Real Homes of Genius – From $5.5 million to $2.7 million in Newport Coast. Million dollar foreclosures grow in Southern California elite housing markets.

If you want to know what God thinks of money, just look at the people he gave it to. –Dorothy Parker- The fuel that inflated the California housing market for a decade is now largely consumed. The myth that toxic mortgages only infiltrated lower income communities is now a thing of the past as we now see elite communities taking it on the chin in terms of price cuts and rising foreclosures. The obvious answer to all of this is that incomes never justified housing prices. Even today, many cities in California are largely in housing bubbles. What this means is that a multi-million dollar home is now a few million dollars cheaper but still too expensive for the average Joe. Yet price cuts are here. Only a few years ago people with modest incomes were able to purchase majestic palaces with incomes that clearly did not support the home’s value. Today we are seeing that last holdout of the market collapsing. Southern California home sales had their second worst month in the decade for October and we enter the weakest part of the selling season. Today we are going to examine a home in Newport Coast and show how the bubble is already bursting in prime markets.

Newport Coast and losing millions of dollars

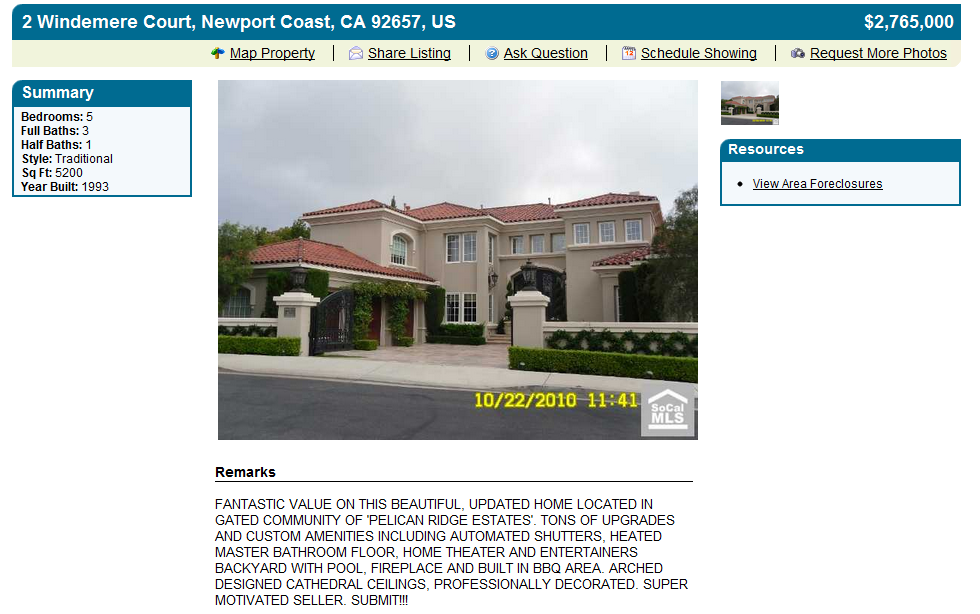

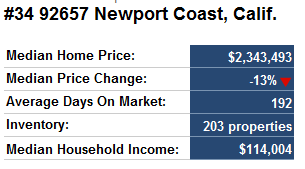

The above is a beautiful home located in Newport Coast. According to Forbes magazine Newport Coast is the 34th most expensive zip code in the US:

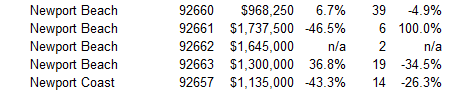

The median home price from Forbes seems a bit high but they may gather their data from other sources. In the latest month data of sales we find the following:

