3 housing stories that’ll surprise you – FHA only starting to tighten loans standards (for real this time, maybe), deed-in-lieu of foreclosures growing, and fining banks for neglected properties. BofA FHA insured delinquent loans increase nearly 200 percent in one year.

Last week HUD came out with laser focused ways of addressing its impending insolvency because of defaulting FHA insured loans. Now some of you were under the impression that something was already done to tighten lending standards given the precarious situation the housing bubble brought to our economy. Yet that is not the case and incredibly, what passes for basic due diligence today seems excessive because only a few years ago loans were given out to people making $14,000 a year and financing their $720,000 home purchase. FHA insured loans have become the staple of moving properties especially in areas like California. The 3.5 percent minimum down payment is all people can muster up and apparently this has caused further deterioration in this market.

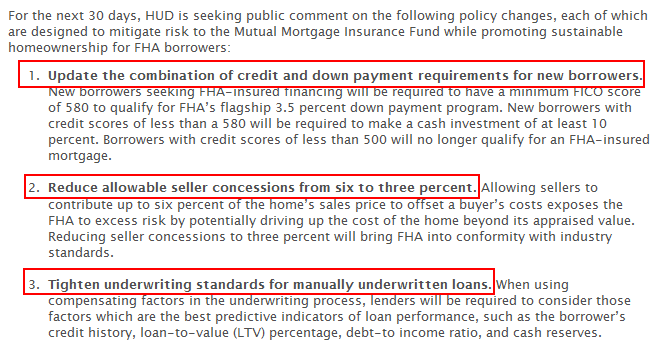

HUD is seeking public comments for the next 30 days on the below:

Source:Â HUD

Now some of you might be thinking why we are asking these basic questions three years deep into the housing implosion. The first question focuses on the credit score of borrowers. Can you believe that a 580 credit score will enter you into the “flagship†3.5 percent down payment FHA insured loan program? No wonder why defaults are off the charts. No bank in their right mind would lend their own money so banks are basically using the government as their lender and sucker of last resort to continue to make these financially troubling loans. The second point relates to seller concessions. Yes, this stuff is still going on. Serious reform apparently doesn’t involve basic common sense. Finally, the third point focuses on tighter underwriting. If we are asking these questions today from an agency that now insures approximately 4 out of every 10 loans we have some major issues coming down the pipeline.

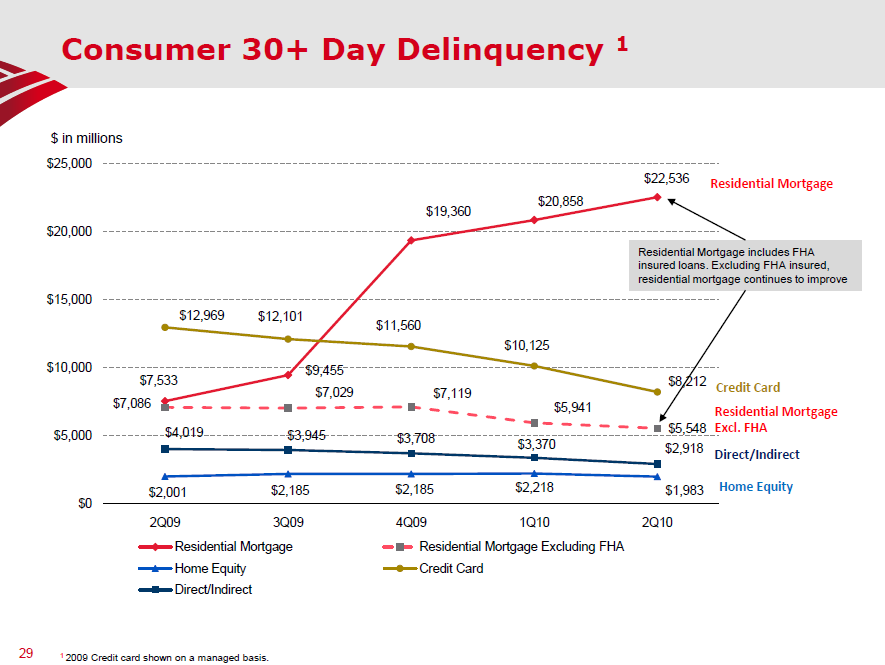

Bank of America released their second quarter earnings report and you can see how poorly FHA insured loans are doing:

BofA saw a jump from $7.5 billion in Q2 of 2009 to $22.5 billion in their 30+ day late delinquent FHA loans. This is nearly a 200 percent increase in one year. Now how is this happening? Well refer to the questions that are being asked from the agency overseeing FHA. Did we not learn that a low down payment is a recipe for disaster? It is also the case that a low down payment inflates housing values because it takes away the focus from actually saving money and going into massive debt instead. What if you had to save 10 percent as a minimum to buy a home? Think people would be willing to walk away from a property so quickly? Plus, having a down payment creates a buffer. I seem to be one of the few that think a good sized down payment is necessary in protecting us from future asset bubbles. As you can see from the BofA chart above, the FHA is now in a big mess and this came about with income verified and documented underwriting. But if you don’t correct the bigger issues, then what use is it?

The government will not voluntarily tighten standards on mortgages because the only lender right now is the government. And even with these ridiculously low down payment programs, the demand for housing is waning because the economy is in a major funk. A house can cost $100,000 but without a job, it might as well cost $1 million.

