The Stalemate of the Century: Housing Facing an Existential Moment

It was only a matter of time that the housing market hit a giant wall of apathy and the level of denial is deep out there. People are starting to understand the cost of easy money policy which has created an insane level of moral hazard and rent seeking behavior. I’ve been following the FTX story and that is a picture perfect example of the market – tech as a religion, nonsense charity, easy money return chasing, and shiny new object syndrome with no real work being done. The day of reckoning is here and with mortgage rates at 8 percent, those million dollar crap shacks are no longer looking tasty. This is the new normal and we were in an artificial market for such a long time, that people do not realize that an 8 percent mortgage is actually affordable relative to historical norms. Let us look at the market overall.

California Sales Hit a Wall

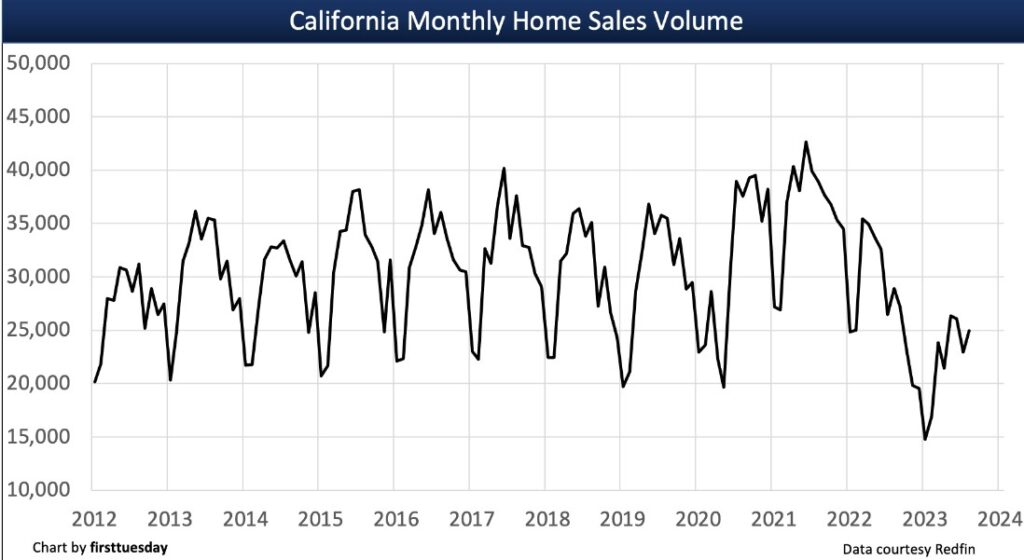

As it turns out, interest rates do matter. The housing cheerleaders seemed to believe that easy money was never going to go away but it has. And now we see this:

What you are seeing here is low sales volume reminiscent of the last housing crash. But the Great Financial Crisis was a once in a generation event! Well in terms of sales volume, we are probably in worse shape since we’ve actually added more people since 2007. But prices are still high! Indeed. Keep in mind that sales volume hit a wall in 2007 and prices did not hit a trough until 2012. So things just move slowly with housing. The reality is, home prices simply outpaced any gains in incomes. To put it into perspective, at some point in California, home prices were going up $100,000 per year yet the typical family in California makes $84,000 per year! Bwahahaha. Why even work when you can just sit in your house and make more money than a family putting in 4,000+ hours of work (assuming 50 weeks of work at 40 hours).

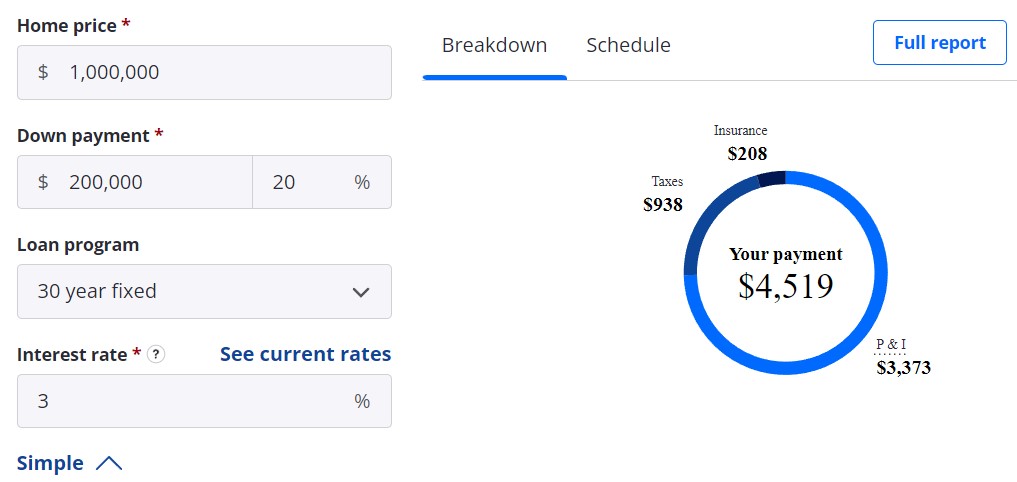

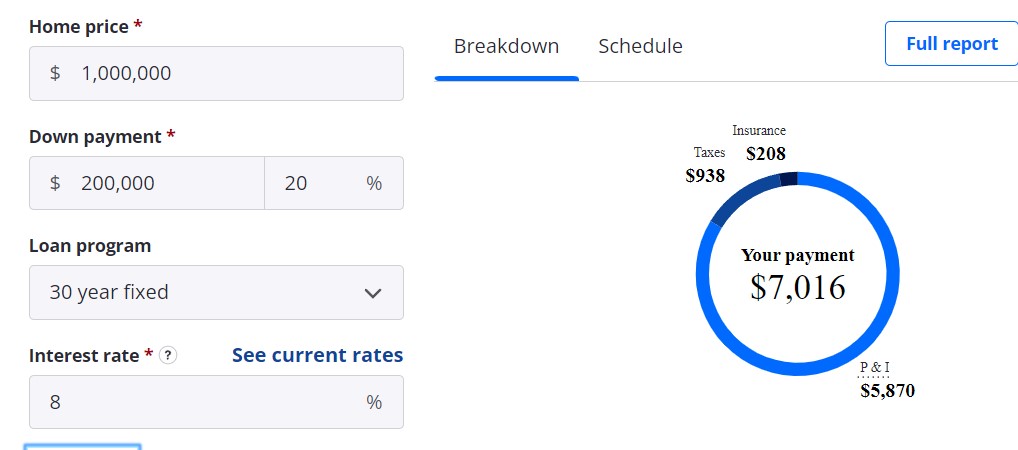

We are at a cross-roads moment. Take a look at the amount of a mortgage payment per month here:

So that drywall mass produced home that sells for $1 million just went up from $4,519 a month to $7,016! That is a 55% increase in less than one-year. So we now have realtors struggling since they make money on high sales volume. You have commercial real estate getting absolutely smashed. Banks are in a tough spots since they made bets on a low interest rate environment. But now, that same home will cost you $2,497 per month with no measurable increase in underlying value. The house does not have a built in chef, or unlimited childcare, or a Tesla that comes fully charged every day with no cost to you.

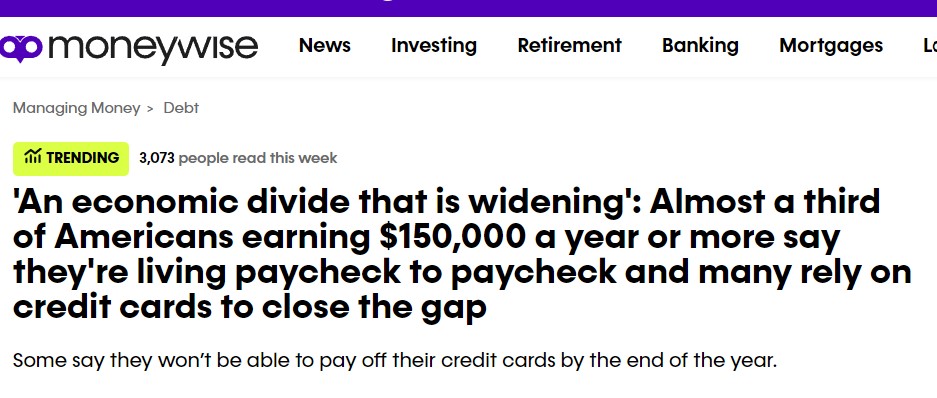

Which brings us to headlines like this:

So one third of Americans making $150,000 a year or more are living paycheck to paycheck and using credit cards to close the gap? So that increase in the monthly mortgage nut is really going to hurt. We are seeing massive increases in defaults with auto loans and credit card debt. Student loans which were paused during the Covid-19 lockdowns, are now coming back to cash strapped buyers.