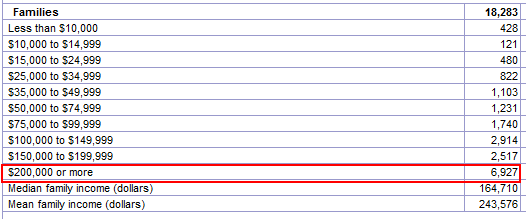

Now we first have to understand why something like this is occurring. Median prices for Newport Coast (92657) have fallen by 43 percent on a year over year basis. In the last month of sales data 14 homes sold. But in these markets, you have a wide variance of home prices. What this tells us though is that cheaper homes are moving while homes like the one we highlight today remain stagnant. Why? Because the leverage of Alt-A and option ARM products are now gone. Jumbo loans are available but you have to carefully document your income. It is unlikely that many even in these elite markets have the money to purchase these homes because these are excellent areas so I’m sure people want to buy here but they now have to document the cash to backup the purchase. Let us look at the income data for Newport Beach in general:

Source:Â Census

It is too bad that the 2009 data doesn’t go further in breaking down income levels. Out of the 18,283 families in Newport Beach only 6,927 make more than $200,000. But for the home we highlight today, a family would need roughly $750,000 of income per year. How many fall under that category? The median family income in Newport Beach is $164,710 per year. A good sum and if we go with the average family income, it jumps to $243,576. But let us look at the details of today’s home:

Bedrooms:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5

Bathrooms:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3 full / 1 half

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1993

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5,200

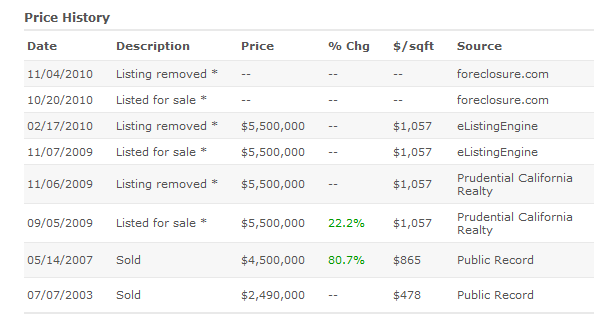

We can’t get any street view pictures here because the home is in a gated community. But you can see from the above picture that the place is definitely a prime property. But we should track the history of the home to see the progression of the housing bubble:

Sold in July 7, 2003:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,490,000

The place sold for $2.49 million in 2003. The bubble was already healthy in California at that point. Alt-A and option ARMs were filling the pockets of mortgage brokers with sizeable commissions. The home then sold at the peak for a sizeable gain:

Sold May 14, 2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,500,000

The person that bought at the peak was looking to make a quick buck, just like the fortunate buyers from 2003. The 2003 buyers made a $2 million gain on a home that they sat in for four years. Not bad for a few years of work. I imagine the last buyer had the same idea but they bought at the peak. Let us examine the action that took place:

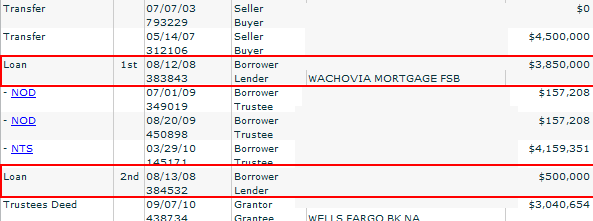

In September of 2009 the home was listed for sale at $5,500,000. Now there must have been something magical about “making†a $1 million gain over two years. But the bubble had burst even in these prime areas. As you can see from the listing history, the home was listed and removed a couple of times to keep the listing “fresh†but no fish were biting. I’m sure there would have been plenty of suckers that would have paid this if we still had Alt-A and option ARMs flooding the market. But those days are over. If we look at the note details, we find a few of the toxic mortgage All-Stars showing up:

You can tell from the above that only a year later that these owners had a need to refinance. So in August of 2008 they refinanced the property with Wachovia. Wachovia as you know was one of the option ARM kings. In fact, they lead the group in this kind of toxic mortgage. With the two new loans, the mortgage balance went up to $4,350,000. This left roughly $150,000 (3.3 percent) of equity in the place assuming the $4.5 million sale price). So if you think of the listing in September of 2009, you can see that the money was running out. Assume that the $500,000 was taken out as cash. The $3.85 million mortgage would cost roughly $25,000 a month just for the principal and interest. We aren’t even looking at the $500,000 second mortgage. So in a year, $300,000 will go just for principal and interest on the first mortgage. If you look at the details, the first NOD was filed in July of 2009. So it is likely that a few months later when they listed the home at $5.5 million they were hoping that they would get lucky and simply get out. Clearly that did not happen and the money ran out.

