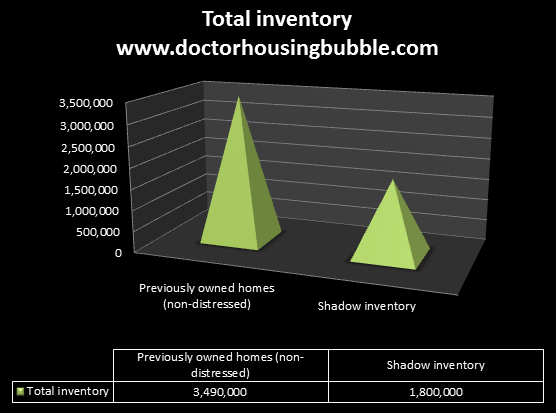

The never ending pipeline of shadow inventory – 1,800,000 homes in foreclosure while another 2,000,000 are underwater by 50 percent. No housing recovery without clearing out shadow inventory and expanding real household wages.

There will be no recovery until the shadow inventory is cleared out. This backlog of properties hangs over any sustainable housing recovery like a dark cloud overhead. Many of these properties are still priced at values too high simply to inflate bank balance sheets. The problem is apparent although not transparent. If these homes could fetch breakeven prices in the market they would have already been sold by banks. However with the prospect of a decade of stagnant home prices moving forward because of stunted wage growth many banks are starting to leak out some of this inventory onto the market. They were able to stomach 2 to 3 years of non-payments but 4 or 5 years? Bank of America plans to unload a sizeable amount of shadow inventory through a three year process. So where do things stand today? Is the shadow inventory really decreasing at a sizeable rate? Let us take a look at the current figures.

Shadow inventory still too high and will drag prices lower

Source:Â CoreLogic

According to recent information 3,490,000 homes are listed for sale that are non-distressed previously owned homes. This is part of the “healthy†market if we can even label it that way. Yet as you can see from the chart above, we have another 1,800,000 properties that are in some stage of foreclosure or have the stigma of being 90 days behind on payments. What is more disturbing is that this doesn’t capture the entire potential future pipeline of problem properties:

“(LA Times) The CoreLogic statistics don’t include nearly 2 million homes that are more than 50% “underwater,” those worth less than half of the mortgage balance. These homes will probably fall into foreclosure in the near future, CoreLogic and other experts say.â€

In other words we have more homes in foreclosure or that are 50 percent underwater than we have of actual previously owned homes (non-distressed) that are looking to be sold. This is the core of the issue and it has been this way since the beginning. If you can pull your memory back to 2007 and 2008 much of the bailout talk revolved around putting mechanisms up for clearing out the shadow inventory. Whatever happened to that? The financial industry used a Trojan horse ploy to funnel money into their system while still keeping these properties on their portfolio.  Why?  Consider it double dipping. First with bailout money in hand, they found other speculative methods to make money. This is clear by their profits and where they made their money. Yet they also believed that home prices would rise shortly so when prices did move up, they would be able to unload properties at a profit and make money yet again. How can you lose with this kind of system?

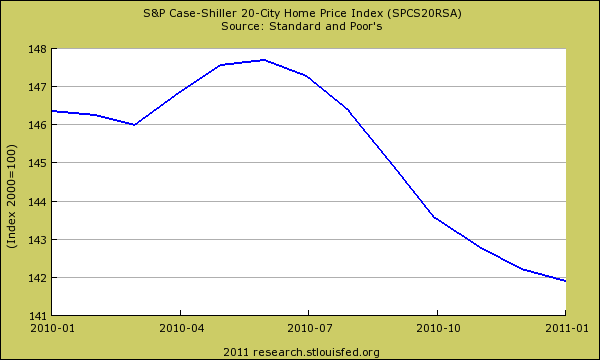

However home prices continue to move lower and the shadow inventory is still extremely high. After a brief bounce in home prices in 2010 thanks to gimmicks and tax credits home prices are now moving lower again:

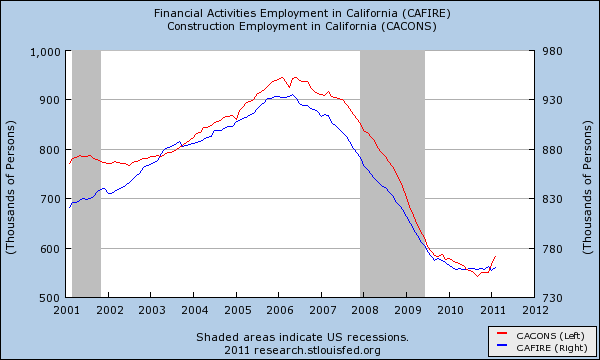

The only way home prices can stabilize and move up is if family wages move up in tandem. This just doesn’t seem to be happening, at least in the short term. It has been one decade of negative wage growth for American families so ultimately this I believe will be the key in either maintaining home prices or allowing for further declines. States that had the biggest housing bubbles face even deeper challenges because a large part of their economic success was tied intricately into the housing market. Take a look at employment sectors in California tied to housing either directly or indirectly:

The employment sectors of finance, insurance, and real estate (FIRE) are still way below their peak. It is unlikely that we will be seeing the peak number reached anytime soon. Construction is seeing a tiny perking up but this is a blip in the above chart. What this means is that high paying jobs in these fields are still gone. Where have these workers gone? If recent hiring trends are any indication they have gone into lower paying service sector jobs. Certainly not any career that supports $500,000 home prices. The shadow inventory is keeping prices lower and moving prices lower in many markets. So even the cut of the pie has shrunk relative to the income you can derive from an inflated asset. Bottom line is we have a structural change on hand. The nationwide housing market is being turned on its head. Not only is the perception of home ownership being directly questioned we have demographic shifts that will play into the headwinds of the shadow inventory coming online. Many baby boomers who were able to support a household with one income are selling to younger professionals needing two working professionals to support a household. Many are delaying starting a family or even thinking about having one at all. In the end, the consumer has changed and this is happening when inventory is massive and will only increase.

Think for a second what “shadow inventory†is composed of and what it signifies about the housing market. It means 1,800,000 homes are currently in foreclosure or are bank owned but do not show up in the regular non-distressed inventory. Another 2,000,000 homes are underwater by at least 50 percent. These are likely to end up as foreclosures since the number one predicting factor for future housing issues is being underwater (otherwise you would simply sell into the market and move on). I would put these 2 million homes into the category of the 1.8 million homes and these two items combined are larger than the “healthy†market. And don’t think the pipeline has stopped growing. Each month we add more people into this and there has been little movement here to purge the inventory. This is probably the more troubling factor. The inventory is slowly dissipating but at this rate we are looking at 3 to 7 years before the market is “normal†depending on the rate and that assumes no more homes fall into the pipeline which is unrealistic.

Ultimately what we are left with is a horrible housing market. This also means an entirely new generation of Americans will be absolutely reluctant to buy a home or at the very least, do more significant due diligence. The fact that we are leaking the inventory out slowly and the system is designed to help banks preserve their balance sheets guarantees us problems down the road. The financial industry is largely a drag on the economy right now and will continue to operate that way. Until we truly clean out the shadow inventory to a manageable level there will be no recovery in the housing market. Until solid wage growth occurs, there will be no push for home values to go up. This is the end scenario of the experiment orchestrated by Wall Street investment banks. Gear up because the bill is now coming due and it certainly isn’t Wall Street investment banks that will be paying the bill.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “The never ending pipeline of shadow inventory – 1,800,000 homes in foreclosure while another 2,000,000 are underwater by 50 percent. No housing recovery without clearing out shadow inventory and expanding real household wages.”

There seems to be a confrontation brewing in San Diego over CA foreclosure law between the Court of Appeal and the Bankruptcy court. It focuses on MERS’ authority to assign trust deeds and appoint trustees. The resolution will likely require legislative action; I expect the Legislature will bow to the banks and “sanitize” MERS’ frauds.