Deed-in -ieu of foreclosure

Banks are catching on that people are willing to stay rent free in homes for 12 to 24 months in some cases. At first, this might have made sense with a handful of borrowers but the flood is now growing. Banks realize that losing 12 to 24 months of mortgage payments might not be a good idea. So some are now going after the deed-in-lieu (DIL) of foreclosure option. Why would they do this?

I think there are a few reasons for the DIL of foreclosure option now being explored more carefully by banks. For some areas, banks may realize that spring and summer (clock is ticking) may be the prime time to put some properties back on the market. After all, we don’t know where interest rates will be next year and it already seems that the government is going to have to tighten lending standards more given massive defaults. So banks would rather get a property back, ignore going after the borrower, and simply get the home back ASAP so they can put it back on the market while the government mortgage liquor is still flowing. We don’t have clear data on this but I will venture that banks are only going the DIL of foreclosure path on select properties in more targeted markets. How many DIL of foreclosures did banks pursue in Detroit?

Some are arguing that this has more to do with HAFA:

“(WaPo) To qualify for a HAFA short sale or deed-in-lieu, the mortgage must be for a borrower’s principal residence; the loan balance may not be more than $729,750; the borrower must have incurred some hardship such as a medical emergency or a drastic reduction in income; the loan must have closed before Jan. 1, 2009, and first-mortgage payments (including property taxes, insurance and mandatory homeowners or condo fees) must be more than 31 percent of current gross household income.

For a deed-in-lieu arrangement, borrowers must also be able to deliver clear and marketable title to the home, free and clear of all liens or encumbrances and leave the home in “broom clean” condition. Homeowners are given a minimum of 30 days to vacate the home from the date the short-sale agreement expires or the date of the deed-in-lieu agreement.â€

I’m not sure I agree with this assessment. I think the bigger motivating factor is the amount of money being lost by strategic defaulters and the prospect of taking a property back and selling it in the current market while government cheese is still flowing out of politicians’ pockets like mozzarella. Next year it might be a very different picture.

Neglect and pay a fine

Another issue that might light a fire under banks to move shadow inventory is fines for neglected properties. L.A. launched an effort to fine banks that don’t maintain foreclosed properties. The biggest landlord today is the banking system with the entire shadow inventory out in the market:

“(LA Times) A dilapidated South Los Angeles home with tall weeds, a fallen fence, broken windows and graffiti was chosen to serve as the backdrop for a news conference Saturday as city officials announced the launch of new efforts to clean up foreclosed properties.

The beige stucco bungalow on West 77th Street is a neighborhood eyesore, playing host to drunken transients and stray animals and reeking of urine and feces, neighbors said.

“A lot of vacant homes have become a nuisance in the neighborhood because of the foreclosure crisis,” said Betty Steele, one of several community activists who canvassed the 77th Street neighborhood encouraging residents to report problem properties via the city’s 311 hotline. “And the banks should be held accountable for cleaning them up.”

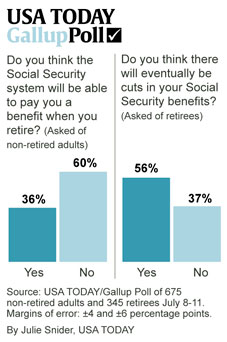

As local governments hurt for money while the Federal government is off bailing out Wall Street, cities are going to try to get their funds from somewhere. We are starting to see some of this trickle out into the market. While all this is happening, a large number of Americans now have little faith in Social Security:

Source:Â USA Today, Gallup

60 percent of non-retired adults believe Social Security won’t be able to pay them a benefit when they retire. Ultimately people get that the party has ended and major changes need to be done. But the choices we have aren’t pretty and very few politicians have the backbone to make the changes happen especially in an election year. So what will happen? We’ll have more public comment on things that should have already taken place (the public is very clear on the bailouts by the way) and more bread and circus for everyone.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “3 housing stories that’ll surprise you – FHA only starting to tighten loans standards (for real this time, maybe), deed-in-lieu of foreclosures growing, and fining banks for neglected properties. BofA FHA insured delinquent loans increase nearly 200 percent in one year.”

FHA needs to tighten its standards much more. Hopefully this is just a first step.

Of course, Social Security benefits will have to be cut. Anyone with even a rudimentary grasp of math and demographics can figure that out.

Age to collect full benefits will be raised to 70. I think Congress should raise it to age 80. Since most people will be DEAD by then, problem solved!!

My friends and I were just talking about this FHA stuff last night. I know a couple up in the Bay Area who just bought a $709,000 home with only $21,000, or, 3% down. It seems insane to me. I mean, if he (only the husband works) makes that much money, why not try to just save $4-$5,000 a month for a bigger down payment? I don’t get it.

I LOVE this blog by the way, I’m so glad there are people out there questioning this crazy world that is real estate!

I disagree with the Doc about the choices for fixing SS “not being pretty”.

The most beautiful choice available is to “raise the cap”.

That means the richest people in America would have to “pull their own weight” and pay the same % as the working man pays.

Oh! The Horrors!

You would think that asking rich people to pay their own freight was the same as asking people to keep on working until age 70?

if SS is cut, MediCARE and obamaSCAM will have been gutted first. Then, if SS is cut, FICA contributions should return to zero because there is no SS. Government will just spend the largess with more criminal negligence.