This home is now a bank owned foreclosure. How are things going in prime markets today? Let us take a look:

The home is now listed at $2,765,000. So Wells Fargo is eating over a $1 million loss on the first mortgage if it sells at the current price. The second mortgage is completely wiped out. $2.76 million is a long way from that $5.5 million listing price and is still a long way from the $4.5 million purchase price in 2007. Get used to seeing homes like this.

Today we salute you Newport Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “Real Homes of Genius – From $5.5 million to $2.7 million in Newport Coast. Million dollar foreclosures grow in Southern California elite housing markets.”

I really wish CA would just hit the bottom. I’ve been waiting in santa clarita for the last 5 years now to buy my first place but things just wont settle out.

Santa Clarita home prices have been falling for 5 years, they are dramatically losing value now. Hang on another year or so and in those 6 years you will have saved a few (or more) hundred thousand $’s. I sold there in 2005 and have been watching (laughing) ever since.

Be careful what you wish for. The Cal and US economies are all paper wealth…there will be no soft landing and if things aren’t artificially supported there will be total chaos.

If the average income in that area is $165,000, then the average home in that neighborhood should be about $500,000. This home is probably much nicer than average, but not worth 5 times what the average family in that area can afford.

If you look at the Forbes data, then you can see that this house was more than 20 times the median income at one point. To put it differently, the average family in that zip code would have had to work over 4 years just to pay the closing costs. Wow.

Average salary numbers are completely useless.

The fact that a FULL 1/3 of the residents make over $200k means home values will remain high. As DHB notes, the over $200k range lacks breakdown – MANY of those residents are probably pulling down $500k-$1M or more based on other well-to-do neighborhoods. A $2M house when you’re making $1M/year ain’t that bad.

Yes, homes are overvalued still, but not as much as people would like to think. If you see the right home for a decent price… you should think twice before passing on it.

“Yes, homes are overvalued still, but not as much as people would like to think. If you see the right home for a decent price… you should think twice before passing on it.”

And call you at your realty office to close the transaction 😉

Home prices are set by income and all of the fantasies in the world don’t support the plethora of $1mm plus houses anywhere in Cali…

I get your point about “average” salaries not being useful – the thing is we don’t know the distribution curve in the local area.

Perhaps just a few households are in that extreme range and most are in the 200k range. That’s still a lot of money but nowhere enough to sustain that 10: 1 ratio.

Just because person A paid 2.5 million and makes 750k doesn’t mean the other people down your block got into their property with such a low income to price ratio.

Factor in a general economic downturn and formerly huge earners may see deep cuts in their over bloated lifestyle.

Either way, the prices in Cali will continue to drift to pre-bubble levels. Would be fascinating to see a rundown of every household financial statement history on a neighborhood block like that to see just who is making that 750k+ and who is playing make-believe.

…screw the bubble…i want that house.

lolol!

That house looks inviting, like cheese tempting a mouse into a mousetrap. Even if mere mortals could afford the house, huge houses need a lot of maintenance. That lawn, exterior, roofing, cleaning, etc. will cost you a ton of money. People who own these houses have entire household staffs to make it work.

And are you going to park a Honda Civic in the garage and get laughed at by your neighbors? You better have a BMW 7 series of Porsche 911. And how do you dress? Housing is but one part of the conspicuous consumption lifestyle that went down in flames after Depression ’00.

Many lottery millionaires go bust when they pay cash for a mansion and cannot afford to heat/cool or maintain the property. Energy bills for that place must be IMMENSE.

Look at Redfin and search for Newport Beach. There are a TON of multi million dollar houses for sale. That’s not counting shadow inventory. There just aren’t enough high income earners to support those prices.

