (just like every time we had an extrem bull run? Yep! Do market go up forever? No.”

Just following your advice… except for BTC going to $100K this year, how’s that working for you? looool

Whether we see a 20-30% correction or the market stagnates, who knows. Inflation is definitely eroding any perceived equity by that amount over the next few years regardless.

@Bob

I totally agree. I don’t think a primary home should ever be considered an investment as you have to live somewhere. I’ve made all kinds of improvements to my home that I will never see a return on but I sure do enjoy them now which is what counts.

With regards to your friends’ scenario, the lines are blurred because the rental market wasn’t ever this crazy in my memory. Rents actually fell during that time.

I remember houses renting for cheap during the days of neg-am loans in my neighborhood. Once the bust occurred, there were a lot of homes renting for even cheaper as investors scrambled to find people who could pay the bills. I had more than one friend during this period who were living off their rental income while simultaneously not paying their mortgages. They used all kinds of legal shenanigans.

My point is, it really depends on the difference between the rent ($2000/mo) and what a mortgage would run for a similar property. You also have to figure in maintenance, taxes, and depreciation they didn’t have to pay (that roof has 9 years less of life). So it’s not so simple to say they lost all that money. There’s also an intrinsic value to renting which is the ability to pack up and leave at a whim.

Long term, of course owning beats out renting. Right now, if you have a decent rental that isn’t raking you over the coals with yearly increases (I have several friends in this scenario), I don’t see it hurting to sit out on the sidelines until this all plays out over the next year or so.

Socalguy,

“ So buying at the peak (like now) is the worst time to buy.”

You said that to me during Q1 2020 as well when I bought my first house. You never admitted that you were soo wrong.

What makes you so sure that prices will be flat or negative in 2022 compared to 2021?

This time you are able to time the market better than in 2020 during your Covid-crash call?

Sounds like timing the market to me. Sometimes you get lucky, most times you don’t. So you sold your 2011 purchased home and are renting now? I imagine your monthly outlay to get into similar property went WAY up. And that beautiful Prop13 tax basis is gone forever.

The hassles of selling, moving, renting and then hoping for a market correction to get back in is something most people just don’t want to deal with. And the experts on this blog told us 5 years ago there is simply NO way that socal housing can go up any higher. Nobody knows what the future holds, people holding for the longterm should sleep well at night.

Is California housing due for a hosing?

“…Typically, when something as obvious and terrifically financially/economically destructive lies directly ahead…the Fed has three choices. 1) Let it all blow. 2) Come up with a whole new set of acronyms to avoid a free market outcome. 3) Do a little of #1 and then go all in on #2!?!…”

https://econimica.blogspot.com/2022/01/california-real-estate-market-totally.html

oh oh oh, that hissing sound, that’s the sound of your equity leaking out, sssssssssssssssssssss opps, upside down, foreclosure, bankruptcy, sorry your honor, I listen to the realturds and purchase, refi’d at the top, math was never my strong point, promise I won’t do it again, like I did in 2009 cuz 2022 is different this time 🙂 lmao

That’s correct. The market today couldn’t be more different than 2005/2006 which led to the Great Recession ( job loss recession ).

Todays market has record low inventory and an extremely healthy owner credit profile. People who bought the last few years could afford it and are sitting on a stash of equity. Very different than 2005/2006. In 05/06 prices started declining and people bought homes on NINJA loans. Back then they all thought but now or be priced out forever. Different from today when everyone things this is a bubble and will crash any minute. I

Remember one thing: the market usually does the opposite of what the masses believe.

I experienced that first hand when I bought in Q1 2020 during Covid and everyone told me the market is going to crash. And here we are 2 years later and I made out like bandits.

The May 1 OC Register had two views of the Bubble:

1) A review of data from Fitch Ratings for 2021 Q4 by columnist Lansner. Fitch compared prices with economic fundamentals including local rents. Fitch says homes in LA & OC were 7.3% overvalued. This was compared to Boise which is 25.9% overvalued. Naples FL is 25.5% overvalued. I visited Naples a while back and it seemed like a good place to move to. San Francisco was CA’s most overvalued metro area (+17.1%) and Santa Rosa was the most undervalued at -8.7%. Lansner gives LA/OC a 1 bubble rating on his 0-5 scale. He does give a caveat that this data is old history as we are now in 2022 Q2 and interest rates are popping. That could alter the bubble landscape.

2) An interview with PIMCO bond manager Mark Kiesel has a man who sold his OC house in 2006 and bought again in 2012 predicting little appreciation for anyone who buys now. He says his buy/sell algorithms are flashing “Orange” now (I assume this is one step below “Red”). The author of the article (a writer with Bloomberg) also cites the Natl. Assoc. of Realtors’ home sales contract leading indicator for falling for 5 consecutive months. Oddly, PIMCO’s forecast isn’t as gloomy as their chief investment officer’s. The housing sector analysts at PIMCO see no bust, with a national shortage of 2 to 5 million houses. Kiesel still insists that he wouldn’t buy in this market and may sell. “It’s only a good investment if you buy at the right time” says the unsentimental Kiesel. He thinks the potential return (2% ) from buying now could be beaten by other investments.