The outcome is no different here from the previous housing bubble. Either incomes are going to catch up to match home prices or home prices will need to adjust lower. Housing is a funny asset class. In any neighborhood, if you have 100 homes, the price of all homes is dictated by the most recent sale prices. Say you have 5 homes that sell at an average of $700,000, then the new price of all places is adjusted based on those sales. A really poor way of measuring value unlike stocks where you have a very liquid market that is turning over all the time.

So say with slower volume, you have 5 sales and they sell for $600,000. That is the new baseline. In other words, housing is and has always been a musical chairs like game. We are now in the slow awakening of the population that no, housing doesn’t always go up. Sales volume is a leading indicator here. But people with 3% mortgages will never sell! So long as they can keep up their monthly nut. The last housing crisis of 7,000,000+ foreclosures was largely from prime mortgages (not subprime mortgages which were a smaller portion of that number but of course were the canary in the coal mine).

This time is different of course.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

98 Responses to “The Stalemate of the Century: Housing Facing an Existential Moment”

One thing that I think that is different than 2007 is Inflation.

I think that inflation will continue for many years for multiple reasons:

1. It is easier for government to manage debt in lower value units of currency. The whole debate between the 2 parties is in regard to the speed of spending increase (they call that “cuts”).

2. The fight against “fossil” fuels by some politicians in power is highly inflationary (the whole economy depends on price of fuel)

3. Wars are highly inflationary, and we are involved in many; the geopolitics today are very different than 2007.

4. The budget deficits are the highest ever outside of WWII and there are not as many foreign entities as in 2007 willing to finance them; the buyer of last resort is the FED by “printing” money, which is highly inflationary.

5. The increase in money supply in the last few years (over 40%) is highly inflationary (we didn’t have that in 2007). This is the highest increase ver.

6. The Inflation Acceleration Act of one trillion is highly inflationary – they didn’t have the money and created them out of thin air (they didn’t do that in 2007)

7. Massive immigration (legal and illegal) is highly inflationary – the rent component of the inflation went up a lot. The illegal immigration these day is the highest ever (for all practical purposes we don’t have a southern border; whoever wants to come, they come). We didn’t have it to the same extent in 2007.

In this highly inflationary environment, real estate is wealth and currency is just a medium of exchange. We don’t have so much of a RE bubble as we have a currency crisis. In many places, the cost to built a new house is above the market value. Based on the cost of building, we don’t have a bubble. Many builders are reluctant to start new construction because of cost and uncertainty. In 2007 we had massive construction and inventory.

The value of the currency is dropping like a rock due to energy cost – everything is based on “fossil” fuel and Washington DC and EU are in a war on “fossil” fuels. There is nothing fossil about it (it doesn’t come from dinosaurs). The term was coined to imply very limited supply. As long as we have this insanity, inflation is causing the price of everything to continue climbing and interest along with it. The only time the price of oil came down in the last 3 years, is when we dumped the strategic oil reserves on the market. Now that those are depleted, the price will continue to go up. We don’t have the infrastructure and electricity production for more people and more EV cars. The mining minerals for those batteries is also based on “fossil” fuels. You can’t talk about RE prices outside of cost of energy and the currency crisis.

Not a single word about historic low inventory. But a repeat of low sales volume and sales volume as a leading indicator. Come on man. Wake me up when inventory levels go back to just historic trend. Nevermind, above trend.

And 8% are not high historically speaking?! Hahahah

True, but 50 years ago the median house price wasn’t 400k ish in the US.

15% interest rate isn’t bad as long as the house only cost you 100k.

Now people realize the housing cheerleaders were right: inflation over a long period of time pushes house prices up. The so often referenced great financial crisis of 2008……the peak prices of 2006 are sooooo dirt cheap compared to today. That’s why we cheerleaders always say: the best time to buy was yesterday, the second best time is today!

In 20 years from now, prices are twice as much as today and people in 20years will say how cheap prices were in 2023.

I hate spell checkers! My last post had the word “speculators” changed to “spectators” which somewhat means the opposite! Here it is again corrected for the checker:

In my opinion a true deflationary depression like 1929 won’t ever happen again because the government will always inflate the currency; even in the 1930s the government resorted to inflation, the devaluation of the dollar from ~$20/Oz to $35/Oz. “Stagflationary” depressions will occur though. Real estate does well in the recovery phase but will drop big time in the crash, particularly when real estate speculation on credit is causing the crash. Right now, the situation is quite different from 2008 since there is much less credit for speculators to access. Easy credit is the mother’s milk of market crashes.

Not the end of Real Estate, just the end of Realtors. It is going to be hard to make a living in Real Estate unless you are established and have invested in distressed properties wisely with mostly cash.

Thanks to reaching the maximum Social Security age and still working, we are now over $150K in annual family income. But due to having a paid-for house, we are not living paycheck to paycheck. I’ll bet the one third who are doing that are mostly under 40. My Daughter, who bought a house during the crash and upgraded to a bigger house in 2013, has been spending quite a bit on upgrading that house. She has ~$800K in equity and a low interest rate. We have about the same equity (smaller house) but no payment. She is just over 40 and they have over $150K in income. Sorry about you thirty-somethings!

OC Register columnist Lansner has an article about housing shortages by metro area. The survey has 193 metro areas of which 23 are in California; #1 nationally is Ventura Co. with a 12.5% shortfall. All CA metro areas had a shortfall with El Centro metro area being the lowest one in CA coming in at #136 with a 1.6% shortfall. Six of the top ten shortfall metro areas are in CA including the Inland Empire, Madera, Salinas, Merced and Stockton.

Another article in the Register is about a subsidized ADU building loan agency in Orange County. The unincorporated County areas and most of the incorporated cities are in the program. Brea, Cypress, La Palma, Laguna Woods, Los Alamitos, Rancho Santa Margarita, San Clemente and Villa Park are non-participants.

The loan amount is $100K which is probably enough to build a small studio apartment. You can rent to a relative or a friend as long as their family income qualifies them. For a single person, that would be a maximum of little over $50K/year income according to the ochft.org website (50% of the area median income). Maximum rent for a studio apt would be about $1250/Mo. The interest rate you pay is dependent on the tenant’s qualifications. The affordability term is 10 years and the loan term is 20 years. There is also a loan forgiveness for time a qualified tenant is in the dwelling.

The ripple effects of rising interest rates are becoming glaringly evident, not just within the U.S. but globally. Germany is witnessing a record decline in real home prices, falling almost 25% from 2020 peaks. Yet, paradoxically, homes have never been more out of reach for many. With a 30-year fixed mortgage now at 7.78%, homes today, even post-price adjustments, are less affordable than in notable years like 2008 and 1989. To realign home affordability with its 25-year average, we’d need a combination of home prices to drop by 28% and a reduction of over 400 basis points in 30-year mortgages or a healthy 60% surge in household incomes.

The repercussions of a housing market slowdown can’t be understated. About 2.9% of the U.S. workforce — equating to 7.8 million individuals — are in construction, with an additional 1.6 million working as realtors. Historically, shifts in the housing sector have been pivotal in catalyzing recessions.

“To put it into perspective, at some point in California, home prices were going up $100,000 per year yet the typical family in California makes $84,000 per year! Bwahahaha. Why even work when you can just sit in your house and make more money than a family putting in 4,000+ hours of work (assuming 50 weeks of work at 40 hours). ”

In the last 4 years, this could have happened every year.

Price goes up 100K, refi at 30 years and pull out 80K every year for 4 years to:

1) Quit your job and live off your windfall

2) Buy a yacht and a big truck.

4) By more RE because RE can’t go down.

What could go wrong?

“Either incomes are going to catch up to match home prices or home prices will need to adjust lower. ”

I am old enough to have seen the the 80’s with massive inflation where as a new engineer, I received a 4% raise PLUS a 6% COLA increase. 10%! That was the time to buy a house with an 11% mortgage. It only took a few years before I was comfortable and rates started to drop.

The last 2 years, as a senior engineer, I received a 2% raise and no COLA despite a 9% inflationary environment. Wages are not rising.

Time to leave.

House prices will fall since wages aren’t rising.

“House prices will fall since wages aren’t rising.”

Market is more complicated than that. Wages play a role ONLY on the demand side. The supply side is also very important. In many cities (not all) the cost of construction is higher than the market value, which means that almost no building takes place. I define the cost of construction as cost of land plus cost of actual construction plus all cities/counties fees plus energy code compliance which is getting very expensive with every year passing – cost increases exponentially for marginal results and no impact on “climate change”.

The inflation affects not only food and energy but all construction cost and cost of land. Builders know that prices went through the roof, not just by the published bogus number called CPI (that’s only to cap entitlements and make the Real GDP seem bigger). That’s what the builders and buyers have to pay and the market doesn’t care about Bidenomics.