Here’s part of the mess I don’t get, so your comments are appreciated. What’s the deal with all the PMI insurance that was required by 85% of all loans issued in the past 6-9 years? When the property went into foreclosure apparently the banksters didn’t file a claim for the insurance because it would allegedly put these “insurers” out of business. If they didn’t pay off, I want my premiums back!

You are right on. The investment bankers(e.g. Goldman Sachs and their relatives) will not pay for their own mistakes because they buy the politicians. Our taxes are going up and the dollar is going down(those BMW’s will cost more). As PIMCO(the rats who billed on Treasury bonds) says the “new normal” will involve a lower standard of living. Get use to eating rice like a coolie because your wages will be competing with theirs.

What will happen next will be the “rich” foreigners cherry picking the nice homes in desirable good schools areas with cash or almost all cash. Much like you see in London or parts of Mexico City where the quality areas are bought up by wealthy foreigners like the Indians, Asians, Middle Easterners, etc. The locals will end up with crap in the end. Just remember, in the very near future, the worthless dollars you are saving won’t buy much from now on. If a loaf of bread is $10 or a gallon of gas is $6 or a Honda Civic cost $100K, what kind of a house will the dollar buy?

It’s a proven fact that when foreigners buy US assets, it’s a top. Works every time. Ask the Japanese in the late 80’s, as one of many examples.

LOL… too true, or at least a local-top, i.e. another tooth on the sawtooth down-wave. Saw it this past tourist season here in So-Fla, where Canadians, esp. “Quebecois” (don’t get me started), with their strong-by-default CADollars, were paying too much (e.g. 2003 prices) for “good deals” that will be underwater by Memorial Day… or, if they used a Realtard, then it was underwater the moment they closed… D’OH!

Anyway, more power to them. I’ll be picking up their “good deals” and “never again opportunities” at an even lower price in 12-18 months.

The German and Scandinavian money is still shaking its head and saying, “ja, ziss izz still ze falling daggers kind ov mah-ket, vee vait a bit…”

Everything you say is right on, the state of california is ready to explode, this has been coming for years. as the dollar continues to collaspe the masses will riot and pillage.

When the buck hits 50 now at 74,we will see a world crash that cant be saved with more debt. take a look at the NIA website, real inflation is here gas, food, clothing . but the goverment says no problem. People are thinking budget cuts will save us there is no way

that even the most severe cuts would stop this. only default can happen sooner or later.

Many have figured this out and are feverently getting out of the dollar.

As it is now and will continue the goverment housing will be the only thing most will be able to afford. Many will end up in the streets. parks will be packed as these peoples new homes.

Sometimes I wonder if we get caught up in a bit of a pessimistic cycle reading this kind of stuff and then feeding it back in comments. The history of America is littered with bubbles that the wealthy used to defraud America, a land that already does not abide by normal economic constraints due to the hugely disproportionate resources over time we have, out of even more wealth as their greedy, beady little eyes cannot stand just being ok with everyone having an equally fair chance at comfort and freedom.

Is this just another bubble that we are moving from into the next bubble that might finally be the tipping point? That is how it feels to me.

I haven’t quite figured out where the scammers on “Wall Street” are moving next, or are they exhausted and just fine sucking America’s blood until we pass the point of un-sustainability and slip into a mortal death spiral? They are working on the next scam; it’s just figuring out which. I have a dreadful suspicion it is a suicidal bond scheme to suck the blood while it’s flowing, just to profit on America’s death and demise.

The wealthy don’t care about your simple-minded country names and borders. They play on the global field and there are more that don’t have nationalistic ties to any particular target country than those who do. Dread we lose psychological control over the significance of our stalwart position. It is all over in a matter of seconds if the sharks smell blood.

I think the point about family incomes needing to grow is very important. Especially because the costs are going up for things that most middle class families would consider important: Healthcare, college tuition for the kids, food, energy, etc.