It won’t happen.

SS cannot be tinkered with because too many Americans need it that have nothing else.

Cambridge,

Why should the rich pay more into the SS system if they’re drawing an equal amount of benefits out ? That is, when the poorer person gets his SS benefits, they will be a greater percentage of what that working man made during his life versus the percentage of the amount of benefits the rich guy receives and what he made during his life time. It cuts both ways, doesn’t it ?

@cambridge – on that line of thinking why not ask rich people to pay more for food, cars, and everything else. I mean Joe Six Pack has to pay a $25K for a Ford, why shouldn’t someone who makes more have to pay $125K to own the same car, that would be more fair and the car is a fixed benefit the same as the capped and fixed benefit on social security (he doesn’t get any more because he’s rich, why should he pay in any more than the maximum he might receive, maybe he should fund the whole thing for everyone else just because he can?).

Eventually you get to the point where everyone has exactly the same thing no matter what they do and you wind up with what? Utopia and world peace? No, a bunch of lazy a** people who are all trying to rely on someone else to do their work for them. Basically the total welfare state looking for a handout from some demotivated hard working portion (like Atlas Shrugged – but also consider if government employees vote as a block to keep the yoke on the private sector feeding them, majority rules and you create a democratic endorsed slave class).

Capitalism at its core works well because when combined with freedom it allows people to seek their own fate and earn according to their own merits. It provides the opportunity and reward for success and innovation. Granted all things need some stable platform that makes sense and this can be twisted and our government has done a pretty good job at messing with market forces (you can thank them for a good portion of the housing bubble supplied with funds, marketing, regulation etc…).

The wealthy already are subjected to higher levels of taxation on income and the majority of tax revenue is generated by them. They pay an equal unlimited tax on just about all state/local/housing etc…I’d certainly close some loopholes and make it a bit more streamlined but I’m not in favor of taking much more from someone as I think eventually you wind up at the point where this will have a negative spiral on productivity.

For the record I make a reasonable income, rent currently (have never owned), have low to modest savings, plenty of mouths to feed at home, and do not own my business. I’m not rich by any standard but I do owe my job to people who have created my company and others looking to invest in their own talents and those of others in order to create something and be rewarded both personally and monetarily. Those are the major contributors, innovators, and drivers – where would we be if not for them? Recall up until the last century there was no income tax and no social security. The only reason social security existed was to get old people out of the work force and get the youth employed in the aftermath of the Depression.

Dr. HB, thank you for your tireless efforts to bring us the cold hard facts! Another outstanding bit of research and reporting.

Those FHA “tightened” guidelines are a complete and utter joke! How nice to see subprime loans never really went away – that market was simply completely taken over by the bank of last resort, the federal government. 3.5% down, laughable! Awww, no loans for sub 500 credit scores? There should be no loans for sub 600 credit scores, and forget 10%…it should be 20% down MINIMUM.

This market is a complete nightmare and the handouts, entitlements, corporate and public welfare simply continues to flow. Just remember one of the great quotes from Thomas Jefferson “The democracy will cease to exist when you take away from those who are willing to work and give to those who would not.†Or my preferred (and frightening) Tyler variant: “A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always votes for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship…” – in our case, it will more than likely be in the form of a multinational corporation based oligarchy.

I have to disagree on Social Security actually getting “cut”. It more than likely won’t be cut in terms of dollar amount…instead it simply won’t be raised in line with actual inflation – so when the dollar goes even further to crap thanks to our fiscal policies of spending like no tomorrow/hyperinflation to combat deflation, that $600 a month SS payment will be enough to buy a couple of weeks supply (at best) of cat food for the average senior citizens.

“Why should the rich pay more into the SS system if they’re drawing an equal amount of benefits out ?”…Completely agree with you.

I got 100% financing on my current house, but I’m a physician with excellent credit. I was careful not to overextend myself. My initial mortgage payment was about 30% of my gross monthly salary. My income has risen since then as I expected it to (I am on salary) and currently my mortgage payment is about 18% of my gross monthly salary.

I know – effectively I am a renter, because I’m building equity so slowly. But I’m OK with that, because I didn’t have to tie up a 20% down payment. Plus, paying huge amounts of interest takes full advantage of the mortgage interest deduction.

Naturally, this house is not in SoCal. If I’d been living in SoCal, I’m sure I would have been sucke(re)d into over-leveraging myself, and then caught on the hook of raised taxes.

Those 100% financing programs have gone away since I bought the place a couple of years ago. For a few, selected borrowers, 100% financing makes sense. For most folks, it’s lunacy.