Yes, you can have stagnant wages with house price increases; it is called reduced standard of living and that is the end result of zero carbon emission – that is a whole other subject where we can write books as to why it is so. For a short post here it is enough to say that RE prices and standard of living are strongly affected by these policies regardless if you understand/believe it or not. They work like gravity – you don’t have to believe it in order to fall and feel the effect of it.

Flyover,

Good points and I agree. It is much more complicated than that single statement.

Another few points:

Since we no longer have market driven Capitalism, the Fed and US Government are in control. They are fighting inflation that they caused by handing out free money and lowering rates through most of the 2010’s and 2020’s. Handing out free money and drastically lowering rates will cause bubbles (Housing, Crypto) AND inflation. Combine that with the AirBnB craze, crypto, and stock market bubbles which drove housing prices up 100K’s per year. The end result HAD to be an inflationary period.

Now that we are in saner times (still government/Fed controlled), they have a problem. They have to let the air out of bubbles and drive inflation back down.

1) Raising rates seems to be the best solution. But how much? Since the housing market has stalled, is it too much? How do you remove the 40-50% price increase that occurred over the last 3-5 years that is painfully inflationary? House prices have to come down.

2) They could control government spending. That would control inflation. It started to go down in 2015 but since 2016, it has gone only up.

3) Wages could rise. This also drives up inflation in everything due to higher labor costs.

4) They could remove key drivers blowing up the bubbles such as the craze of buying ST rentals. How about a higher tax on ST rentals? More supply then for LT renters and less demand for buying houses. Using taxes as a suppression tool.

5) They could subsidize home builders to provide more supply. This is also inflationary but home prices would fall.

6) They could cause a massive job-loss recession will drive down inflation and house prices. Too much pain and not during an election year.

So many things could happen since the Fed and government have the control to do them. Given the disaster of 2008, I don’t think they have the competence without accidentally causing 6 above.

BobE,

I agree with your points; however, I believe that your assumption is incorrect. You assume that the government want to help lower the cost of housing. My assumption is that they want to increase the cost of housing for 2 reasons:

1. Depopulation agenda – the “climate change” narrative is just a tool for that (an excuse). Man has very small effect on climate and most of the CO2 emission comes from SE Asia where we have no control over.

2. Banks want high housing costs because that means high assets for the banks to offset their risky investments.

In EU they have the same policies. High cost of living means less use of natural resources which is in line with current policies.

Flyover,

I respectfully disagree.

1) The latest Supreme Court ruling indicates that there is a trend toward creating a higher population. Every baby must be born which will increase population.

2) Unlike 2008, banks don’t own home loans. The banks gave 70+% of those assets to the US Government and taxpayers through Freddie, Fannie, FHA, VA. The Fed and banks don’t really care about a housing crash unless it drags the rest of the economy down with it.

I believe that Supreme Court ruling was politically motivated and not a true agenda. I believe that climate change agenda and net zero emissions are just tools to achieve a higher cost of living for the average couple – depopulation. I also believe that those mortgages, regardless of who owns them (banks, Fannie Mae or Freddie Mac) are heavily protected by FED actions to avoid a domino effect which can spill into the larger economy.

We may disagree, but it remains to be seen which one is right long term.

BobE:

You said:

“3) Wages could rise. This also drives up inflation in everything due to higher labor costs.”

But, I say:

Wages do NOT drive up inflation. Don’t buy the elites’ narrative. Wages are a price, like everything else. They are the price of labor. Wages don’t cause inflation, they are a reaction to it. Case in point: in 2021 when inflation started to go crazy, had we all just prior to that received huge pay increases that caused the inflation? Of course not. We were all making something very similar to what we were making in 2020. Here we are a few years later and our wages STILL have not caught up with inflation. Thus, credit card debt is on the rise, savings rates are dropping, and people are struggling. In fact, elites know that wages don’t ever keep pace with inflation. Therefore they like it. It means their assets rise in nominal price as they benefit from access to newly created (printed) money first, while what they pay us lags. It’s a temporal arbitrage game between us and the elites. And we lost this round. But this time, to ensure our wages NEVER catch up, they are importing another 15 million low-wages, low-skill workers from around the world. That’s the con we’re up against.

You say:

4) They could remove key drivers blowing up the bubbles such as the craze of buying ST rentals. How about a higher tax on ST rentals? More supply then for LT renters and less demand for buying houses. Using taxes as a suppression tool.

But I say:

The main drivers of housing prices is interest rates manipulation (ie. keeping rates artificially low) and zoning regulations that preclude the creation of new housing where it is needed. Any other factor, such has long term vs. short term rentals is virtually a non-issue compared to the first two. A marketplace where participants are free to meet the demands for housing is more than capable of keeping pace.

You said:

“5) They could subsidize home builders to provide more supply. This is also inflationary but home prices would fall.”

I say:

True, there would be more supply. But since that printed money that is subsiding that construction is cause inflation, as you correctly pointed out, this will cause construction costs to soar, ultimately negating the subsidy and placing a burden on we the people in the process. Additionally, it would make the process of creating supply of homes less efficient as bureaucracy slows down decision making, invites corruption, and perverts market incentives. I mean, it’s not like we have homeless housing in Los Angeles that cost a million dollars a unit…oh, wait, that’s actually happening. That’s a prime example of subsidized housing at work for you.

You said:

“6) They could cause a massive job-loss recession will drive down inflation and house prices. Too much pain and not during an election year.”

I say:

Again, our wages are not the problem.

The main point of this article is that even if the housing inventory is very low, all it takes is several fire sales in any neighborhood to throw off the comps. It is a standoff between sellers and buyers now. This game will soon end as sellers will lower prices to unload their property due to inheritance (want the cash), not wanting to be landlords, or just wanting to move to low tax states.

5,500 baby boomers are dying everyday in USA. They are leaving their adult kids their homes. Those adult kids will eventually capitulate and sell as they want the cash to pay off debts due to inflation.

What is the probability of a fire sale when inventory is low?

Good advice from an article by financial writer Jared Dillian:

“When I bought this house in 2015, I put in a stink bid.

What is a stink bid? Well, “stink” is slang for “teeny,” or a sixteenth—the lowest price that you could pay for an option in the days of fractions. I put in a stink bid for this house in 2015. It was listed at $1.2 million, and I bid $950K. I ended up getting it for $1.1 million.

People are really weird about stuff like this. There is some sort of weird etiquette in the real estate industry that you don’t lowball people on their houses. I would like someone to lowball me on my house. Show me a bid; let’s get a conversation going!

I don’t have any ego about this. But people won’t do it, for fear of offending, and people really do get offended by stink bids. In my case, I knew the sellers were motivated, and I wanted to squeeze them. Mission accomplished.

I recently had a showing of my house where the buyers loved the house but balked at the price. Hey, it’s not a store. It’s not like you’re going to the house store, and you pay what’s on the price tag. Everything is negotiable. I’m going to start out with an aggressive offer, and you’re going to start out with an aggressive bid, and we’re going to meet in the middle. People are strange.

In any case, it appears as though the housing market is set to retrace some of its gains over the last few years.”

Anyone planning to buy a house in this market should definitely make a stink bid and have sufficient cash to make it stick with some desperate seller.

I’m kind of a novice with selling and buying houses. I’ve only sold 2 houses and bought 3 spread out over the 1980’s to the 2010’s.

Some points I learned in a normal market.

1) When selling, always list for more than the comps by 10% and point out why your house is better than the comps. It is not enough to frighten buyers but it is enough to get the bidding conversation started.

2) When buying, bid 10% less than the comps (comps, not the asking price). It is a good starting point for negotiations.

It is the goal and objective for the seller to bring positive emotion into the sale. ie if you hear one of the buyers state “It is my dream home!”, you now now much more negotiating power to raise the counter-offer. As a seller, always give something to close the sale. Do be an stubborn A**hole seller and refuse to give in (Remember, you should have asked 10% more than the comps). That causes hatred in the buyer.

If you are a buyer and completely lowball ie 30% the offer in a normal market, you will lose for 2 reasons:

1) Some Sellers now hate you and may not sell you the house for any price with extreme emotion. .

2) It is likely another lucky buyer will only offer 10% lower and negotiations will begin as you pointed out.

in 2017, we sold a house that needed a lot of work. We added up the costs we would need to fix to sell it and lowered our asking price to compensate for that plus 10%. We asked 825K. We immediately got an offer for 800K (down 20%). We countered at 815K and the house closed within one week (down 12%). We had about 1.5K/month in carrying costs so we didn’t want to piddle around waiting for 817K.