But this brings up an important point: What are peoples’ incomes actually doing? I’ve been thinking about that since we just went through tax season. How much of peoples’ incomes are even known, and how much is hidden/cash/gray economy? The article refers to a median household income of about $50,000. But is that really what it is, or is that just the visible part?

Henry

Your point, though well made, is largely irrelevant, because… YOU CAN ONLY GET A MORTGAGE BASED ON THE “VISIBLE” (legit) INCOME, right? And if you’re an all-cash buyer, you’d better believe Duh IRS is tracking those huge wire transfers… but hey, given all the scum in the FIRE biz, there MIGHT be someone who will literally let you buy with a steamer trunk full of used greenbacks, and for extra “points” at closing, generate a convincing paper trail, post facto… ;’)

Henry, this is from Calculated Risk:

I’ve been more upbeat lately, but even as the economy recovers – and I think the recovery will continue – we need to remember a few facts.

There are currently 130.738 million payroll jobs in the U.S. (as of March 2011). There were 130.781 million payroll jobs in January 2000. So that is over eleven years with no increase in total payroll jobs.

And the median household income in constant dollars was $49,777 in 2009. That is barely above the $49,309 in 1997, and below the $51,100 in 1998. (Census data here in Excel).

Just a reminder that many Americans have been struggling for a decade or more. The aughts were a lost decade for most Americans.

And I’d like to think every U.S. policymaker wakes up every morning and reminds themselves of the following:

There are currently 7.25 million fewer payroll jobs than before the recession started in 2007, with 13.5 million Americans currently unemployed. Another 8.4 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6.1 million have been unemployed for six months or more.

So even as we start to discuss how to fix the structural budget deficit, and also to address the long term fiscal challenges from healthcare costs, we can’t forget about all of these Americans.

You are so right when you say it isn’t Wall street that is going to pay the bill. The way things are going, it looks like the great depression is just going to start.

California was one of the few states that lost jobs in the last month. 11000. Jerry isn’t gonna get a tax hike, so he’s gonna have to cut services: more job loss, less money in the mix. We haven’t seen anything yet because he government and banks have managed to kick the can. Well pretty soon that cans gonna come up to a brick wall.

I live in a central California small town on the coast. They built a small housing community here in 2004, 2005. Almost ALL of the homes sold for $700-$950K! Un-friking believable. Now many of the poor suckers are losing (or have already lost) their homes there.

They have a very slick stategy in that community of not letting the prices come totally crashing down. Some vacant homes are for sale, but MANY others sit empty, with no for sale sign on the lawn! I don’t know if its the banks or the homeowner’s association, but it’s an organized scheme to prevent the home prices from collapsing. I’m sure it is – I drive through the community and see all the empty homes and just say “wow.” If they put ’em all up for sale, the prices would collapse and EVERYONE would jump overboard (because they all overpaid). But they just trickle them onto the market – a few at a time, creating the illusion of scarcity (“only a few are for sale,” “prices aren’t collapsing”). What a complete ****ing joke. And this is the real sad part – the poor fools who buy now (in a community like this) and don’t realize they are buying an overpriced asset which is imploding / falling like a rock.

Can I add a few expletives pointed at the financial industry that orchestrated the sub-prime MBS fiasco and the banks holding the aforementioned shadow industry.

The Fed can just print more money. If wages ever do increase along with employment, the basket of goods those “real wages” will buy will demonstrate an actual decrease in buying power.

It is unbelievably infuriating.

Are you talking about Cambria? Where I lived for ten years in the 90’s. There was a development being built at that time between Cambria and San Simeon.

No, I’m talking about Seaside, near Monterey. Seaside is basically a schitt hole. It’s on the border of the former Fort Ord (now closed thanks to Billy Bob). Seaside has many old, small homes (2 bedroom, 1 bath) that really should be demolished now. It’s starting to get overrun by illegal immigrants, and the crime rate has increased. But – it’s a nice area and is on the Monterey Bay. In about 2004, they built a small new development in Seaside. Prices have crashed since then. Sad situation!