One Bitter Guy, you are right — so there needs to be another method to “equalize” the contributions across the board, besides social security. In fact, we don’t care about social security – it doesn’t exist – it’s just another “tax and promise” from the government – there is no trust fund set aside. So being that all the taxed money gets lumped together — if charging the rich guy more social security tax isn’t the answer — then take your pick of one of the multitude of other “giveaways” the rich have as an option with regards to tax loopholes/discounts/write offs – etc…. Because the system is unfair – it allows the rich to keep a higher % of their earnings from taxation than the poorer person. So the answer doesn’t lie in just discussing paying more into social security – it is a tax in name only, it goes to the same place as every other tax, regardless of how it’s “tracked” on a balance sheet… Every president in fact spends the surplus to make their “budget” look better. SO the solution to this is to close off or reduce the rich guys tax breaks or rate somewhere else — Huey Long had a point — because in this completely corrupt and rigged market – this whole “free market equal to all” BS doesn’t hold water….so the guy at Goldman Sachs who benefits directly from the govt bailout and pay off of their credit swaps – saw his income stay high and untouched — how does that rich guy argue that ? how does he argue class favoritism — when the poor didn’t benefit from that (in fact they contributed to it via taxation) — so where does the poor “get their piece” in this free money yard sale if not from a benefitting from social security? That’s why something like the first 65k somebody makes should just be tax free PERIOD. Then we wouldn’t care about this compartimentalized issue called social security – that ignores the broader issue – the rich benefit more from our tax system than the poor, and because the poor do not — they struggle. The rich of course own the game and if they can squeeze more from the poor (to have the poor fund their own class welfare system as they are) then so be it. But the poor also fund the rich class welfare system — so somehow, somewhere, things must be equalized… social security debate is really all illusion if you think about it – we’re just talking about people keeping more of their pay — it was the governments idea to hold on to it for 50 years (wink, they spent it) and then give it back to them in the form of a monthly check….

@ EL K

Low (or no) money down mortgages may “make sense” for any number of potential homeowners but they do not make sense for lenders. The only reason for lenders to support such a foolhardy practice is that they are able to pass the eventual (and statistically inevitable) losses along. Even physicians can lose their jobs, run into other financial difficulties, or make a bad investment decision that renders them underwater.

I have no problem with some cowboy bank making these risky loans except when that cowboy is fully backed and protected by our government. Since we all now back these loans, there should be much more conservative lending standards. Personally, I think 10% down is too low. I have bought three houses in my lifetime and have never put down less than 20%. Did I need to sacrifice other wants and save for years to do this? Yes. Did I get as big or nice of a house as I could have with no money down? No. Did I ever foreclose or need a bailout? No.

Our collective need for instant gratification and the banks willingness to accommodate our juvenile “I want it and I want it NOW” attitude, is going to send us all down the road to ruin.

All it takes is an additional 1 to 1.5 % increase in the tax rate. The corporations just want to do away with SS to save them money. The House leaders(Dem and GOP) want to make it only for low income people(a welfare system) . The Dem’s would be happy to keep their people happy(low income folk) and the GOP would keep the Corp’s happy. The rest of us would be the losers.

You want to tax the rich equally? Easy peasy, tax capital gains like regular income.

@John

Actually both parties cater to the extremes, I think. The trailer-park GOP that have more weapons than IQ, in nominal terms, and the visionary dems preaching from their ivory towers. Lou Dobbs was an advocate for the war on the middle class, but the subroutines are written and code is executing. We’re all just holding on so we don’t fall into the pit with the chose-to-be losers.

Someone should post the link to where we can leave comments regarding the new fha loans…….. Let’s tell them how they could really protect themselves and let this market correct to where it should.

Hud is seeking public comments but where do we go to comment?

http://portal.hud.gov/portal/page/portal/HUD/press/press_releases_media_advisories/2010/HUDNo.10-150

@Partyboy

Just think if all the SS money had been invested in the market, as some we-intentioned pundits had suggested. By March 2009 there would have been literal blood in the streets. With a couple million families out on the street, there could be some serious civil unreset by 2012…Seems like the last depression got really bad the third and fourth year in, which might be like 1931-1932.

“Fear the time when the strikes stop while the great owners live – for every little beaten strike is proof that the step is being taken … fear the time when Manself will not suffer and die for a concept, for this one quality is the foundation of Manself, and this one quality is man, distinctive in the universe.”

The Grapes of Wrath

Chapter 14

Social security is a giant Ponzi scheme. If you are collecting now, you are getting a good deal. Chances are that you’ll take out much more than you ever paid into the scheme. The real losers are the kids who just started working today. It is almost guaranteed that they will see higher social security withholdings, a much higher retirement age and maybe even a “means” test. If you are considered rich by the governemnt, no social security payouts for you.

~

This fraudulent scheme started out with about 15 workers for every retiree. Fast forward to today and there are 2 workers for every retiree. With boomers retiring in huge numbers soon and modern medicine keeping zombies “alive” for years, it’s not hard to figure where this will all end up. Thanks a bunch FDR!

The only way to save this economy is to raise taxes on the rich. Of course, that will never happen, because the rich control the media, and they always manage to subvert the needs of the middle class and the poor to serve their ends. Am I advocating class warfare? Absolutely not; but every study shows that the gap between rich and middle class (not to mention poor) is widening every year. The middle class has been suffocated by trickle down economics, which never trickles down. The rich are always bailed out by the votes of the people they elect to office, with the help of the lobbyists to whom they pay big money to co-opt the elected officials. And so things get worse and worse every year for the average working man and woman.