Palo Alto “pods” renting for $800 a month:

https://www.zerohedge.com/news/2022-05-07/you-can-live-orwellian-nightmare-just-800-month

… Brownstone Shared Housing has begun renting sleeping pods in a Palo Alto home owned by the company for $800 per month. …

Their Palo Alto home is designed to accommodate 14 people who would sleep side by side in a hive-like sleeping pod apparatus.

Each pod is 8 feet tall and comes equipped with a fan, lighting, fold down desk, charger for smartphones and other devices, as well as a curtain for “privacy.”

Despite being designed to accommodate up to 14 renters, the house only has 2 bathrooms alongside communal living space which includes a single kitchen. …

And people think that when there is a revolution in this country it will be because everyone wants a free handout.

Bitcoin down 40%

Housing heading into the toilet

The pain is to great, but the worst is yet to come.

When someone is bragging about his investment, you know they are BS’ing

Buy when there is fear, sell when everyone (shoe shine boy) is buying.

Enjoy what’s coming, I know I will :))))

M is an idiot of the highest order

Well, let’s let the success speak for itself:

Bought a nice house (brand new) in Q1 of 2020

>>> everyone told me I bought the peak.

Fast forward to today and I have close to 500k of equity gain and a super low locked in rate.

In addition I have bought my first rental (also brand new) which has already appreciated nicely.

I call that success. Obviously, that brings out haters and jealous people. But all they do is name calling 🙂 you gotta earn the jealousy.

I have never heard a homeowner be jealous of our renter-boy SVs9000 🙂 🙂

I’m sure M sold all his crypto right before the crash (because of course he did), and is right now buying the dip

Sol, why would I sell my precious bitcoin?!?!?!

Buy the dip baby! A crypto crash is a gift from god! I am DCA’ing and love lower prices!

This strategy has worked now for many years!

The boomers used to say: don’t change a running system. I sort of agree.

Investing isn’t hard:

Don’t let emotions take over

Slow and steady wins the race

DCA and hold long term

Don’t Panik sell

Buy when everyone tells you it’s going to crash (remember when I bought a house in Q1 2020?)

LOL on M doing the right thing with BTC right now and will tell you about it in 1 year. I see a slow squeeze of BTC to 18k range. Possibly as low as 12k range. Nasdaq and DJIA possibly a slow squeeze down 30-40% more from current levels over next few years.

Real estate will be a lagger. But with rates nearing 6% and possibly an uptick on foreclosures due to crypto and stock market turmoil\Inflation pressures we could see a small bit of pressure on current levels in next 12 months (10-20% off current levels possible). I still have more concern for the rental market. If Washington DC does not re-fill state coffers to give people free rent money again there will be eviction tsunamis coming in 2023. So hard for low/middle income to pay the inflated rental costs as well as all other energy and living costs. Hence why the adminstration diverted a lot of printed Covid stimulus to go pay landlords and back utilities. They know there is a big leak, they are trying to plug it with some bubble gum.

Yes. It is a certainty that he will claim he bought the dip. Meanwhile his net worth just decreased by 25% in the past six months.

“Bitcoin has surged tremendously! New all time high baby and the first US Bitcoin ETF is trading on the Nasdaq!but to your question: HODL means hold on to dear life.

What it really means for stock and crypto trading: buy the dip instead of panicking and selling your precious Bitcoin/altcoins.”

“DCA’ing (dollar cost averaging) and HODL’ing (don’t sell during corrections) are an excellent strategy to become wealthy. This is true for stocks and crypto!

If you need more help to get started, download the coinbase app and purchase Bitcoin, ETH and Cardano. Thank me later ????”

No, he’s a HOLDler… looooool. If you followed this advice from Oct 21 you’d be down over 50%+ with no bottom in sight. Bitcoin ETF’s introduced Oct 21, also down 57%. Loooooool.

I went to almost all cash in December. I decided to leave the game after the 8th inning versus waiting until everyone is fighting to exit the parking lot when the game is finally over.

My primary home isn’t an investment so I don’t really care to brag what it’s worth right now unlike the resident troll here. Here’s a hint, that AZ property will drop like a rock when all the overextended credit criminal roaches stop paying their rents/mortgages. Same goes for Las Vegas.

Jdm,

“ eviction tsunamis”

Lol. Reminds me of when people said the end of the mortgage forbearance will result in a foreclosure tsunami.

And in Q1 2020 people told me I bought the peak and the market will crash. Lol

“ If you followed M’s advice”

You would be a wealthy man! Remember don’t follow what the masses will tell you.

Here my advice:

Real estate

Buy as soon as you can comfortable can afford it

Never try to time the market

Stocks

DCA and hold long term. Buy more on dips

Crypto

DCA and hold long term. During bear markets people will tell you it will go to zero. Buy here and there and never more than you can afford to lose.

Sell when everyone is talking about bitcoin again (new all time high).

The crypto cycle repeats itself over and over. It’s relatively easy to make over a million if you buy when everyone thinks it will go to zero and don’t get too greedy.

Once you have a hundred’s of k in cash after doing the above, buy your first rental property.

I wish there was an inverse Realist investment index. That’s my personal strategy and it’s made me the most money in my life. Thank you Realist!