Ha. I live nearby! I used Redfin to track listings and foreclosures and I found something very curious about the Monterey Peninsula area. The ‘less desirable’ parts like Seaside and Marina actually have foreclosed homes or REOs on MLS from time to time. Not a lot, but yes, they exist. On the other hand, I RARELY see any foreclosed or bank owned listings in areas like Pacific Grove or Carmel. It’s strange because those areas are at at least 3-4 times more expensive than Seaside or Marina, but yet, no foreclosures? I agree that they (whoever that might be) do strategically release (or not at all) houses to the market to keep the price high.

Incomes don’t need to rise. Western nations bubble prices (of just about everything) need to fall. I suspect that the people who yammer on about $10 loaves of bread are the heavily indebted ones that need inflation to bail them out.

Just remember folks…The option-ARMs are just beginning to reCAST and won’t be done until 2013.

I agree with you on all the people whining about hyperinflation. But what’s this about prices? In terms of gold commodity prices have never been cheaper.

The fat lady really starts to sing when the various bloated governments need to trim headcount in earnest. Today will look like the good old days in residential housing.

I doubt there will ever be significant govt layoffs. It’s always the same, lots of pink slips, hysteria ensues, lots of press about teachers and firefighters losing jobs, local media shows extensive footage of crying kids holding signs; a few months later its quietly announced maybe a few jobs were lost, if any; mostly involving “open” positions eliminated that had never had been filled. No job loss. Unions won’t allow it.

If Brown’s tax increases don’t materialize, he’s got lots of cards up his sleeve. Lots of special, new taxes. People and businesses will surely pay because they’ll never leave California; weather, Disneyland, surf and Hollywood are irresistible. Weeee!

Dead-on analysis, Dr. !!

The housing market has a tremendous over-hang of home mortgages that will NOT be paid-off. How and when these eventually cycle into the market will determine how the prices move. But the lenders holding these mortgages cannot survive if they had to actually process them. So the housing market in the US is going to have a long and slow grind to the down side.

As Dr. HB has been preaching, income is the main point. Check out this home thats been chasing the market down; 1 year, $200k in reductions and still no buyers:

http://sanfernandovalleyblog.blogspot.com/2011/04/is-housing-making-comeback-in.html

Nice article. We were looking at homes in Chatsworth in 2008-2009. Although we liked several homes, and all that horse property is great, one couldn’t get rid of the realization that even though the San Fernando valley is the home to the ‘porn industry’, Chatsworth is the “epicenter “. And that is the overriding reputation of that town. I don’t know if that impacts the overall prices there, but I wouldn’t be surprised.

I am fascinated by the reporting of the CPI. The media routinely quote the number that does not include the “volatile” oil prices. This is interesting because oil price underpins just about everything. Take any product you like. If you break out the cost of fuel in the production and delivery of that item to the point of sale, you will see that fuel is a large percentage. Nothing moves without fuel.

Yet the media focusses on the lower of the two numbers routinely. It gives the impression of a lower inflation rate. Curious. This is much like using the term quantitative easing. What a lovely term. It sounds so comforting. Why does our media not use the proper term, “printing money”.

If oil price underpins everything, then everything will go up in price as the price of oil rises. These rises will be reflected in the CPI.

It’s not that simple. You’re thinking of the 1970’s, and people who fight the last war generally get slaughtered.

The central theme is this economic screwup is Credit (and correspondingly, Debt). For example, without Credit, oil doesn’t get pumped, or shipped, and refineries defer maintenance and/or slow down.

Oil can rise, but then that dampens the economy. The economy will spiral downwards, and as it does so, the price of oil goes down. Throw in the effects of a deflating amount of Credit, and that adds more downward pressure to Oil. Throw in the fact that even the IEA now acknowledges that we’re at Peak Oil, and you have an upwards limit to the economy.