In 2014, we put an offer of 390K on a 435K house (down 10%). The house had been on the market back then for 9 months with comparable carrying costs. We were rejected and kept looking. 2 months later, we received a request from the seller to offer 400K. We did and closed at 400K. We apparently offended them initially but after 11 months of carrying costs (16K?) they became a little more agreeable.

Somebody famous once said that a good deal is when the buyer and seller leave happy but with a little discomfort.

I can’t wait for a normal market again. Overbidding by huge amounts is not normal.

“Do be an stubborn A**hole seller ”

should be:

“Don’t be an stubborn A**hole seller “

BobE, I’m not looking at housing in California but in TN. That market is hot due to CA and NY transplants.

I tried to do what you described but wasn’t successful. A house listed at a price equal to that of a fully updated, high end, move in ready home. $235K above comp. The house had no updates since 2005, year built. We offered 15% below comp price and didn’t even get a counter. I think it went contingent after 60 days on market, but don’t know yet what actual sale price is. We weren’t willing to overpay for a house that needed fully renovated.

Hopefully it will bring down prices in the area for future listings.

Cribbander,

I recommend that you wait 6 months until it is a normal market again in TN.

Then follow my advice. It is still crazy with multiple overbids in some areas. That is not normal.

After 30 years of buying a few houses in different markets, I ry not to let the mania affect my bidding decisions. I would only buy now if it is my dream home that I could guarantee living in for 15 years.

Good luck!

OC Register columnist Lansner had an article last Sunday about housing shortage data. Data for 193 US metro areas showed that 11 of the top 25 housing shortages in the US were in California, including # 1 Ventura Co (a 12.5% shortfall). The IE was #3 nationally. All other CA metro areas on the list had a shortfall including #136 El Centro at a 1.6% shortfall (lowest in CA). These numbers are backed up by the rent financial burden in CA.That is families who have trouble making the rent. 53% in CA and 46% nationally. This is a reflection of the devastation to the households in the US caused by massive inflation.

There are articles in today’s OC Register about buyer’s markets and affordability.Unemployment is typically high in a buyer’s market Interest rates are lower in a buyer’s market. More people say they are looking to buy in a seller’s market vs buyer’s market in CA (5% vs 3%). In the 90s, 79% of the decade was a buyer’s market; in the 2000s, 27% and in the 2010s 3%. No buyer’s market yet in this decade! Buyer’s markets are really good for RE speculators with deep pockets and great credit in my opinion.

Another article discuses prices in SoCal (both article are by Lansner). In LA/OC Riverside/SB, 46% of single-family houses have asking prices in the millions. OC has 84% for > 1M, LA 66%, Riverside 23% & SB at 11%. Statewide, 39% are > $1M. The big bucks towns are Beverly Hills, Malibu, Laguna Beach, Newport Beach and La Canada/Flintridge; all with a median asking price of $5M or greater. By the beach or in the hills brings the price up.

Dream on if you think a buyer’s market will crater those towns. If you are already rich, you’ll find comparative bargains there, but you’ll probably be more likely to get something for a good price in one of the cheaper rich burgs like North Tustin, San Clemente or Rancho Palos Verdes ( all between $2.1 & $2.3M median).

Homelessness is big business in CA and its being funded with your tax dollars which you will pay more off next year.

https://news.yahoo.com/broken-model-570-000-renovate-130000747.html

After years of falling into disrepair, the Sequoia Hotel at 911 K St. will receive a $50.1 million face lift, transforming the dilapidated building into 88 units of affordable housing for the homeless. A team of on-site case managers will provide mental and physical health care, substance abuse counseling and job training for residents. And the historic building, standing prominently just a few blocks from Golden 1 Center and the state Capitol, will be gutted and rehabilitated.

Sacramento officials are promoting the renovation as a triumph in urban renewal that will provide shelter and essential services to dozens of those in need. That said, the public investment it’s taking to make that transformation is another sign of how difficult – and expensive – it is to create and sustain affordable housing in Sacramento.

Backed by state, city and county grants, it will cost nearly $570,000 per unit to renovate and operate the Sequoia. Most of the units are just 150 square feet and don’t have private bathrooms or kitchens, although all will be equipped with a microwave.

Congress spends 8% year over year in borrowed money. We hid that prior to losing Reserve currency status. Those days are over. That borrowing cost isnow immediately inflationary as inflation is always a monetary phenomenon. We have to reduce our spending by 30% to get inflation back to even. Medicare and Medicaid is growing at a unsustained pace as cost increases because of monopolies. It’s all unsustainable. Wages will never keep up. The only reason housing went up is not because of supply and demand but because of low interest rates. That will be coming back out of the system so anybody thinking inflation going forward will continue does not understand economics. You want to destroy a government you do it by monetary inflation. Everybody is saying the currency is getting weaker yet the dollar has been on a terror because the bond market wants a higher interest rate as collateral. It always leads the Federal reserve. Is anybody seen the interest on the debt lately?

The bears had covid, the forbearance tsunami, the silver tsunami, millions of shadow inventory, record low sales, 8% mortgages and the airbnb bust.

The market shows all time highs in price in some locations.

The bubble boys were betting on an epic crash in price and never bought during the last decade. Now they face record unaffordability. But just keep waiting a little bit longer. Maybe the next great financial crisis is around the corner with record high unemployment. Something’s gotta get that market down, right? It has to crash right? What goes up must come down. lol

I can’t understand why people stick to their guns after being dead wrong for many many years, especially when it comes to finances. There is no such thing as “maintaining pride by refusing to admit being wrong” when it comes to your livelihood. Instead of revisiting every single incorrect comment they made throughout the years and trying to understand why they made the wrong assumptions to better one’s ability at valuation and forecast, they’d rather keep doubling down. I just don’t get it.

I am readying this book “psychology of money” by Morgan Housel. It’s fascinating. And so true. Finances isn’t really about hard science and spreadsheets. It’s about behavior, emotions, greed, perception etc. it explains why the retail investors flock into crypto when prices skyrocket, it explains why super intelligent, successful people go broke and why some people are stuck in a perma bear mindset and can’t admit they are wrong. One of the rare books I will re-read. I highly recommend it. I’ve met so many people in my life that are miserable because they believe since close to a decade that the RE market has to crash and then they will buy a nice house. It’s the most unrealistic and most unlikely scenario for so many reasons. Yet they are so set on this that nothing you say will change their mind. they will die as perma-bear renters.

The Atlantic published this article pointing to likely high home prices for the foreseeable future and I think there is merit to their prediction. https://www.theatlantic.com/ideas/archive/2023/11/buying-house-market-shortage/676088/ I have been following these housing blogs since the crash in 2008. I gave up being a housing bear in 2015 and made peace with the possibility that I would never own a home. I came to love renting and the freedom it afforded me. I continued to save my money when my friends spent everything citing YOLO (you only live once) meanwhile my moto was LILY (life is long yo). Then one day in early 2020 my dad and I went for a walk and came across an ugly house for sale in a neighborhood we both loved so we decided to become joint homeowners. We turned our ugly SFH into 4 beautiful units over two years during the pandemic with the money we had both been saving for the past 20 years. Even though I love my home I would never allow myself to be upset if I ended up as a renter again someday. For those looking to buy I hope you end up with your dream homes and also find some joy in renting as life is just too short to stay upset.

That is a great and healthy outlook on life.

If everyone had that attitude, there would never have been the overbidding mania we have seen during this Housing Bubble II.

Only one comment refers to migration. One difference between 2007 and now is mass migration. The pressure on housing costs (and rents) will be upwards as millions of new folks move into the USA and Canada. As long as mass (il)legal migration continues, so will the upward trend in housing and rent costs. Mass migration is also inflationary….

USA is in a steep population decline due to 5000 baby boomers dying everyday and a birthrate of 1.5. The amount of illegals coming into the USA is not making much of a dent in the population drop. With the illegals coming in, how the heck are they going to put a down payment for a home? Who will hire them and pay them fair wages? With high inflation, the illegals coming across the border here will realize there is no American dream and will go back to their homeland.

“Who will hire them and pay them fair wages?”

Hey MGE:

“What kind of a sissy word is fair anyway?”

Sammy Glick

I think the illegals will have a lot of government support from politicians that want them here. Subsidized housing and everything else. They can’t buy a house, but they need to live somewhere. They will get help renting and the former renters will pull the family together and buy something. The rising tide will push from the bottom. We are entering a severe imbalance between supply and demand. In the ‘80’s the average affordable house in Southern California was under $300k and we bought a mild fixer-upper for less than $200k with a 11.5% loan in West LA and our combined income was less than $40k. We made it work. It’s not the same today, but there are similar pressures. There weren’t 100k new people a month looking for a place to live getting government help then too. I would like interest rates to drop and housing prices to drop but with these pressures I don’t see how it happens.