The ship is going down and we’re arranging the deck chairs. At least it will look good when it sinks underneath the waves.

I would have absolutely no problem parking a clunker in that driveway and walking my dog down that street in greasy coveralls. Your point about the cost of upkeep is spot on, but if being laughed at by the type of people who would laugh at a person’s car and clothes were the only downside, I’d live with it. They’d have plenty more to amuse themselves with when I fired up the entertainers back yard for my friends.

I wonder if that would be allowed. Looking like the equivalent of the Beverly Hillbillies living next to the Rich and Famous seems like it would bring down neighborhood property values.

They’d probably set fire to your house. Seriously, I know someone who bought a house, the neighbors didn’t like him moving in, and they burned his house to the ground.

@Red just curious, what zip of Santa Clarita you are talking about? Seems like a lot of them are down as much as 40%. I’m curious how much further it could fall myself but a lot of that area seems STRONGLY corrected.

I have also been waiting in Santa Clarita. It seems that the area has not corrected nearly enough. Inventory is very tightly and obviously controlled. Lennar, the only builder allowed in Valencia, seems to release about 2 homes a month to sell. They even closed down their models, to save on operational

costs, so that they can release the homes even slower. They hold the price constant, or raise it, while not selling any homes. How can you call yourself a home builder if you don’t sell homes? I wish the Dr would do an article on the SCV. There still remains plenty of delusion up here yet unexposed.

Good luck with that whole waiting thing. I’m as bearish as they come, but the past several years have shown there’s no hurry by the banks or builders to dump their inventories and crash housing prices. They’re not stupid. Plus, many sellers are delisting their homes because they don’t have to sell. The stats are that delinquencies are at 10% of homes, whereas the historical average is 5%. So keep things in perspective. If you’re waiting for another 30% downleg… good luck. The sidelines are getting crowded and further drops will pull people into the market – boosting prices.

The last thing you should do in SCV is buy a new home, there is no building there, but it is not because Lennar does not want to. Look over at the Tesoro area, stunning price drops, Creekside, well over 50% drop, Northbridge 30-40%, the area around the pond,Bridgeport, pick up a waterfront home at another 30-40% off.

“Good luck with that whole waiting thing. I’m as bearish as they come, but the past several years have shown there’s no hurry by the banks or builders to dump their inventories and crash housing prices.”

You’re absolutely right, because once prices hit rock bottom (which it looks like they already have) we will see price appreciation immediately like we saw in the bubble year. Just sprinkle some pixie dust on the damn thing and we’ll be rolling in it.

“They’re not stupid.”

Yeah, and the buyers in the market place are stupid – they cant wait, they need a house right away even if they have just been burned by a foreclosure. Good point.

“Plus, many sellers are delisting their homes because they don’t have to sell.”

Sellers dont have to sell or cant sell because of market conditions?

“The stats are that delinquencies are at 10% of homes, whereas the historical average is 5%. So keep things in perspective. If you’re waiting for another 30% downleg… good luck. The sidelines are getting crowded and further drops will pull people into the market – boosting prices.”

Yeah, the sidelines are getting crowded with all of the unemployed/underemployed and people that have lost their benefits. Last count California real unemployment is 20% and climbing. Yeah, those people have tons of money and can buy properties with cash. Good call.

Again, you seem to indicate that once prices bottom out they will bounce back to bubble years when in reality prices will tread at 0%-3% growth for the next 5-7 years. See Japan.

Delinquencies have doubled from 5% to 10% – which means what? Those homes will be heading to foreclosure. Also, keeping things in perspective – OK, lets do that, whats an additional 5% times millions of properties? How about that for perspective.

“Again, you seem to indicate that once prices bottom out they will bounce back to bubble years when in reality prices will tread at 0%-3% growth for the next 5-7 years. See Japan.”

That’s not what I meant. No, prices are not hitting bubble levels anytime in the near future. And by near future I mean 15 years.