The idea that “if we just get off the backs of corporations, and let them make all the money they can, free of regulation, then we all will benefit,” has been tried over and over again, and failed every time. It failed in 1929, and caused a decade of absolute misery for working people, while the rich generally did just fine. It surely failed in the decade of the 2000’s, as a bunch of infinitely greedy and corrupt lenders made housing loans to greedy and stupid buyers, which both knew could never be paid for–unless the housing bubble went on and on, which bubbles cannot do. So now we have 10% of our populace unemployed and suffering, and the vast majority of these were absolutely innocent victims of all the loan and packaged derivative scams. The middle class and the poor always end up suffering for the financial orgies of the wealthy.

The former President inherited a budget surplus, and immediately gave it away in tax cutting and tax breaks for the wealthy. Now the current President, in desperate efforts to stimulate the economy, has ballooned the deficit even further. The only way to avoid massive cuts in social services–in California and every state–is to bring in some money by at least temporarily raising taxes on the rich. The idea is that the marginal utility of an extra 5% in taxes (the rich used to actually pay 70% taxes, before their lobbyists and media friends led a campaign to vastly reduce that percentage) is felt less by the person making a million or ten million dollars a year, than by the person earning twenty thousand, to whom every dollar is precious, because it has to be spent on necessities. But the rich, in their infinite greed and contempt for everyone who is not rich, actually have been pushing for a flat tax, so that everyone pays, say, 10%. That would have two effects: bankrupting the country, and making sure that even more money stayed in the hands of the very rich, to….well, to just roll around in it, or buy a few more houses or paintings. Actually, we are all in this together; and if the disparity between rich and poor continues to grow, you are going to either have civil unrest, or “Soylent Green,” where the masses of people live in their cars and are doled out wafers to eat, while the few ultra-rich live in luxury.

I will just add that I do not like paying taxes, either; but I would rather pay reasonable taxes, and higher ones for my income group, and actually have some parks and some libraries for people; and have the roads fixed; and guarantee people that their Social Security and Medicare will stay intact; and have the ability to try to clean up the air and water. That benefits me, and all of us, more, than a few hundred or even a few thousand dollars (depending on the income level) in our pockets each year. I hope we realize this before it is too late.

I’m staying put! I’m 46, I live in a commercial/residential bldg. that my dad bought back in the early 1970s. I live in one of the apts. and my elderly mom ( she’s in assisted care) and I live off of the rental income….I’m so glad we didn’t sell when my dad passed away back in 1987.

God where do you even start with this one?

>

(1) “Capitalism at its core worksâ€

>

It does and it doesn’t. It does encourage individual initiative which is good and bad. Good because people are rewarded for their efforts, bad because it promotes greed, selfishness and avarice. It doesn’t create the kind of society in which most would want to live simply because the things valued by all (clean air, water, good highways, free schools to all, compassion and care for others – you know, the stuff that guy wandering around the Mid-East talked about some 2000 years ago….) are not the sort of goods and services which make anyone a lot of money. It does create vast numbers of impoverished people and a tiny number of wealthy -and that leads to things like the French and Russian Revolutions.

>

(2) The wealthy already are subjected to higher levels of taxation on income and the majority of tax revenue is generated by them

>

Ummm …..they pay more because the top 1% (incomes over $520,000)

>

(a) have 36.4% of all total net worth (bottom 80% have 15%)

>

(b) have 49.7% of all financial wealth which is stocks, bonds, business equity etc (bottom 80% only have 7%)

>

(c) have 38.3% of all stocks (bottom 80% only own 8.9%)

>

(d) have 21.3% of all personal income in the US (bottom 80% only have 38.6% of all income)

>

(e) and the top .01% (1/100th of 1%) have 6% of all wages in the US and the top 10% receive 49.7% of all wages and the bottom 90% have 53.3% of wage income.

>

(f) “Although overall income had grown by 27% since 1979, 33% of the gains went to the top 1%. Meanwhile, the bottom 60% were making less: about 95 cents for each dollar they made in 1979. The next 20% – those between the 60th and 80th rungs of the income ladder — made $1.02 for each dollar they earned in 1979…… {O}nly the top 5% made significant gains ($1.53 for each 1979 dollar). Most amazing of all, the top 0.1% — that’s one-tenth of one percent — had more combined pre-tax income than the poorest 120 million people (Johnston, 2006). …†As of 2007, income inequality in the United States was at an all-time high for the past 95 years, with the top 0.01% — that’s one-hundredth of one percent — receiving 6% of all U.S. wages, which is double what it was for that tiny slice in 2000; the top 10% received 49.7%, the highest since 1917 (Saez, 2009). And the rate of increase is even higher for the very richest of the rich: the top 400 income earners in the United States. According to an analysis by David Cay Johnston — recently retired from reporting on tax issues at the New York Times — the average income of the top 400 tripled during the Clinton Administration and doubled during the first seven years of the Bush Administration. So by 2007, the top 400 averaged $344.8 million per person, up 31% from an average of $263.3 million just one year earlier (Johnston, 2010).â€

>

So when compared to the typical household in the bottom 80%, the top 1% have 194 times the net worth; 568 times the financial wealth, 344 times the stocks; and 44 times the income.

>

Based upon the comparative resources when the top marginal rate in 35% and the single store clerk making $8 an hour pays 12.27% of his/her income in Federal income tax ($770+-) and payroll taxes, that 35% is not near high enough. The clerk is clearly in the bottom 20% of earners and is paying 12.27% in federal taxes. Since the top 1% have 44 times the income and 194 times the net financial worth, they should be paying far far more than 35% on those amounts over $375,000 (where the 35% kicks in.)