REAL HOMES OF GENIUS

You too can now buy a home in the semi ghetto of LA for under $2M!!!

https://www.trulia.com/home/2342-s-cochran-ave-los-angeles-ca-90016-20597036

If only my crystal ball had been working in 2006 when it sold for 384K.

I wonder if it had trash cans in the listing photo back then.

I would not pay $84,000 for a house like that in a neighborhood like that. But, then, I’m a Midwesterner.

I love finding out about counterintuitive trends. In today’s OC Register, Mr Lansner has an article about a drop in single family houses that are owned as rentals. Between 2017 and 2022, CA lost ~81500 single family rentals FL led the nation with ~87800 units lost. Apparently, in the hot housing market, single family home landlords were selling to owner-occupants. Most single family home landlords are small investors according to Lansner. So they were cashing in during a bull market. Some states gained rental houses (led by Texas with ~53400 more rentals) but no state had a greater increase in rentals vs owner occupied houses. Rentals are still a significant percent of single family houses in CA; CA has 23% rentals which is 2nd to Hawaii. In 2017, 25% were rentals in CA.

It would be interesting to see the statistics including 2023 when they come out. The brakes were slammed on housing sales this year, and that may have frozen the market at the 2022 level.

Dingggggggg, Popcorn done :)))))

A report from the Mercury News in California. “It might be hard to fathom in this real estate market, but one in eight home sellers in San Francisco and on the Peninsula is now taking a loss. How can that be? Some sellers who bought at the top of the market in 2021 and 2022 are being forced to accept less than what they paid for their homes. According to Redfin, more than 13% of those who sold homes in San Francisco and San Mateo counties between August and October went into the red — a rate about four times the national figure and the highest share of any major region in the country. The typical loss in the area: $122,500.”

“In October, the median single-family home price in San Mateo County was $2.1 million, according to the California Association of Realtors. That’s a roughly 13% decline from the local market’s peak in April 2022, when the median topped $2.4 million. There was an even bigger drop in San Francisco, where prices fell 20% to $1.65 million. For the entire Bay Area, the median price tumbled 15% from its peak, coming in at $1.27 million in October. After San Francisco and the Peninsula, areas with the highest share of sellers losing money were Detroit and Chicago at around 7%, followed by Cleveland and New York at about 6%.”

“Many would-be sellers are still on the fence, reluctant to give up the lower interest rates they locked in before the recent spike. The drumbeat of news about sky-high rates, sometimes boosting monthly payments for new mortgages by thousands of dollars, is only adding to sellers’ hesitance, said Silicon Valley agent Mary Pope-Handy. As a result, the inventory of homes on the market remains tight. ‘It’s like the toilet paper shortage,’ she said. ‘People say there’s a shortage, and then it becomes one. Except this one is real.’”

As California goes, so goes the country

Got Popcorn

Realist, you are becoming a meme.

I hope you won’t go away. You have been so consistent for years now. “Magic beans (crypto) and RE crash, getting popcorn ready.” An absolute classic.

Keep it up my friend, keep it up.

I just closed on a house. Came out to $865K, about $5000/month total payment. Please feel free to reply with comments below on how dumb I am, how I’m going to lose my ass off, how you’ll be waiting on the sidelines to buy my house for 2 filet-o-fish sandwiches down and $3.50/month once it gets foreclosed on, how much popcorn you’ll munch on till my inevitable fate comes to fruition, etc. Get really creative with it too! It’s my one Christmas wish guys ????

Congratulations!

Enjoy your house for the next 15 years and you will be financially secure in retirement.

Just don’t treat it as a short term investment and you will be fine.

NewAge, you bought the peak. Say goodbye to your equity. No popcorn for you.

BS aside, congrats! You just bought recently in San Diego. Did you sell or rent out the other house you bought a couple years ago? (I know you have several houses).

Did you buy again in the SD area? Tell us more!

Happy holidays. Always enjoy your posts!

There were two articles in the OC Register today about expectations for housing prices. One article was a survey by age and ownership about expectations for housing prices. The old “If wishes were horses then beggars would ride” was in full play. Older people and owners expect prices to remain up and younger people and renters expect them to fall. The same author (Lansner) had an article about what will cause prices to change. Historically, unemployment causes prices to fall and full employment causes prices to rise. Correlation with high unemployment for lower prices is strong since 1975.

I think that the current low unemployment is due to demographic changes, with Baby Boomers retiring and not being counted as unemployed. That doesn’t mean that the job they used to have is being filled. Eventually, job contraction will overtake Boomer retirement (hit the fan) and we will see a change in housing prices. I am in a fairly early Boomer cohort and I’m not retired. I know Boomers who are younger than me and retired and some younger ones who plan to keep working into their 70s. My employer is definitely not cheering for me to retire any time soon. That is the case with a lot of skilled workers. More easily replaceable workers may be the ones retiring before they get automated out of a job.

After Powell’s speech, it looks like the mortgage interest is trending lower – it’s already under 7% after it passed 8% only few weeks back. It might go below 6% in few months. That would be the catalyst for higher RE prices in areas with high demand.

More counterintuitive information on rentals from OC Register writer Lansner. He breaks down rentals into 4 groups: large complexes (20 or more units), small complexes (2 to 19 units), single family houses and other…e.g. mobile homes, RVs and boats. California’s 28% of renters in large complexes is nowhere near the highest (DC=55%, Minnesota 45%). Small-to-mid-size complexes have 36% of CA renters which is on the low end for states (14th lowest). 34% of CA renters are renting single family homes which is above the national average of 31%. 2% of CA renters are in the “other” category (mobile homes etc.). The national rate is 4%. South Carolina and West Virginia are tops for the “trailer trash” index (16% and 13% respectively). No surprise there!

Get your popcorn ready, this movie is just starting :))))

From Newsweek. “Many areas across California, one of the most expensive markets in the entire country, have experienced steeper price drops than the rest of the United States since the beginning of the nationwide cooling trend which began in late summer 2022. A home in Palm Springs, which was sold in March for $1,400,000 and put back on the market some two months later for roughly the same amount, is now going for only $635,000—a price cut of $765,000. In cities like San Francisco, one of the most overvalued urban areas in the country, home prices have dropped by over 10 percent since reaching a peak in 2022.”

Munch Munch Munch 🙂

Another bad year for the perma bears. 2024 will be brutal for the bears. Mortgage rates have been dropping like a rock. Now they all hope for a Great Recession.

It’s election year folks, they are gonna pump up the markets like a mofo.

Housing to go up!

Btw., I am bigly into crypto. Never before did I have so much money invested in crypto. Outlook 1-1.5y until cycle top. Buy dips along the way like spot etf (sell the news event). Bitcoin to the moon baby!!

Financial writer Jared Dillian has an article about buying a house in today’s interest rate environment (that’s the title). He does mention the current interest rate drop but doesn’t think it’s enough to get buyers off the fence. (He is currently trying to sell and transaction volume in his area hasn’t budged.)

However, he notes that homebuilder stocks are jumping. I looked up DR Horton and Lennar and both are up since the beginning of November. He says they’re building in #1 growth area Myrtle Beach tens of thousands of houses. He thinks they won’t be able to sell as fast as they think they can.

He still thinks it is not the time to buy. He sees the current economic situation as favoring renting over buying. He says buying a house is probably the riskiest financial decision most people will make. Debt he says is the chief activator of financial stress. You should take emotion out of your decision; don’t go over 25% of income… maybe 30% if you stretch. Homes now are exceptionally unaffordable, and he has no idea when that will change. He sees a cult of home ownership among young adults. They write in and tell him that they don’t feel grown up until they get one. There are the benefits of appreciation, but these are limited if you overpay.

He says that the current environment is better than earlier this year, with lower prices and interest rates, with a buyer’s market beginning to emerge. He says:

“And remember, you can always refinance. If you get a 6.5% mortgage today, you can always refi into a 5.5% mortgage a year from now if rates continue lower. YOU ARE NOT A BOND TRADER. You cannot forecast the direction of interest rates. But you always have the option to refinance.”

I disagree that you can always refinance. If your livelihood implodes, no one will want to lend to you. I know I can always have income from my retirement savings, pension and government payments (well…four more years of Biden or a worse progressive Democrat would be a problem). Inflation (which will keep on being a problem no matter who is in charge here) will probably reduce the buying power, but I am old enough not to need to work. But the 27-year old house horny renters he writes about can’t do what I can do at my age. As I previously posted, buyer’s markets are nearly always brought on by high unemployment.

They can manipulate lower inflation numbers all they want, but the average Americans don’t buy it when they go to the grocery stores.

OC Register Columnist has a couple of articles which discuss economic problems in California. I’ll pick out the ones I thin are most problematic for the economy.

1) California isn’t attracting people. CA has the lowest percentage of arrivals from other states. Our population is at the 2016 level.