The economy is basically going to be on a saw-shaped pattern to a generally low energy state, with oil prices and GDP both rising and falling. And as far as house prices go, this is largely driven by credit availability. No credit and the prices go down. Condos are a superb example of this today.

But as for today, Credit is still collapsing, even though the price for essentials is going upwards. This is to be expected, as the money which is out there chases the goods that people need.

I think you are confusing inflation with something else. If you believe that the price of going up causes inflation, then you must also believe that the price of oil dropping causes deflation, as it did from $140 to $40 a couple of years ago.

“Curious. This is much like using the term quantitative easing. What a lovely term. It sounds so comforting. Why does our media not use the proper term, “printing moneyâ€?

It’s called Newspeak, aka mind control… see Orwell… 1984.

Anyway, I’m sure the PTBs know what they’re doing, and have only your best interests in mind… ;’)

And nowhere is fossil energy more important than in the production, processing, packaging, and DISTRIBUTION of agrobiz/Big Pharma food.

The other thing that the CPI ignores.

glisten, it’s like the GDP. You just ignore what you don’t want to measure in favor of whatever is going the direction you want. It’s like Orwellian crimethink: remove the language with which people can think wrong things, and wrong thinking will go away, QED!

Don’t think for a second that this is accidental. Inflation is DRAMATICALLY underreported, as are many other adverse effects of government action that benefit a powerful few. Reminds me of the media reports on the “new paradigm” in housing prices in 2004-2005…

EconE…..

Look around……..The nicer areas like San Marino, San Francisco, Beverly Hills are full of foreign-borns. Option ARMS are another issue. Yes, there will be numerous resets, but the desirable properties are scooped up fast by cash buyers. Take a look at Vancouver, Canada. Most locals have been locked out from buying there forever years ago by Chinese cash buyers. If you don’t travel around, it will be hard to understand what is going on. It’s hard to accept and sad, but stronger foreign currency will eventually crush

American purchasing power. But, if interest rates go up a few points, that would be a different story and probably won’t happen. Wall Street and the Federal Reserve are destroying America.

Where did I say I don’t travel around?

I’ve spent plenty of time laughing with a fomer mortgage broker who tells me about all the “rich foreigners” sitting on multi-million dollar option-ARMS that will explode in the next couple years.

Foreigners fed at the debt trough more than good ‘ol Amerikans!

It’s all about FACE. Especially with the Asians.

It is what it is.

True. They tend to believe in “lucky” and takes greater risks:

http://www.nwasianweekly.com/2009/09/homeownership-fell-in-%E2%80%9908-%E2%80%94-asians-get-hit-the-worst

~Misstrial

“stronger foreign currency will eventually crush American purchasing power. But, if interest rates go up a few points, that would be a different story and probably won’t happen. Wall Street and the Federal Reserve are destroying America.”

+1

Indeed, but it is easier to rally about the spending policies of this administration as the root of all economic turmoil and cry for smaller government and less taxation.

For over a decade, low taxes combined with heavy borrowing for foreign wars and the recent subsidization the broken and corrupt financial system has also created economic ruin and resulted in a weakened greenback.

FX will be an ongoing weakness if the fed doesn’t raise rates.

However, I will not be buying into affluent areas like coastal OC, San Marino, Vancouver, etc. and will hold on to my down until the Average Salary is able to afford a middle class/middle income home in southern CA – in other words – it will be a while…

Maybe I’ll never have a mortgage so a bank can’t own my home with the next system wide downturn caused by a natural disaster, political instability, or homegrown corruption and lack of regulation.

The FED *&* Banks need to refi ALL loans that are paying to 3% without credit or employment requirements

If, loans that are now paying will decrease payment——- with

difference of say between current $2000 a month -new payment 1500 a month and

give consumers money to consume —Thus adding employees to keep-up new consumption .

Screw that. It’s another variation of bailing out the crooks instead of the people who are financially responsible.

Here’s a radical thought. How about we let the market place work as intended, instead of trying to live in the modern equivalent of the Soviet Union?