>

(3) “I think eventually you wind up at the point where this will have a negative spiral on productivity.â€

>

WHAT “productivity’? They are HOARDING the money honey! 70% of the Forbes 400 wealthiest are TRUST FUND babies who inherited their money. Yep the US’s very own version of ‘aristocracy’ – a class of inherited wealth and position. I can bloody well guarantee you that Jacqueline Mars (heiress to candy bar fortune) is NOT out creating new businesses and new products. She is hanging out in Virginia spending money on horses to make the US Olympic Team. (And she is one of the ones funding the fight on estate taxes.) I can guarantee you that the Walmart heirs have their own personal fortunes that they inherited from daddy tucked aside and they are not taking their money and expanding Walmart or creating new products or businesses.

>

And why on earth do the sycophants of the wealthy (who would make them use the servants’ entrance) persist in the delusion that money put into creating a new business will be taxed? If Mars/Walmart heirs take a $100,000,000 and sink it into a new business and buy buildings, equipment and hire employees, every penny – every single solitary penny – of the money put into the business is 100% deductible and IS NOT TAXED. Creating a new business is one of the best tax deductions going. By why should Mars/Walmart heirs bother? They will only pay a piddling 15% on their earnings from gambling on Wall St or other passive investments. Now tax that income at the 90% of Eisenhower and you will see them shoveling that money into creating new products and new businesses to avoid paying tax.

>>

And then there is the self-centered comment by One Bitter Guy with “Why should the rich pay more into the SS system if they’re drawing an equal amount of benefits out ?â€

>

How about because they made their money through the labor of others (or at least their daddy or grandaddy did who gave them a trust fund). Because those at the top of the pyramid want to pay the absolute least for goods and services and keep wages as low as possible. (And that is why the bulk of the economic gains of the past few years went to them.) Because they could have paid the higher wages (and thus more from the worker would have gone into SS) or they can pay later when the retired worker is faced with poverty. Because the top 1% are taking a disproportionate share of income in the US that is unprecedented for the past 95 years. So since they didn’t pay it in wages, they can kick it into SS so the retired workers won’t starve. It is called “maintaining political and social stability’ and ‘practicing compassion’ – that Judeo-Christian thing.

>

BTW, SS is NOT a savings account. Each generation pays into and the money goes to the current retirees. So if the upper 10% of all workers (about 5% of all households) have to kick in more, then that money goes to support their parents and grandparents. As to what the current upper 10% of all workers would get when they retire…..well, they will have to take it up with their kids whose payments into the system will go to them.

>

Bitterguy – Social Security Retirement payments ARE NOT EQUAL!! They range from around $650 a month to about $2300 a month and are based upon earnings during the worker’s lifetime.

>

And there never was a ‘trust fund’ until the 1970s when the decision was made to increase contributions beyond what was needed for current retirees in order to not have to really jack the tax rate for the Boomer bulge. It would have worked ‘but for Reagan’ who raided the extra SS money for his mad spending spree which is actually about 60% more or less of the current deficits.

>

____

wheresthebeef writes (again and again and again) that Social security is a giant Ponzi scheme. If you are collecting now, you are getting a good deal. Chances are that you’ll take out much more than you ever paid into the scheme. The real losers are the kids who just started working today. It is almost guaranteed that they will see higher social security withholdings, a much higher retirement age and maybe even a “means†test. If you are considered rich by the governemnt, no social security payouts for you…… forward to today and there are 2 workers for every retiree.

>__

>

Oh hogwash. The US has NEVER had a birth rate that has fallen below replacement level. Want more workers paying in who are younger than you? Go breed more.

>

And at least try to get your facts correct before hitting a keyboard. There are 45,000,000 who receive Social Sec. retirement or disability or survivor’s benefits (kids under 18 whose parent died) There are 73,800,000 under 18. That means there are 182,200,000 working age adults. That is at least a 4::1 ratio.

>

If you don’t want to pay more into SS, then have a really good time being the primary support for your parents, grandparents, aunts, uncles, older cousins……Yep, that is exactly how it worked before SS. The younger family members supported the older. All SS does is spread the burden across all younger workers rather than 1 having to provide for 5 older relatives while another doesn’t have any older relatives.

~

Alan Zibel, AP Real Estate Writer, On Tuesday July 20, 2010, 5:38 pm EDT

WASHINGTON (AP) — The Obama administration’s effort to help those at risk of losing their homes is failing to aid many and could spur a rise in foreclosures that would further depress the housing industry.

# # #

Gotta love unintended consequences.

Everyone is talking about a gentle correction to mean housing prices relative to the standard metrics (income, rental income, employment, etc.).

What nobody is forecasting is a correction through the mean.

That will come about due to ruined psychology, which only happens during long, drawn-out corrections.

Social security has been around 80 years. I think they will try to make it work-it was supposed to be toast in the Reagan years too.

580 credit score for their top loan. The FHA needs to get out of the mortgage business. Banks are giving loans wiht the govt as guarnatee. This is just dumb. I think I read somewhere that 95% of today’s loans originate fromt he govt?

I thought we are heading to a Japan like situation. but our two political parties are so dumb-we migth head for much worse. maybe the dollar will crash so much that we will be competetive with China and India again???