I agree with this except that there are arrivals that do us little good or harm us (e.g bums and illegals).

2) Not enough babies. 10.5 births per 1000 residents is way below our average over the last century. More older residents and young adults without resources are the causes.

Joe says: What ever happened to “everybody loves a baby”? Having babies from families that can nurture them and make them productive adults is what makes human society thrive.

3) Not enough manufacturing jobs. We are losing these jobs due to high costs. This is also a national problem but particularly true here.

Joe says: Our state government is good at scaring away or driving out manufacturing that wants to locate here.

4) Foreign tourists. Spending by foreign tourists is 16% less than before COVID. Overall tourist spending is only off 2%, so the missing tourists are from abroad.

Joe says: Maybe foreign tourists are more interested in our cities than our national parks? The bad publicity about all the bums may be scaring off foreigners.

5) Number of workers. There are the same number of people with jobs here as 5 years ago. A no growth environment.

Joe says: This isn’t surprising as we aren’t growing our population either.

6) All metro areas in CA have above average cost of living. CA is home to 12 of the 15 most expensive metro areas. Even the cheapest metro area (El Centro…yuck!!!) is 0.1% above the US average! Inland costs are rising to match the coastal cities now.

Joe says: California has been more expensive for a long time in my opinion. It’s just that now people are at the point where the negatives are starting to outweigh the huge amount of positives for the Golden State. And this is due to our state government which has changed from the days of Deukmajian and Reagan (heck even Arnold & Jerry!).

Housing to Tank Hard in 2024!!

Joe R,

““And remember, you can always refinance. If you get a 6.5% mortgage today, you can always refi into a 5.5% mortgage a year from now if rates continue lower.”

I agree with you that in order to refi, you need to keep your income/job to qualify.

Some other things happened to friends/co-workers during Housing Bubble I in 2008.

They were all fully employed.

1) One friend’s house fell 10% and they could not refi until they came up with that amount for a 80% Loan-to-value. They were lucky enough to have 50K in their 401K that they borrowed to pay down their mortgage or they would have been stuck with the higher interest mortgage until the market recovered enough 6 years later in 2014.

2) Some friends went completely underwater and just rode it out at the higher interest mortgage rather than doubling down on their declining house. By 2016, their houses recovered enough to refi and they saw ENORMOUS appreciation by 2021 to refi again below 3%.

3) Some co-workers and many others were still working but their houses went completely underwater (-30%) and they panicked. They couldn’t refi and took the foreclosure loophole by jingle mailing their keys back to the bank. It took them 7 years (2016) to get the foreclosure off their credit record so they could buy again.

They treated their house like a bad stock investment and bailed out cutting their losses even though could still afford to pay the mortgage payments. Since many home loans are no recourse, all the banks can recover is the house.

I think you are correct that a job loss recession will cause a housing crash.

However, if prices drop more than the down payment (20%?, 10%?, 3%?), there could be mass panic when their houses go underwater. Even if they are fully employed.

Nobody wants to sit on a declining asset.

Prices haven’t fallen that far yet. So far, it looks like a soft landing.

BobE,

Thanks for your additions to my comments on refinancing. You gave a lot of nice examples of the right and wrong way to handle this situation. The main points of Mr Dillian’s article on buying a house were don’t overextend yourself and be patient. On that I heartily agree with him. I think that is also the main point of this blog.

Oh Boy, more popcorn please, these previews are just getting started 🙂

From Newsweek. “The housing market has proven to be a tough terrain in Joshua Tree, California, evidenced by a house that sold for $340,000 in December after being purchased for $600,000 in 2021, marking a $240,000 loss. Initially listed at $625,000 in early 2023, the home, situated east of Los Angeles in the Mojave Desert, saw multiple price reductions over the year, finally settling at $340,000 in December, a 47.3 percent decrease from its 2021 purchase price.”

From Moneywise. “California’s once-glorious Golden Gate City is a shadow of its former self. Office towers sit empty, hotels are closing their doors, shops are boarded up to prevent crime and San Franciscans are ditching their beloved city in search of safe and affordable housing elsewhere. And the California city’s decline hasn’t gone unnoticed. Business leaders have been open about the problems eating into their bottom lines, such as the shrinking population and the lack of affordability in both commercial and residential properties. According to real estate company Savills, San Francisco had one of the lowest office availability rates in the U.S. before the pandemic at 9.5%; however, vacancy is now at 36.3%, up from 35.1% reported last quarter.”

“Another factor that caused retailers, in particular, to ditch downtown San Francisco during the height of the pandemic was crime — in particular, a huge surge in shoplifting incidents. While retail crime levels have since receded, many retailers, like Whole Foods, Walgreens and Nordstrom shuttered stores when things got bad.”

munch munch munch….. Got Popcorn :)))))

That’s what happens when you let the tech overlords take over your city.

Mr. landlord

I am willing to make a bet that if the stock market can maintain the ATH level a bit longer, Mr Landlord will make a comeback here. It’s usually a signal to take some profits.

The only forecast for RE and Bitcoin I have is both will be higher by the end of 2024.

Stocks, that’s the easiest play, just DCA.

“Stocks, that’s the easiest play, just DCA”

M,

in 2009, I was buying 70+ % stocks in my 401K. As the market rebounded, I bought less and less as a percentage. I still do that…increase the percentage of stocks as the market drops and increase bonds and cash percentage when it rises. In rising interest rate environments, I alter the ratio of bonds vs money market. Higher rates, increase percentage of bonds. Somewhere along the timeline, my 401k added a foreign stock fund, so I included that in the stocks. The domestic stocks are in small, mid and large cap index funds. None of this is Dollar Cost Averaging. I put in as much as I can afford, minimum of enough to get full matching, but nowadays a lot more.

Of course my 401k doesn’t offer individual stocks or bonds. DCA is probably fine if you’re buying one or two individual stocks that you have a strong belief in. Reinvesting dividends is a form of DCA.

BTC might be higher in 2024 given that the SEC just approved low fee BTC ETFs.

Now great-grandma can go to Schwab/E-Trade and cash out her safe conservative CDs and start trading in Crypto. To the moon in 2024. It will be like when Beanie Babies started appearing in the grocery store aisles.

What could go wrong?

People said the internet will fail. People said the microwave is a bad idea. People said personal home computers won’t stick. People

Said there will be a Great Depression when Covid hit. People said there will be a silver tsunami. People said there will be a forbearance tsunami. People said there will be a Airbnb bust. people said bitcoin will go to zero.

In ten years from now, nobody will be surprised that bitcoin remains above 100k.

When I bought my first bitcoin at 4K people thought I am crazy and will lose it all.

People also told me I will lose my equity after I bought my first house in Q1 2020.

I bought my first rental and people told me the same thing. after I bought, rates shot up and buying the same rental today would cost me much more due to the rate increase.

The court has ruled and the anti-crypto guy gensler HAD to approve the BTC ETF.

I will convert my entire 401k into BTC ETF and retire early. BTC is likely the greatest opportunity to make it big in our lifetime. If you can’t beat it, join it.

I have a few coworkers who are beating the drum about the “big crash” coming this year. I got a good chuckle at them thinking they’ll get the sweet deals with their 5-10% down payment. As usual, the big money players will swoop in and get all the deals (if there are any). This economy sucks for the majority of people; however, it has been very good for the upper crust. RE, stocks, crypto and even boring treasuries keep the money coming in. Keep your powder dry as usual.

A bunch of my relatives (gen x and millennials) haven’t bought because the market is gonna crash. Meanwhile I am working on getting me second rental. Can’t wait to have a conversation about the upcoming crash 5 years from now. Rates going lower and inventory is not going to skyrocket. Perfect Formular for higher RE prices. But what do I know. I don’t have popcorn

Happy New Year to Everyone!

Thank you for all of the discussions, information, and entertainment during 2023.

When the good Dr updates this blog again, I’ll post my predictions from last year and post my predictions for this year.

I fear that I have done horribly so trust no one. Especially Realist and M. They did worse than I did. 🙂

OC Register columnist Lansner has an article about cost of housing from federal price parity data between 2015 and 2022. CA 2022 data has the lowest percentage of average national housing costs since 2015. CA housing parity costs were up 2% in 7 years compared to 13.5 points for ID, 13 points for NV and AZ up 12 points. ID is still below the national average. CA is still #2 for overall cost of living behind DC.

He also discusses cost of living savings in the states that CA expatriates are moving to in the greatest numbers:

TX: 39% housing savings, 13% overall.

AZ: 34% housing savings, 11% overall.

FL: 27% housing savings, 9% overall.

WA: 20% housing savings, 2% overall.

NV: 30% housing savings, 14% overall.