What I meant was that people seem to think prices will crash like the stock market – suddenly shooting down 30% (or more). But real estate is an incredibly illiquid vehicle. It moves slowly and deliberately, like a tanker or cruise ship.

My point was that there are MANY people who CAN afford to buy a home and are waiting. Those people will eventually get nagged from their significant other, or feel like they really “should” settle down for the kids’ sake, or any number of other reasons that are unique to home buying (as opposed to buying some arbitrary stock).

If you see a nice place, I would lowball now, personally.

Prices won’t shoot back up, but every home is unique too. If you pass on a home, it’s GONE for probably 10+ YEARS.

BTW, unemployment is very much concentrated in the sub-$100k demographic. Above that and it’s not that much different than pre-recession levels.

Wait to see that place for less than 2 m. Maybe 1.5 m.

Averages are not that useful when looking at homes in this price range. How many families in the area with $1m or more per year income, or 8 figure net worth? I’m guessing at least a couple hundred.

“Averages are not that useful when looking at homes in this price range.”

I can agree with that. But it’s not the whole truth either.

“How many families in the area with $1m or more per year income, or 8 figure net worth? I’m guessing at least a couple hundred.”

Probably even more. But there is also hundreds of houses for sale in that price range too and many in that income range are satisfied with their current house and aren’t looking for a new house. There are some really unique houses but I’d doubt this is one of those.

Oversupply, no matter what perspective you take. If the sellers are not forced to sell, they can sit on their property for a long time and this slows the decline. But it can’t continue forever: Eventually seller is the one asking the highest price and he either drops the price or ceases selling -> average goes down.

This is a home for Jed Clampett….if it has a cement pond!

You know it is bad when realtors even tell you that things are bad. Went to an open house yesterday and I a realtor basically said things are a mess and that she wasn’t sure how bad it was going to get. She was very open about the number of homes in inventory and the difficulty buyers are having getting loans approved.

However, I did met a loan officer that said it didn’t matter if prices decline in the next two or three years in the long run. Actually, it does matter because I would be paying less if I waiting a year or two!!!! I knew my business degree would come in handy some day.

Actually, renter, if you need a business degree to understand the fourth-grade arithmetic around simple and compound interest, you’re in worse shape than you think.

Pretty sure he was being sarcastic.

I am about to leave the state. I don’t believe that things will get better in the next 5 years. In the meantime, I can start to build equity, and this is from someone that is in the top 5% of income earners in the state.

I believe as time goes on anyone with money will leave this state because they can. The rest of are stuck here waiting 5 to 10 years for the market to improve. Does anyone think California is going to be a great place to live the next ten years. The best rated schools here don’t rate with with the average schools from other states. In-state tuition is going to keep going up. Business climate unfriendly. All we will be left with is the weather. After all this chaos, California is still too expensive. I would not pick this place starting out as a young professional wanting to have a family, a house and build a healthy retirement. The only people who will want to live here is the people who bought at the right time.

Well, if everyone with money is leaving, then when will Google be moving to Alabama.

Because it’s so cheap there?

Hahaha, yeah right!

I’m sorry, but the TOP people have always been attracted to California.

If you’re just the average Joe the Plumber, then by all means, move to Kentucky.

But seriously, Beverly Hills and Silicon Valley ain’t turning into a ghost town anytime in this century.

yes its got to be fun for the bank to pay to maintain that place to sell it , property taxes of 45k a year alone will be compounding that million dollar loss quite nicely !

What’s crazy is that for every home like the example in this article, you still can find 5 in the same neighborhood that are asking more than what they paid during bubble years!

LOL… no doubt waiting for the fabled Chinese/Saudi/Russian buyer to emerge from the proverbial (Hollyweird FX) fog. ;’)

To be fair though, peeps in this net worth bracket probably have a better handle on their REAL carrying costs (and can deduct/shuffle them), plus during the last bubble (S&L crisis, late 1980s), there actually WERE rich Japanese buyers–who “should have known better”–paying WAY too much for Cali props as late as mid-1989, when the smart money knew all signs were flashing RED… I’m STILL laughing at the losses the Japs took, Pebble Beach, etc… LMAO.