The bets thing is try to get the SS now and if not just rip off the investment firms……No, but I would really love to get the SS now rather than waiting tell later….

Everyone reading this, I have a suggestion, lets all do small business…and save money on the side….we still have hope people, don’t give up 🙂

Not trying to get too off-topic here, but most estimates are that there have been close to 40,000,000 abortions performed in the United States since Roe v. Wade. Assuming that 75% of those aborted would be of working-age today, the SS problem would be non-existent. We’d have plenty of workers to pay for all the baby-boomers…the most selfish, ruinous generation in U.S. history. And, while I’m not a bookmaker, I’m sure Vegas would give pretty good odds that a lot of our economic problems we are currently experiencing would have been solved due to an invention from one of those aborted…assuming that the odds of such an invention, innovation, technological discovery, etc. were less than 30,000,000 to 1. But hey, at least women have gotten to make their “choice” for the last 38 years, right?

At this point – to hell with SS. Get rid of it. Just apply the payroll taxes to retirement on your own. No crazy investments, just a savings account. You’d be better off. Of course this will never happen.

Heard that for FHA a non strategic default in a full recourse state, they want 88 percent of the mortgage paid back or else no short sale. If it’s strategic, the borrower can go pound sand or try bankruptcy. They bought a couple of years ago, and the husband has gotten a new job out of state out of necessity

I get a kick out of those who constantly complain that people get far more out of social security than they put in yet also complain when people should put in as much as they take out.

What I mean by that is the cap should remain at aprox 100K and then pick up again at 300k. Those with the ability to pay for what they take out ought to, and then some.

The rich SHOULD pay more than everyone else. It is pretty simple, they have benefited the most from this society, and ARE reaping the rewards of this society and should therefore pay more due to their rewards. Yes their rewards are due to their hard work but it wouldn’t have been possible without the society we have given them to toil in.

I cannot understand how anyone can expect the average Joe to keep working til they are 70 so that some guy making a mint can save even more money so that he can die even richer!! Yet, a particular party has gotten those working their fingers to the bone for 20K a year to defend this practice!

@slim

“why not ask rich people to pay more for food, cars, and everything else?”

Uh, rich people do pay less for cars. They get 0.1% loans, because they are rich and do not need credit. Poor people pay 10% for the same vehicle, thus raising the total price greater than what a rich person pays.

See how easy it is to “repudiate” Republican talking points designed to let the Rich act as “parasites”, “freeloaders” and “moochers” upon our society of mostly working class people?

We now have a system in which the wealthy hire the clever to use the foolish to exploit the good.

Thank you William for confirming to me that I’m not a freak for wanting to help out my fellow man. Everyone’s so wrapped up in their own mean spirited selfishness that it takes a brave person to stand up and say “I have enough to be able to share and a rising tide float all boats”. Kudos dude 🙂

Sheesh, that’s what I love about this country – that good old “Get Off My Lawn!” attitude…

I’m with William on this – we make enough that we can afford a modest tax increase, if it mans that libraries, state parks and teachers stay open and keep thier jobs.

Call me a Bleeding Heart Liberal if you want to. I’ve never considered Liberal as a perjorative term.

@ William

I’ve never heard a “conservative” explain what you brought up: that a continuing widdening of the gap between the rich and everyone else is good for a society.

The rich don’t bother with loans……ever.

DIL is whatever the lender will accept. But why move when you can stay in the house for free until they evict you? Most people are savvy enought to figure out that the lender cant really foreclose without going BK.

As for SS….When the brunt of the baby boomer start to collect, it’ll have to be “adjusted”. The math isnt there to pay them all.

I think the lower tax rate on capital gains (and qualified dividends) than earned income contributed to the run away increase in income inequality. Small (although a 10-20% savings in taxes isn’t that small) advantages like that were leveraged to become big ones were leveraged to become huge ones and buy off the politicians and rig the system to transfer ever more money to the rich. So the rich buy off the politicians, who use their power to transfer more to the rich, who have even more money now to buy off the politicians, who due to the influx of ever more money into campaigns have even more incentive to vote in favor of their rich donors etc..

–

And the transfer of our tax dollars to the rich isn’t even hidden anymore …. the bankrupt banks manage to make profits month after month, thanks to our subsidies. The Fed could also be argued to be part of this run away wealth concentration but that is a topic for another day.

@cambridge – plenty of republicans, democrats, and high income earners from both parties are getting it handed to them right now and it won’t change any time soon. As far as financing costs I’ve seen plenty of low income folks with excellent credit and plenty of high income folks with lousy credit. There is no doubt correlation but if one lives within one’s means and one meets their obligations consistently – their credit reflects this, none of the scoring systems include an income component for rich/poor, it’s just track record. When purchasing something income/price ratio is checked for reasonableness. Living beyond one’s means seems to be a problem for American government and citizens across the board. Of course the reality for the very poor is that they are going to struggle particularly on any kind of major capital purchase (many don’t make enough to afford new cars or houses hence their being poor – shocker for subprime securitization fools) but its not as if the opportunity for success was never made available to them and some safety net isn’t present. There will always be people who have less and more. It’s not a big deal, if material wealth provided happiness this would be the happiest culture to ever exist – something tells me it’s not. Mainly that’s people not appreciating what they have and always wanting more. Or in some cases feeling entitled to more. This is the essence of the housing bubble, just another expression of that fatal flaw so many have – this time done with a huge capital asset heavily leveraged with debt (very expensive gamble to lose and the major reason I don’t own a home). Some things just don’t work out in life and some things aren’t fair. It’s never been otherwise and I don’t expect it to ever become so. Be happy, appreciate life, it’s all anyone really has regardless of the trappings they surround themselves with.