I think that Washington is an anomaly on overall savings because most people I’ve heard about are moving to the Spokane, Richland/Kennewick and Bellingham/Oak Harbor areas rather than the more expensive Seattle/Tacoma metro area where cost of living is much higher.

When 50% RE Crash? Need mansion for half price

RE:

Did you see my posts of Nov 9 (post # 2 of that day) and Nov12? The situation today is not 2007-2009. That was a speculative bubble with Ponzi financing. Now we have people like me who are sitting on property that is paid for and has Prop 13 taxes. There are fewer houses available in many markets and high interest rates which discourage Ponzi financing. The next drop in RE prices will come when we have high unemployment (which is when most buyer’s markets occur). People like me won’t sell under those conditions. And cash buyers will blow borrowers away at getting the choice properties. How much cash do you have?

I have mentioned this before about the 3 stages of investment financing:

Hedged (can pay principal & interest)

Speculative (can pay interest only)

Ponzi (can’t pay either without liquidating)

OC Register Columnist Lansner had a column today that our friend M would love.

He looked at price swings over time to see how often waiting a year to buy paid off (since 1987). There were declines in 30% of 12 month periods. Even so, the average was a 6.1% one year gain.The biggest drops and increases for any 1 year period were the same: 28% down in Oct 2008 and 28% up in Jul 2004. On the side of waiters is that the interest rates fell 64% of the time for 1 year periods since 1987. However the average 1 year change was only 0.1% interest so it isn’t a giant windfall most of the time. The biggest 1 year dip was 2.1% in Jan 1996 and the biggest 1 year increase was 3.8% in Oct 2022. Mortgage interest rates averaged 6.3% over the time span.

Lansner speaks of this in gambling terms: To win big, he says you are making a parlay bet that both loan rates and prices will fall. This happened 23% of the time, with the winners averaging a 14% discount on the housing payment. But when rates and prices don’t fall, there is an average 12% hike in the CA house payment.

Lansner also says that the drop in prices and rates almost always coincides with increased unemployment. That’s what I posted earlier in the segment of Dr Housing Bubble. So who cares if you can get a cheaper house with a lower payment if you are starting out as a prospective homeowner and you lose your job!! This type of economy favors cash rich buyers of investment property.

As of now, supply is not meeting demand. Homeowners with low interest rates don’t want to give them up. That’s what’s propping up the Southern California real estate market.

Like the movie Rocky Balboa taking shots to the head, CA hits just keep coming DING DING DING end of 3rd round.

The Los Angeles Times. “Southern California’s real estate market is as cold as the snow currently adorning the peaks of its mountains. Interest rates are up. Inventory is down. And deals are few and far between. In slow markets, the agents at the top — those with experience, connections and plenty of clients — typically maintain a modest but steady stream of business. It’s the agents at the bottom — those just getting into the industry who’ve only managed to close a handful of sales — who starve. As those agents have grown more desperate for leads, they’re trying alternative ways of finding them. Some are outsourcing the work overseas, and others are turning to AI or automation in a last-ditch attempt to find a seller.”

“More than 43,000 single-family homes traded hands in L.A. County in 2021, and more than 42,000 were sold in 2022, according to the Multiple Listing Service. But then the market started to freeze in 2023 as mortgage rates shot up. Only 11,539 single-family homes sold that year, and sales are at a similar pace so far this year. In California alone, NAR lost 9,723 members from December 2023 to January 2024 — a 4.75% decline . But even after the drop, California still holds the second-most active Realtors in the nation at 194,964, and they’re all fighting for an extremely small pool of sellers.”

“At the peak of the pandemic market, Tyler Andrews, 29, tried his hand at real estate in the Inland Empire, thinking he would use his outgoing personality to sell homes as L.A. residents flocked to the area during the pandemic. He got his license and helped a few friends with their house hunts, but ultimately didn’t earn any commission and stopped in 2023. He’s one of many agents who rushed into real estate hoping for a taste of California’s latest gold rush. In 2022, Realtors with 16 or more years of experience made a median gross income of $80,700, according to the NAR. But those with two years or less experience made just $9,600. According to a report from business networking platform Alignable, 31% of real estate firms struggled to pay rent for their office in January.”

From Newsweek. “One woman in California is searching for answers after her homeowner insurance policy left her uninsured for a $600,000 house that burned down during a wildfire. Amber Bush, a 44-year-old living in Redding, remembers the day she saw her home burn down in 2018. The home was destroyed by the Carr wildfire, which saw more than 110,000 acres devastated in the state. At the time her home was destroyed, Bush was enrolled in a Farmers Insurance policy, but the nightmare soon continued after she got in contact with the company. She said Farmers Insurance had terminated her policy because they said her contractor never completed her home. Altogether, Bush has spent more than $600,000 building her now uninsured home, so the stakes are high. ‘If anything happens to it, the mortgage company gets their money and I get nothing but a plot of land,’ she said.”

“While Bush filed a claim on her homeowners’ insurance for liability coverage to pay for an attorney to protect the home from the contractors, the process is still in review. In the meantime, Bush said she is left without an attorney and will probably lose her home without any representation. Alyson Dutch, another California homeowner, has struggled for nearly three decades to buy insurance on her Malibu home because it’s considered a ‘high risk’ area, she said. The only option for many is the California Fair Plan. The state-subsidized option, while providing some support for fire and earthquake damage, often leaves many frustrated when it comes time to rely on the coverage for repairs, though. ‘It’s crap insurance and barely covers anything,’ Dutch told Newsweek. ‘This is the reason why so many houses in Malibu that have burned in fires, or slid in rains that followed, had to leave the state and their properties remain in shambles.’”

Got popcorn 🙂 munch munch munch

lol

Realist ????

No crash in sight but the guy still keeps posting his popcorn phrases.

Will he do this for the next 5 years or throw in the towel?

You do realize that the real estate/property sector has collapsed in China, right? And that all over the world the property bubble is popping. But that won’t affect California, right?

lol? The RE market all over the world is expensive. Try buying a house in Europe.

China RE market collapse?! What has that to do with us? We don’t live in a communist country that manipulates data. You can’t trust any numbers that come out of China. In the US we haven’t built ghost towns like in China to prop up GDP.

We have the strongest economy in the world. And only people who can afford it buy in the US. There is no way we will see a RE crash in the US anytime soon. The opposite, as soon as rates come down, prices will go up significantly.

My Wife just showed me a listing for a 3 BR 2 BA 1385 Sq Ft house on a 5300 Sq Ft lot in GG a block off “Trash” Ave (Orange County people will get the reference) that is now under contract for over $1M! My Wife knows the seller who wants to move closer to the beach. She is now worried that she might not find a place that is for sale in that price range. The offer was in CASH! (Shouldn’t be a surprise.)

This is a new era…prices maintained due to low inventory, and high interest rates freezing out borrowers. The 2024 election will decide if inflation goes up or stays flat in my opinion.

10 days ago an Orange Co. Judge issued a directed verdict in a lawsuit where First Team Real Estate sued Coldwell Banker for “poaching” agents between 2015 an 2017. The judge threw out the case when the plaintiff’s lawyers went over their allotted time to present the case (that was on day 12!). Coldwell Banker attorneys never called a witness and made a motion for a directed verdict. California courts generally rule that non-compete or non-solicitation clauses are unenforceable.

CA Foreclosures are burning down the market, hope your Down Payment hasn’t disappeared, that’s the movie Towering Inferno MUNCH MUNCH MUNCH

https://www.youtube.com/watch?v=cqNpyflngWg

Got popcorn 🙂

This guy for realz?? Delinquency rate was peaking at 10% in Jan 2010. The delinquency rate right now is at historic lows (1.4% ish).

The RE market will got up for the next 100 years and until his last breath he will post perma bearish crap. Enjoy being a life long renter

The song “BURNING DOWN THE HOUSE” comes to mind when watch the opening credits for this movie – munch munch munch

https://www.youtube.com/watch?v=_3eC35LoF4U

A report from the Orange County Register. “It was a weaker-than-average early winter for Southern California home prices. December and January are known for price dips as house hunters shy from closing on a home purchase around the holidays. My trusty spreadsheet tells me Southern California homes have averaged 2.2% declines during these two months since 1988. And historically speaking, that’s the largest price drop buyers see in a typical year. This time around, the median selling price across the six-county region fell by a combined 4.6% during December and January to $705,000, according to CoreLogic, which tracks closed sales for all residences. It also was the largest two-month decline in the past 12 years and the fifth-biggest dip for any December-January period dating to 1988.”