That X million cut we see is just the visible part of the iceberg of everything built around the bubble, from a policy and economic perspective.

How many county/city budgets, economic projections, campaign strategies, school board decisions, etc., were made around the assumption that a fall in prices/valuations could never happen?

The implications of that bubble–doomed to fail eventually–will keep playing out for decades.

DHB wrote: ” What this means is that a multi-million dollar home is now a few million dollars cheaper but still too expensive for the average Joe.” True, Doc, but since Reagan the economic system has been run exclusively for the profiteers and speculators.

For three decades average people were conned into believing that they could gamble like the big boys, and win. Preferably wearing “designer” clothes and sipping “gourmet” wines.

The occasional hits at the big tables (the flip that went well, the sudden appearance of the Lexus in the InflataBurb, the new wife with the botox lips and gravity defying boobs) functioned as they do at casinos: to keep most people arithmetically ignorant and banking on Lady Luck.

The problem I see is that most humans have a hard time going from excess to fundamentals without an ugly, generally fascistic and genocidal, period of time in Fundamentalism.

Several commentors have picked up on the Dr’s remark that the average joe cannot afford this house even with the rollback. Let’s be real folks, the average joe is not supposed to afford this house even in an economy favorable to the average joe. this house is affordable to the average, nee above average millionaire. The actual point of the article is that housing does correct even in the high end. My armchair estimate is that this house should settle in the low two mil range. That’s still a good fall from where it’s at now. Still it is prime location high end real estate and a buyer who can afford it cause they are “rich” as in having real money may buy it because they want it and a half mil or so won’t matter. This type of transaction will have minor effect on the average joe’s real estate correction.

I agree that the houses will never fall within the range of the average Joe. Before the price ever got that far, someone else would snap it up, or maybe an investment group. However, if these houses continue to fall, they will cause severe price compression further down the spiral. Now the guy who wanted $2.7 million for his house needs to drop his price to $1.5 million, or spend 1000 days on the market, chasing the price declines. Eventually this will hit the $900k houses in Newport, forcing them back down to reasonable ranges.

Well put, compass rose. LOL@InflataBurb. I’m pretty sure botox doesn’t go in lips though. It goes in foreheads, thus producing the giveaway eyelid-droop/frozen facial expression. 😉

Ahhh, schadenfreude, I LOVE IT!!! Hey, check the listing – Wells Fargo is SUPER MOTIVATED to move this albatross. I’d give them $100 a sq ft for it, LOL!

The community I’m tracking in North S.D. county has taken down a lot of listings during this no-sales season, about about 15% of them off the site. I’m waiting for them to reappear shortly after the new year with “new listing” attached. It’ll be like watching somebody with a dead battery trying to start a car.

Looks like clearing price will be close to 2 million. Finally, some Southern California high end prices are coming back to reality. It’s only a matter of time, before they all do. Until then, find some other place to park your cash.

Gold or silver perhaps?

http://www.westsideremeltdown.blogspot.com

Actually it is not Wells Fargo that is going to lose the difference of what they get for selling the house and what is owed, it is going to be all of us thanks to the FDIC. Go back and take a look at the agreement that Wells Fargo struck with the FDIC for taking over Wachovia. Wells is only on the hook for a percentage of the losses and the government is on the hook for the rest. And I am assuming that this loan is not in the pool that Wells excluded from their loss sharing agreement. It may be 100% backed by the FDIC. Since it was an Alt A loan their is a good chance that the loss is guaranteed by the FDIC not Wells.

That home is not only located in a gated community, it has a huge iron gate leading into the driveway…wonder why. Newport Coast and Newport Beach are strange areas. Newport Coast is mostly new from the last 15 to 20 years, there are quite a bit of condos and townhouses there. Newport Beach is made up of many little slices. The peninsula is mostly 20s and 30s renters. The islands are for the ultra rich and mainland Newport Beach has lots of old money original owners from the 60s and 70s.

