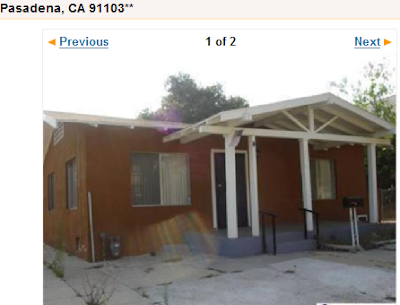

Real Homes of Genius: Today we Salute you Pasadena. $87,000 off in 2 Months for 937 Square Feet.

This inspiring 2 bedroom 1 bath home will put your green

03/06/2007: $507,000

02/25/1987: $75,909

Someone is trying to unload this property really quickly. At the current price, they are taking a $57,000 hit without the 6 percent commission. This was a flip gone bad as you can see from the pricing action:

Price Reduced: 07/09/07 — $537,000 to $450,000

With the first price, someone felt that they would be able to get out of this market with no skin. Let us run the initial calculation ($537,000 – $32,220 = $504,780). The $32,220 is 6 percent if you are wondering. In fact, you can almost derive from these numbers that the person went with a zero down mortgage. How can you arrive at this conclusion? The sales cost minus the commission cost bares an uncanny resemblance to the purchase price in March of this year. This is a new trend. Unfortunate buyers that came to the party too late and are trying to hand off the home to another would be flipper. But guess what? The game is over. Keep in mind you were still able to get your hands on a fantastic supercharged wonderland exotic mortgage in March of this year. In fact, Countrywide was ramping up its subprime outfit and even talking about 50 year mortgages as late as May of this year. Now they are saying “no subprime for you!” How quick things change. You may say, “I feel sorry for this buyer.†Here is the poetic justice, these buyers can hand the keys over just in time for the bailout forgiveness and face no tax consequences. The only ding they will have is a foreclosure on their credit history but after the next few years, having a foreclosure will be in like having a divorce. The stigma is gone when a large part of society has faced a similar circumstance.

So how low can this place go? Well considering that this place would rent for $1,500 tops, it is still a bit on the expensive side. But hey, your $450,000 mortgage just got a boost in the interest rate of .5 percent. That is if the market responds to the injected liquidity and the LIBOR acts accordingly. But even if it does, this place would not make sense as an investment. Let us run the numbers as a prospective investor. Currently for investment properties if you have good credit, you can get a mortgage with 5 percent down for approximately 7 percent. So let us assume that we buy this place for 5 percent down with a 7 percent 30 year note:

5 percent = $22,500

PITI = $3,312 (30 year fixed at 7 percent for investment property).

The monthly payment will be $3,312 and we are receiving in rents $1,500. That means we are negative cash-flowing by a whopping $1,812 a month. And appreciation is gone for at least a few years. The only benefit is in tax relief but this is equivalent to spending $1 and getting 2 quarters back. If you desperately need tax relief why not buy a cash-flowing property out of state? This property has an intrinsic value of $225,000 to $275,000 tops from an investor standpoint (and this is being extremely generous because of the city). Only at that price point would rental market growth, market stagnation, and the headache of being a landlord make any financial sense. As you can see, 100 percent of investors are going to rule this place out. You can’t flip properties as the pricing trend is down.

Many in

Today we salute you

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

5 Responses to “Real Homes of Genius: Today we Salute you Pasadena. $87,000 off in 2 Months for 937 Square Feet.”

This house at 600K is just plain fraud. We need to tell congress to stop bailing Wall Street and banks

that enables these frauds.

Doc – can you get rid of the ad the first blogger put in there?

Surprisingly, go to MSN Money. Mainstream columnists Jubak, Bush, and Markman all have pertinent articles on some of the macro-economics underpinning this whole mess. Markman quotes the ‘father’ of derivates, Das, as saying we are not even in the 1st inning yet – we’re in the national anthem before the game which is headed for extra innings.

Wait til the dollar drops below 70, gold hits 800 and oil hits 100. The printing presses are rolling…

I can’t believe this place sold for that much in 2007 without some kind of fraud

Prices in all bubbles reach absurd levels that have nothing to do with reality (and yes, fraud is frequently involved). While what has happened to housing is outrageous, it is only a manifestion of the real problem which is a massive credit bubble that effects almost every area of credit in the economy. Of course, bailout Ben has decided the solution to too much liquidity is even more liquidity. I wonder what he’s going to do when the US Dollar crashes?

I can’t believe this place is even considered fit for human habitation, and I really can’t believe anyone would pay rent for it.

When I first read of Los Angeles house prices, I just assumed that these shanties were situated on lots with really favorable zoning that were in the path of upper-bracket development. That is usually the case in many other cities- when you see a price on a house that makes no kind of sense it is because the lot got upzoned for a 40-story, 1300 unit building of toney condos.

However, reading your blog has exposed me to a reality I had a very poor, vague idea of before, and I have since discovered that the situation is similar in this city and other top metros.

Leave a Reply