If the homeowners are paying their mortgages, they probably didn’t get a liar loan or an ARM that ended up putting them at 60% DTI, so they don’t need to refi what they agreed to and can afford like any reasonable lendee.

If someone is making a payment after an ARM reset on a stated income loan – that person is a 1/1(add zeros to your liking) outlier and should be given the home outright and a medal from the mortgage bankers association at their next annual meeting for supporting a whole AAA rated tranche of subprime MBS.

Bring on inflation and $200 barrel oil. That ought to send a massive shock into the economy and tank housing. No I don’t really want that, nor do I want to increase unemployment and suffering. I just want the FIRE industry to take long needed dump/correction (that our tax dollars have worked so hard to prevent) and the shadow inventories to be dumped by the banks.

If free marketers can’t take the heat they should quite worrying about the “too big to fail” FIRE. The government fiscal policy should be geared towards long term employment – if not the CCC or the WPA then an entity tuned towards the next decades growth.

Why= 80s = Eliminated the S&L competition

Subprime has already eliminated 75% of Loan Brokers

Vs 70s when we had 30,000+ Lending Institutions’

Next GS *&* the other top 5 Banks will absorb Fanny & Freddie = who in the 80s

thru 90s & Early 2000s were returning double digits returns and will again only

No private investors and 3- 6 Banks Control all Real Estate Loans and eventually

the entire Industry.

Book Mark this and read at 1yr.,-2yrs.,-3yrs., and it will unfold and blow Your Mind

This was “NO” Accident.

SFValleyblog,

Not surprising. The Valley has been on a downhill spin ever since General Motors left in 1992, along with all the peripheral supporting businesses in the area. All that’s left there are welfare folk and credit card consumers dreaming about how the Valley used to be and driving around south of Ventura Bl. for entertainment. The area will never come back unless some positive, productive manufacturing business moves in. Maybe a Monorail construction business?

Put yourself in the shoes of a wealthy foreigner. As an investment option, US real estate has some properties shared with gold. It might not earn interest or generate positive cash flow but it does hedge other risks (such as political) and offers something of a personal insurance policy for the owner.

Just read were Santa Clara County (aka Silicon Valley) had 14,000 homes in foreclosure or deliquency. Yet prices took an uptick.

So what will the demand for housing be in the State? The last Census had the state grow at about the national average but I suspect that the demographics showed that middle and upper middle income earners left and were replaced with low income, low education immigrants, over half of whom drew some sort of government assistance.

The number of people may have increased but the income generation of those inhabitants fell. Household size probably also increased meaning more people per roof.

The thing that I’m trying to grapple with, DHB has made good inroads on here. He returns time and again to the issue of shadow inventory as a total component of the market, and what it means when this inventory is not worth what the banksters say it is.

I am trying to think about that at one step more meta–how many other banking schemes and scams have been built on this actually nonexistent value?

The whole point of “collateralization” of mortgages was to take the actual value of something and inflate it to generate financial service industry profits. So, for instance, people were encouraged to stay in the first 1-3 years of a mortgage for ten, fifteen or more years at a time though toxic mortgage products. (Just as Greenspan directed in, what, 1999? 2000?)

Every time a debtor re-originates a mortgage, the terms reset to the front end, where most of the interest is piled. Look at the delta of total interest repayment on a mortgage, and you can quickly see why it’s in the banksters’ interest to keep people there.

But now that people can’t remortgage, or don’t have the incomes to support the radical new (i.e., conservative old) affordability ratios, the banksters are kinda stuck. They’ve built a whole lot of castles in the air on this creamy interest bling…which is not materializing.

This goes back to what DHB said about them letting people live in a house without paying for 2, even 3 years. But then when it stretches to 4 or 5 or more. It’s as CC says above: you can only keep kicking a can so long before you hit a wall. Or in the case of the Sahara, the ocean.

Why do the banksters and Wall Street jerks care about affordabilty? Hedge fund managers and investment bank financial product derivitive developers are insulated from all of it in their exclusive CT and NY communities.