“San Bernardino: The biggest drop – a 7.9% decline from a record high set in November, vs. 3.3% average dip. San Diego: 5.6% decline vs. 2% average dip. Median of $802,500 is 6% off record $850,000 from July 2023. Los Angeles: 4.8% decline vs. 1.8% average dip. Median of $800,000 – 7% off record $860,000 from April 2022. Ventura: 3.6% decline from a record high set in November vs. 2% average dip. Median of $799,000 is off from a record $828,500. Orange: 3.2% decline from a record high set in November vs. 1.9% average dip. Median of $1.065 million was off from record $1.1 million.”

No Rate Cuts coming, oh that’s gotta burn 🙂 Got Popcorn

If Realists “predictions” was an index fund that was launched when the first market market crash claim was made, then its trading for pennies on the dollar and on the verge of bankruptcy. Munch munch munch ????

This site used to be the go to for SoCal RE, but no posts by the Doc since October 2023? While the market is potentially entering meltdown mode?

Three different bills have come forward in out State Senate and Assembly to regulate corporate ownership of single family houses. One from Milpitas Assemblyman Lee would ban institutional investors from buying additional single family houses for rentals., The second bill from Berkeley State Senator Skinner would would ban institutional investors from purchasing, acquiring or leasing a single family home or duplex for any reason. The third bill is from San Diego Assemblyman Chris Ward would ban developers for selling homes in bulk to big investors. This bill is backed by the state Realtor association because bundled sales hurt their members. That one probably has the best chance of passing. Each bill has its own definition of “institutional investor”. Lee and Ward say 1000 single family homes is the cutoff. There are only 4 companies here that fit that description who own 17,300 homes here. Skinner would use a broader definition that would include managed funds, private equity funds, and REITs. (REITs are publicly traded.)

Corporate owners meeting the least stringent definition own less that a half percent of houses nationwide. That’s 446000 houses. Redfin estimates 13% of homes were sold to investors which includes a lot of small landlords who put their properties into a corporation for legal reasons. In California, less than 2% of homes are owned by investors with 10 or more properties. Institutional investors favor rapidly growing areas with low real estate prices compared to rents. In CA that’s Fresno at 5.9% of houses owned by big investors. One local company there owns 2000 properties. Invitation Homes owns over 11000 houses in CA and they are the largest company of this sort in the US.

The increase in rents in institutional neighborhoods is real but different explanations are given by different researchers: 1) exploitation of a monopoly 2) better managed and safer neighborhoods that are more in demand. Corporate landlords are more likely to operate repair hotlines and are less likely to use racially biased screening. They also pull the trigger on evictions quicker and are less tolerant of tardy rent payments.

I think laws like this should have been passed long ago.

In fact, I don’t think institutional investment entities should be able to own single family dwellings at all. I also think there should be a cap for individual investors, maybe at one. There is no need (other than greed) for the multi-millionaire / billionaire class (or anyone else) to own numerous homes.

Taking housing off of the market to make it permanent rental housing (for vacation rentals or long-term rentals; it doesn’t matter) constricts supply for owner-occupiers to buy. If the foregoing restrictions were implemented, my guess is that housing would instantaneously become affordable for the overwhelming majority of people.

Of course, there is little incentive for these restrictions to be implemented, since politicians are bribed by institutional investment entities and the like, and government in general stands to take in significantly less money in property tax revenue. So the circus continues.

In the last week or so, Realist and I read the same newspaper and came to a different conclusion as to what article was the most important to discuss on this blog. He chose short term fluctuations in housing prices in SoCal. I chose the legislature’s lawmaking in the area of corporate ownership of housing tracts, which is a long term plan for California housing. The question here is which is more important? Housing or home ownership?

Lansner of the OC Register has a column today about the long term trend for length of home ownership. A real estate research group did a study of length of ownership for those selling houses in 2023.The top 50 markets (8 in CA) were looked at. The average for CA metro areas was 10.6 years which was up from 2019 (9.8 years) and 2003 (5.1years). The average gain was $311000! He notes that the trend to longer home ownership has been going on for years, regardless of mortgage rates. This trend has been nationwide, although not quite as much as in CA.

Upgrading homes rather than selling is a long-term trend, and the large capital gains from selling plus transaction fees make it less attractive to move. Lansner says longer ownership is a new norm.So expect a meager number of existing homes for sale until the baby boom ages more.

My example is owning the first house for 9 years and the current house for well over 20 years. And I’m nowhere near the longest ownership on my block. (Although I’m moving up on the list.)

Joe R,

Interesting data and it makes sense.

10.6 years ago from 2013 was the bottom of the first housing bubble in 2012. If you purchased a house from 2009-2014, and then refi’d the balance in 2020 for a sub-3% mortgage, you are living with extremely low expenses.

It would be hard to give that up. Unless you die, divorce, or have a disaster.

Sales volume has been low for the last 4 years so the number of new homeowners less than 4 years is low, skewing the data toward the longer end.

If Housing Bubble 2 crashes, then I’d expect to see more new home purchases and the data will skew back down to a shorter period.

That’s my thoughts on this.

Sorry, 2013 above should be 2023.

Selling and moving is expensive. And if one starts over a 30 year mortgage every few years, they’re just burning cash since first several years of payments or so are more interest than principal. This increase in staying is a healthy trend.

Personally, we could use some more room after 16 years. I’ve been looking at big sheds and garage-to-office conversion. I’m grateful we have a side yard for shed and boat, to free up the garage. It’s nuts that the next construction nearby is selling for 50% more and houses are like 6 feet apart. Golden toilets, I guess?

I wouldn’t move unless I was ready to pay all cash cuz once you’re free from a mortgage, you never go back to your master!

Transactional costs due to moving (selling costs, buying costs, new tax base) are very real.

Resetting mortgage costs – nah….that’s man made. If restart 30 years mortgage every 5 years, it’s not like you do not have left over cash from previous equity.

I think move up buying barely exists these days. The transactional cost of move-up buying can easily be near a years salary for most people not to mention what it does to your property tax base in CA. I bought my home in 2012 and I can’t imagine ever selling and will likely own until they day I die. I could afford to move up and would probably really enjoy a slightly bigger and nicer home. Moving up would mean going from $4k /yr property taxes to $10k-$15k and I suspect the transaction cost would approach $100k. Maybe I’m high on the transaction cost side, but I imagine to move up I’d have to spend well north of a million. Total cost not including mortgage or anything else just transaction and increase property would be $100k + ~$100k per 10 years owned. I imagine the story looks similar to most move up buyers in CA which is probably why that market no longer really exists. When you also factor in current interest rates the situation becomes even more bleak.

No plans to move up for us. We will sell our multi-million los angeles home and retire in a cheaper state. Put the million or so difference in a fund to live off of.. and own our home outright in a cheap area. That’s the plan anyway.

This is very true in California. Move up buying does not seem logical unless one has significantly increase their income or move up is very significant.

The amount of increased cost (and transactional costs) does not seem to justify the incremental improvements.

Lansner of the OC Register has an article about rents in the 75th and 25th percentiles in California since 2017. Instead of using the 50% median, he divided California int the high rent and low rent sections.What he found was that the upper half cities had a 11% increase in rent since 2017 but a 35% surge in the lower half. Movement into the lower half cities has put pressure on rental costs beyond what has happened in the richer burgs.

Examples for the lower half since 2017: Fresno up 43%, Santa Maria up 52%, Moreno Valley up 48%,Pomona up 31%. Examples for the upper half: San Mateo up 6%, Santa Clara up 16%, Irvine up 29%, Lake Forest up 42%.

The average monthly rent in California ($2154) was topped only by Hawaii (($2239). The national average was $1402. California’s rent increase average was 21% compared to 28% nationally. Lowest rent increase percentages were DC at 5%, Louisiana at 11% and Minnesota at 14%. So there are still places that are much less desirable than CA!

IRS allows only $250,000 exemption for selling a house. $500,000 exemption for a couple. Every dime after that goes as part of your yearly income. This means that if you lived in a house for quite a number of years you may be facing a huge bill from the IRS. The only way to get out of this trap is to save all bills to show you made improvements on your house.

Guys, longest streak (6 months) where Mr. Bubble hasn’t posted an article since inception. This is an indicator that we’re in a bull run. We need Mr. Bubble to be posting 8-9 times a year to be a true precursor of a bubble popping.

OC Register columnist Lansner has investigated the CA building permit quarterly data compiled by the St Louis Fed. He looked at the data for multifamily housing permits (apartments, plus some condos & town homes). In the first quarter, fell 22% below the 2023 numbers. This is the slowest quarter since the first quarter of 2014 (10 years ago!). This was 32% below the average pace for the 2021-2023 pace. The 2021-2023 pace was the highest since the 2004-2006 pace. The vacancy rate for this past quarter was 5.2%. The vacancy rate for the first quarter of 2021 was 4%. However, single family permits were up 26% in the first quarter (although they were off 7% compared to the 2021 – 2023 pace).