Newport is still way overpriced in my opinion. Here is the question no one can answer, “where will the next generation of buyers get the financial means to purchase overpriced real estate?” Will they come from Asia, offspring of rich boomer parents or will they go into unfathomable amounts of debt just to “own” a house.

Keep renting and saving for the next few years.

I have lived in the Harborview neighborhood for ten years now. I can tell you all that most homes are supported by a working dad.

The moms are mostly stay at home and for the most part are big spenders.

My block has eight homes that are supported by real estate jobs. All of these executives are making way less money. My buddy down the street

says he is making 70% less than his peak earning years (600-700K).

Newport is full of these types of real estate people. Get ready the trees will fall.

Desmo….You are quite right. I thank God I sold my house a couple of years ago and took a small loss before the roof caved in on prices. Anyone who wishes to buy up there now is brain dead caught up in the credit card crunch life style.

atleast if you live there, you can tell people you live right next door to kobe bryant’s house. errr, well kobe’s personal house is on the next street over, the one next door to this hosue is his, but it’s for the “in-laws”. what a nice guy.

Now this is a house! Beautiful house! However, $5.5 million dollars is the “schitt for brains” price, as you would have to have schitt for brains to buy it at that price. In my opinion $2.7 million is the “moron price,” as in, you would have to be a moron to buy it at that price. Don’t get me wrong – this is a gorgeous house! It’s worth some money, however, there is still too much “hangover effect” from the housing bubble. Prices are still much higher than they should be. People remember the “good ol’ days” and still want a gazillion dollars for their homes.

Is this the house of the former owner of Quick Loan Funding?

Hey Wydeeyed – the banks love suckers like you, and the government loves suckers like you. You say it is worth 2 million? You poor sucker. You don’t know how much 2 million dollars is. If some poor sap puts $576,000 down on this house (a little more that 20%) , he or she is left with a $2.200,000 balance, which is makes a payment of just over $14,000 per month !!!!!!!!!!!!!!!!!!!!!!!!!!!!! Are you listening Wydeeyed????? ($2,189,000 financed at 30 years, 5% interest). $14,000 per month, after plunking down well over 1/2 million dollars! For 30 fricking years!

I realize the very rich sometimes pay cash. They don’t always deal with loans like the little worms do. If they do finance, the banks win big time! If they don’t finance, the government brings in buku bucks in taxes.

Here’s what happens to people when they think $2 million dollars is chump change, Wydeeyed: THIS IS A STORY OF A MAN WHO HAD MILLIONS AND ENDED UP BROKE!

http://finance.yahoo.com/banking-budgeting/article/111434/familys-fall-from-affluence-is-swift-and-hard

The house is on a nice sized lot – 1/3 of an acre, not bad. Nice house. I say it’s worth maybe $750,000. WILL YOU MORONS GET THE HOUSING BUBBLE OUT OF YOUR HEADS? THOSE INSANE, SKY HIGH PRICES WERE CREATED BY AN ORGY OF BANKERS! THOSE PRICES ARE UNREALISTIC. WE ARE ENTERING A DEPRESSION. DR. HOUSING BUBBLE, PUT SOME REASONING INTO PEOPLES’ HEADS!

Ki: it is not sadek’s house, funny enough sadek’s next door to ANOTHER currently for sale bank owned home in there. but not that one. rumor has it he’s fled the country.

Thanks for the 411. I knew it was in that same housing tract, but I didn’t know where. Those houses are beautiful, but they all pretty much look alike. 🙂

Well, for those of you who thought it wasn’t worth $2.7 million, it actually sold for a tad over $3 million, about a quarter mil over the asking price or $579/sq. ft. I wonder what the story was, though since in this environment and the bottom dropping out of the luxury home market now why the buyer paid over asking.

http://www.redfin.com/CA/Newport-Beach/2-Windemere-Ct-92657/home/4749189

Leave a Reply