Dr. HB and Hussman are about the only pundit/analysist who don’t stink of finance industry shill. Bearish insight is what we need at this time. If you listen to the Bloomberg and CNBC talking heads like Kudlow, every day is a new planting of the “mustard seeds” of renewal and growth. False optimism and risk tolerance fueled this disaster.

Most of the views the media expounds are akin to this mensch’s – who was given airtime yesterday on CNBC. This guy is a fine example of ethical research and quite the academic sage:

http://blogs.ft.com/economistsforum/2010/10/the-director-of-inside-job-replies/

“In his article “The economist’s reply to the ‘Inside Jobâ€â€ Prof Frederic Mishkin misrepresents both his own activities and the widespread conflicts of interest which have distorted academic economics and its role in the financial crisis.”

It will be interesting, or maybe gut wrenching, to see how the federal budget situation impacts the housing market. Sooner or later they are going to have to cut spending by a large margin. If you make the basic assumption that no matter what budget areas get hit the hardest, jobs will be cut, then the available pool of buyers will shrink in all regions of the country. So first we will cut state and local govt. job cuts this year, and then several waves of federal pink slips in coming years, starting in 2012.

If you read the work of John Hussman, it would seem that the fed will not be able to raise interest rates to support the dollar, due to the size of the monetary base. So you can pretty much count on massive inflation, which is just another word for dollar depreciation. As a reaction to this inflation, which we already see in the form of $4 plus gasoline, Congress will eventually cut spending, but this will take time. So there will be wave after wave of federal job cuts.

Hey Doc,

You might want to check this article about retroactive taxes on properties already sold in CA.

http://gonzalolira.blogspot.com/2011/04/shakedown-nation.html#more

Happy Friday Everybody! Though you all might enjoy this awesome video by NAR as we watch the curve of home prices swing downward after this oh-so-successful tax credit…

http://moremoney.blogs.money.cnn.com/2009/09/21/housing-tax-credit-cure-or-curse/

So, we finally took the plunge.

Thanks Dr. for all of the information over the years. You have kept me going when the societal and familial pressures have seemed too much. Some of the seemingly best advice I have heard is to buy despair and sell euphoria. So we have decided to buy despair, it is hard to imagine the news getting much worse and everyone agrees (even mainstream media) that the shadow inventory exists. It has been my goal to buy when everyone believes that the sky is falling and the world will end tomorrow.

We went 35% down and 18% debt (PITI and all other)-to-income (gross) on a condominium. The loan funded without a single issue. Not sure what everyone is talking about “Loans hard to get”? We got a 15 year fixed but I hope and pray that we are able to pay it off long before that. Nice safe neighborhood with great schools in the beautiful SCV where my wife and I grew up. Wish me luck. I am going to need it with all the doom and gloom news out there.

Once again, thank-you Doctor for all of the advice and education. It is a good thing, what goes on in websites like this one where information closer to reality is released. By reading reliable blogs and ignoring mainstream media you will have information that is at least 2 years ahead of the rest who only watch the news, read newspapers, or listen to talk radio.

SCV, congratulations. I believe you did the right thing, or at least not anything terribly wrong, for yourself.

I, too, am looking at many condos here in Chicago, now the worst condo market in the country, and will spring as soon as my job situation is stable, which now it is not. I am doing due diligence on pet buildings in my area, to make sure I don’t walk into a building encumbered with liens, foreclosures, assessment arrears, and structural problems due to all that.

Just a few things you must do once you’ve closed your deal: A. Do not, NOT continue to monitor the real estate market. Even in a hot housing market, you will discover you could always have gotten a better deal. Better off not to know. B. This is the most important- pay down that mortgage as quickly as possible. Make extra payments against the principle to bring down your balance and interest as quickly as possible, and forbear to make all but necessary repairs until you have that balance paid down. If you bought cheaply and below your means, this will not be difficult.

Good luck.

Leave a Reply