As a young attorney with excellent credit, I was also able to receive 100% financing for my home. Like you, I resisted the tempatation to overextend. Now, my mortgage is only around 17% of my monthly salary and I have about 25% equity (my region of the country was not hit by the bubble). I concur with your opinion that 100% financing is a great option for some. However, I do know many who got suckered into the trap and acquired great sums of debt based upon easy credit.

@wheresthebeef

Amazing that even from a wheelchair FDR could kick the can down the road with the best of them….Just like Reagan, FDR was championed for saving the world when all they did was prove that Manhattan could ultimately destroy the entire free world…Maybe that is why they called it the ‘Manhattan Project’–the ultimate weapon of mass destruction.

Still everyone is just waiting for a chance to jump onto the SoCal-housing ferris wheel. They already enjoy spending 20% of their waking hours driving back and forth to work. Just because millions do it doesn’t mean it’s not insane.

@William. Awesome, I agree completely, so many of the rich have “generations” of wealth. How much wealth does a person need? You can’t take it with you when you go.. They’re greedy, simple as that. At least people like Warren Buffet are thinking about their legacies in ways that will contribute to the human condition, once they pass on.

I completely agree, anyone who has the audacity to strive to be successful needs to be punished.

It is funny phenomenon that the “working class” want to tax the rich even more “to equal the playing field”, but then when these very same people get money in their hands, they don’t want to “share the wealth” – by way of taxation.

Alas, it easier to be unsuccessful then it is to be successful. It’s pretty easy to become homeless but pretty difficult to become a CEO.

Ideally we would tax everyone at the same rate, but that just doesn’t work in our current society. The wealthier class is usually the class in power, making the laws that make the playing field unbalanced in their favor. The fact is the rich get richer because they control the government. It’s not a conspiracy thing, it’s just the way the world works. So those people with the power need to contribute more to the health of our society, and that means contributing a bigger share of their gains. Call it an opportunity tax if you will, meaning that those who’ve gotten wealthy only because they were presented with an opportunity that you or I have never and will never get, pay a tax on that opportunity.

“Social Security Administration actuaries project that immediately increasing the payroll tax by 1.7 percentage points (for employers and employees combined) would keep the system in balance for 75 years (Board of Trustees 2008).” This is a small amount to take this issue off the table so we can get back to talking about the California real estate market.

I hear that buyers are waiting for prices to go down more. I also hear that banks will be unloading their inventory which will drive prices down.

> Why should the rich pay more into the SS system if they’re drawing an equal

> amount of benefits out ?

Social security benefits are figured out based on how much you made when you paid payroll taxes. The rich do get more back, up to a point. If we tax them even more, then their taxable earnings go up and they’d get even more back.

Now nobody is saying that this is the ideal investment vehicle for the wealthy. They can find much better ones. However, few others come with the full faith and trust of the AARP lobbying wing to back them up.

> As a young attorney with excellent credit, I was also able to receive 100% financing…

Yeah, but over the lifetime of the mortgage, you are still going to end up paying 1.5 (15 year) or 2.5 (30 year) times the principal. I couldn’t afford the house I bought last month if I had to borrow the money to buy it.

Well, whatdoyathink, now that women have had that choice and won’t go back, society will just have to look elsewhere for solutions. Boomers have been pretty productive, especially in the area of science and technology, wouldn’t you agree? So I guess we’ll just have to turn to modern science to clone massive numbers of young workers to support all of those selfish boomers in their waning years! How else to save the economy? Oh, but what about Freakonomics’ argument about how abortion rights ultimately and dramatically lowered crime rates?

Great chart from Yahoo at the bottom of this latest report…

http://finance.yahoo.com/real-estate/article/110131/housing-market-stumbles

Many people have nothing other than Social Security because the government has allowed big business to pay peanuts….many people just run the hamster wheel paying BILLS and unable to save. The rich keep getting richer and the middle class gets screwed. Big business loves illegal immigration to drive down labor prices for the common serfs, while executive pay rises 700% in the last 10 years.

America is sucking hind wind now, and many other countries actually have MORE freedoms on daily basis to live than the U.S. America is still the best country in the world, but it is ONLY because of the Constitution, and they are tearing that down with the CONSENT of the american idiot who keeps voting republican OR democrat. Yes, that’s correct, I just blamed YOU.

Um gee, I dunno, maybe because they can AFFORD too? Why should a person making $10,000 a year have to pay the same percentage of someone making $100 million a year? 10% of 10k = 1,000….9,000 per year to live on. 10% of 100 million = 10 million…..90 million a year to live on.

When is enough enough? Capitalism victimizes the small, and is weighted to make the rich….incredibly richer. There has to be wealth transfer, normally this is done through work, and being paid a salary where you can actually not just survive, but prosper, but we all know that paying people like that is SOCIALISM, and we don’t want socialism, we want 20% of the population to control 70% of the money.

Leave a Reply